Market Review, GameFi & DeFi Gems

It’s been a few months since I’ve published my last newsletter. Since I got hacked I’ve been busy working behind the scenes securing non crypto related cash flows, improving my trading skills, and researching projects. I’m eager as hell to make a comeback and share all the alpha I’ve accumulated. This time around I’m collaborating with a few other aspiring influencers who made killer calls during this last cycle. I won’t be sharing any details until we’re all in sync and producing content on a consistent basis. The market may go down another leg before bottoming but I think at these prices the risk-reward isn’t bad. Whether you begin DCA’ing now or continue waiting for another dip I think it’s the ideal time to begin digging into projects. So get ready to receive copious amounts of alpha from me over the coming months.

Macro Larping

A couple weeks back I issued the following tweet.

In retrospect this would have been a great time to go long. With commodities rolling over the odds of a lower CPI heading into August were high. The market clearly was eager to go risk on after weeks of large players getting liquidated. I suspect the market mean reverted to the upside for the following reasons:

capitulation from large players

no major economic data until 9/13

CPI potentially peaking

ETH merge

low liquidity environment

strong jobs number

We could see a continuation of this market rally for another few weeks. However, we should exercise caution heading into September because the fed will continue to clear the balance sheet and we have important important dates coming up. The CPI on 9/13, ETH merge 9/15-9/16, and FOMC on 9/20-9/21. The markets typically sell off ahead of such major events.

Unlike the bulls I think it’s a bit premature to celebrate. Sure there’s a chance we’ve bottomed but I lean towards this being a bear market rally. Eventually the market will begin to feel the 2nd and 3rd order effects of rising costs. During the COVID savings went up and smart market participants were able take home significant profits. Also, the stock market may have corrected but it’s still above it’s above the pre-covid highs.

Once savings start to dwindle, credit cards get maxed out, and disposable income decreases we’ll see a material impact on earnings. This doesn’t necessarily translate into lower assets prices but they’ll be under pressure. At a minimum I expect more choppy price action with a strong potential for another leg down. Most bears are too focused on the fundamentals and forget how much cash is sitting on the sideline. Investors who cashed out near the top are eagerly waiting to deploy funds and are likely to allocate in increments. I can see them buying with 10-20% of their cash position on every leg down. In part this is why I expect more choppy action for the remainder of the year.

TA

ETH and merge tokens are clearly leading the current rally. We’re also seeing more capital rotate onto L2s like Arbitrum and Optimism.

Overall we haven’t seen significant inflows into the market which suggests that the remaining players are just playing musical chairs. Once the music stop we should see another leg down unless new capital begins flowing in through large caps like BTC, ETH, and SOL.

Most of this move has been supported by the ETH merge narrative, low liquidity on exchanges, and elevated short open interest. I think it’s enough to get the surviving retail participants to FOMO in for another leg up. Generally towards the end of rallies you see high beta assets out perform. We’re seeing some of that as SHIB moves up over 30% and CEL increases over 1000% from its local low - despite Celsius becoming insolvent. Also, from a TA perspective coins like RUNE and SOL look like they’re coiling for a move up.

Unless China invades Taiwan or the Fed takes emergency action my bias is for more upside short term. The large caps should lag while med to low caps out perform.

GameFi

One of my discord members put Galaxy Fight Club on my radar. They’re aiming to be the first cross-ip PVP game in the space. They’ve partnered with other projects like Illuvium, CyberKongz, BAYC, and others to bring NFTs to life. Soon NFTs holders of select collections will be able to engage in PVP fighting on both PC and mobile. The beta version is already out on android and IOS. The P2E features are expected to go live in a couple weeks. Users who own a genesis NFT will be able to earn 5-15 GCOIN/day plus rental income in the future. The in-game currency can staked for additional rewards but there’s a vesting period of 12 months.

They’ve partnered with some of the largest guilds like Yield Guild Games in an effort to make NFTs more accessible through scholarship programs. This supplements their collateral-free lending system with automatic loot split.

Initially the game will have 4 game modes with more coming in the future. Each game mode will provide a different set of rewards.

In terms of game mechanics the fighting system is similar to Brawl Stars with fighters engaging in both melee or ranged attacks. The characters all have different abilities and stats based on their rarity tier. However, the rarer tiers don’t guarantee victory. Highly skilled players are likely to overcome disadvantages against inferior players with higher tier characters.

In regards to the tokenomics the project has a high emissions rate but is likely to be offset by the consumptive demand. GCOIN is required to forge weapons, weapon re-rolls, unlocking loot boxes, train 2nd gen fighters, collab items, skins, and the in-game emoji pack. The team sold 6M tokens in the public offering at 50 cents in addition to the 30M sold in the early rounds. The token hit a local low of 6 cents before rallying to 19 cents ahead of the P2E release. I suspect the guilds and players are accumulating to use in the game or speculators are buying to flip for profits. There’s a high risk of this token dumping in the next few months due to the emissions rate and derisking by early stage investors.

They project deployed their tokens on Polygon and users can purchase them on SushiSwap. The price currently sits well below its high of $2 but is up over 300% above its low.

The NFTs can be bought on Opensea and Looks. Head over to their discord to get the official links and avoid scams. At the recommendation of one my discord members I picked up Arlen and a genesis weapon. I also decided to pick up a small bag of GCOIN at 15 cents. All these are very high risk investments given the macro environment. These assets could easily suffer another 50% draw down during a market wide correction. I’m hoping to flip some of my position into profits and let my remaining bag ride. The P2E features should provide a solid catalyst in the current risk on environment. Given my small position sizing I’m ok if the market moves against me.

I am a little concerned about the lack of engagement in their discord ahead of P2E. Although on their latest medium post they mentioned a surge of 20K+ new accounts in the last few weeks. They recently held a Twitter spaces with Veefriends and their Chief Marketing Office met with Gary 1 on 1 in Germany. They’re also working on cementing marketing deals with MMA fighters.

There’s plenty more to cover but I’ll save that for an upcoming video review. If you’re interested in learning more join my discord and head over to the GameFi channel. My community and I are constantly sharing and discussing quality GameFi projects.

DeFi

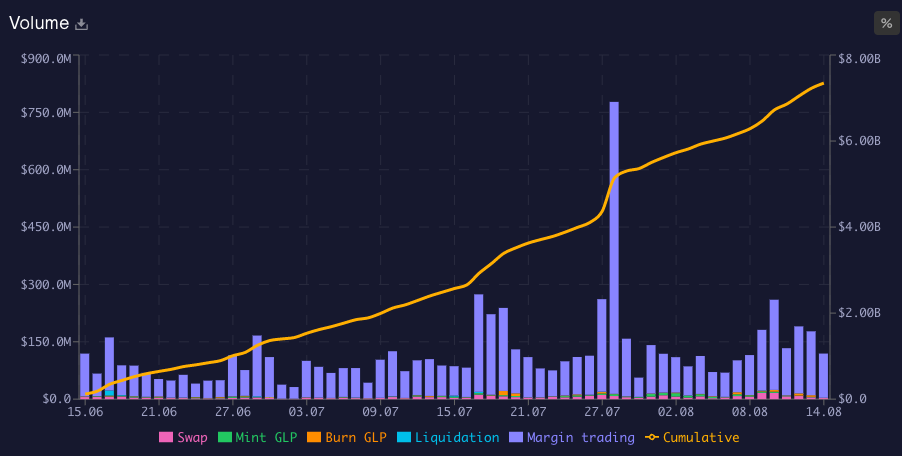

The next big vertical in DeFi is undoubtedly derivatives. Despite declining market activity protocols like GMX continue to see volumes surge.

These protocols are still nascent considering the relative size of their user base. The user experience has a lot of room to improve before they can begin competing with their centralized counter parts. But just as DEXs continue to close the gap on exchanges, I anticipate the same out come for derivative protocols. Currently my focus is strictly on perps because the options are severely lacking liquidity. My favorite two perp protocols are Gains Network and GMX. However, I’m adding new protocols to my watchlist as they come within my orbit. If we get another leg down I plan to accumulate with a target allocation of 10-20%.

Unlike the first generation of DeFi protocols investors can stake their token to capture some of the revenue generated by the protocol. In my mind it’s analogous to owning a piece of the casino. As regulators push for more oversight and begin taking enforcement action the popularity of these protocols will only increase. Perp protocol and DYDX restrict access based on region but I can’t think of a single derivatives protocol that requires KYC. Also, with innovative methods of price pegging protocols like Gains Network have eliminated the funding rate. Overtime these break throughs will make protocols more cost efficient, accessible, and secure compared to their centralized counter parts. Lastly, I expect to see a strong correlation between user experience and market share. Once these protocols make the trading experience comparable to that of exchanges, they’re likely going to absorb most of the market share.

There are regulatory risk of course and perhaps one day they may all require KYC for certain jurisdictions. Short term this will cause disturbances but long term the regulators will capitulate to the DeFi hydra. They can take one down but due to open source code impacted protocols will be forked and replaced. Also, the free market will ensure new competitors keep materializing to challenge the incumbents for market share.

Because I believe this vertical has a tremendous amount of upside in the next bull run I’ve decided to keep an eye on the following protocols. Perhaps in the future I’ll go over the nuances in a video but for now consider adding these protocols to your watchlist.