Hi everyone,

Click here to access the interest rate tracker. It’s been updated so you can see the best rates offered among the various lending platforms. Also, please consider signing up for new platforms with the referral links posted by the moderator. He updates and maintains the excel spread sheet. I’m sure he’d greatly appreciate it.

Get Juicy Yields on Your Stables

Understandably, given the current market conditions peeps out there are reluctant to go risk on. As a result, many have found refuge farming with their stablecoins. It appears the general strategy is to maximize fiat yield and buy back into the market after a decisive move materializes.

Others are leveraging their spot WBTC and ETH positions to borrow stablecoins for yield farming. This way they can keep exposure to assets they’re long term bullish on and farm for yield. On Aave, in many cases you can get paid to borrow.

A couple weeks ago I published a list of farms providing double to triple digit yield on stables. Most yields at some point will get diluted or the token emission rate will be reduced. Consequently, you have to regularly monitor these farms. This is why I encourage people to join my discord because talking to experience farmers can significantly reduce your research time.

Over the last few days I’ve found a few more stable farms for you guys to check out. The yields for a few of these are likely to get boosted after the protocol approves the liquidity mining incentives. I would follow the projects on Twitter if you’re interested in receiving notifications.

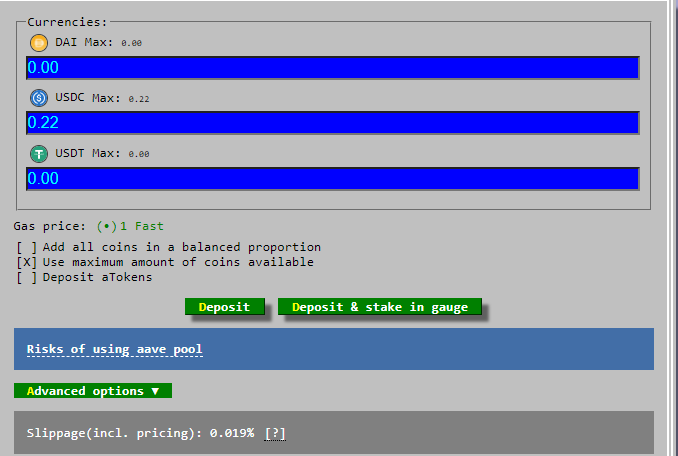

Curve on Polygon

Curve Finance is automated market maker protocol designed to swap between stablecoins with low fees and slippage. By providing liquidity anyone can add their assets to several pools and earn fees.

First deposit liquidity by visiting Curve.

You can just leave your funds here to enjoy the following APY.

Or you can deposit your LP token into Adamant Finance to earn an auto-compounding yield plus a boosted yield paid in the ADDY token. The ADDY boost in this case would 40%. Watch my video on Adamant Finance to learn more about he protocol.

Xtoken XU3LP Token

These are next generation LP tokens that enable users to deposit either asset from a pair and passively earn income while benefiting from a fungible, yield-generating token (xU3LP) that be used anywhere in DeFi.

The first wave of xU3LP pair are live:

xU3LPa: DAI<>USDC ○ 0.9994⇋1.0014

xU3LPb: USDC<>USDT ○ 0.999⇋1.001

xU3LPc: sUSD<>USDC ○ 0.9974⇋1.0054

For the next ten weeks these pools will accrue pool fees and liquidity mining incentive rewards paid in the XTK token. Currently the pools are generating anywhere from 40-46% APR.

Ribbon Finance

This protocol creates structured products for DeFi. They’ve decided to start with a high yield product on ETH which generates yield through an automated option strategy. They’ve back tested the strategy with gas fee costs and expect a yield of at least 20-30%. Since the strategy buys and sells options, abrupt moves in the market could in theory lead to a negative yield. To compensate users for the risk and to bootstrap liquidity, they’ve proposed liquidity mining incentives. This means the yield could potentially get into the triple digit range.

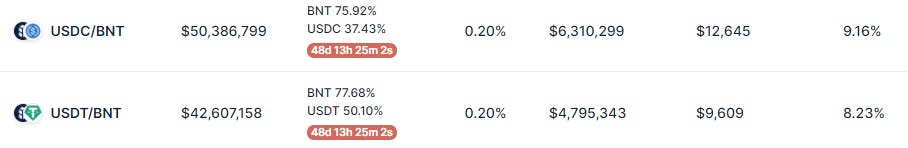

Bancor Network

Bancor is providing boosted yield on USDC and USDT for at least 48 more days. By providing single sided liquidity users will earn bonus rewards paid in BNT in addition to the pool fees collected. Assuming the yields stay the same you could earn almost 60% APR on your USDT. In order to get 100% IL protection you must deposit your assets for at least 100 days. The complexity of the smart contracts can cause the fees to be high, so make sure to double check the cost before moving forward with the deposit. This yield farm is best suited for peeps depositing $5K or more.

The quickest way to learn about farming opportunities is by joining my discord channel. There’s a couple I’m super excited about and on launch I’ll make sure to link you guys.