Twitter | Starter Pack | Reddit | YouTube | Patreon | Store Front | Earn $250 in Promos

Hi everyone,

Click here to access the interest rate tracker. It’s been updated so you can see the best rates offered among the various lending platforms. Also, please consider signing up for new platforms with the referral links posted by the moderator. He updates and maintains the excel spread sheet. I’m sure he’d greatly appreciate it.

Bitrue

Matic just got added to the Power Piggy for 5% APR, meanwhile Celsius users are getting 13.99% and DeFi degens are getting even more. However, they have started to strengthen their partnership with the Binance Smart Chain by supporting an increasing amount of BEP20 assets like CAKE and BUNNY. They also launched a BTR-USDT yield farm on Pancakewap. Currently yield sits at 268% APR . Once BTR goes on a nice pump, I plan to begin cashing out into USDT and providing liquidity to the BTR-USDT farm on Pancakeswap. This way I can lock in some gainz and earn triple digit yield.

Binance has added additional security features to detect users from restricted countries. If you were using a VPN it’s likely you’re no longer are able to make deposits. If this is the case, I’d recommend purchasing Ellipal. This hardware wallet makes it really easy and convienant to convert your assets between chains. I just made my purchase today and may do a video review in the near future.

Celsius

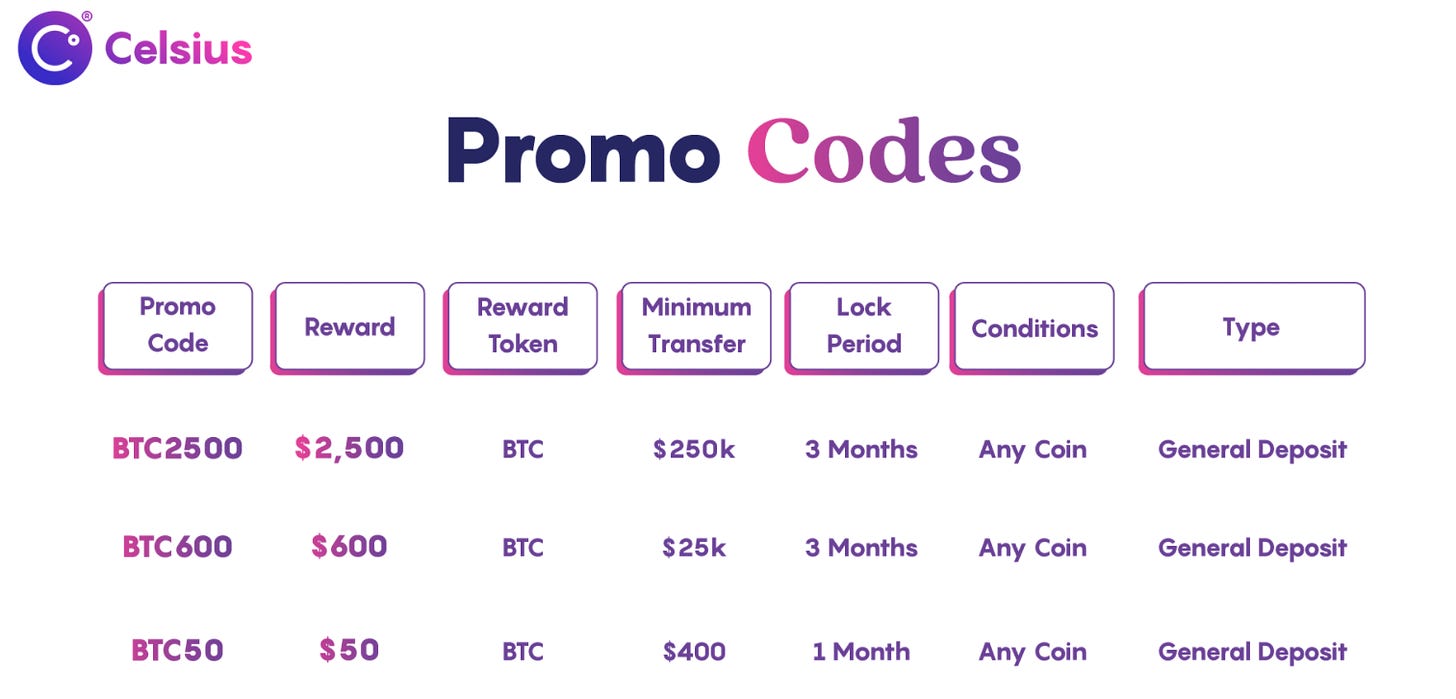

Don’t forget to take advantage the promo codes being offered by Celsius. By just depositing $400 you’ll get $50 in BTC for a 30 day deposit. That’s a return of 12.5% in a month. They also launched their long awaited web application. It makes it much easier to manage your portfolio. All they’re missing is a means to exchange assets.

If you wanted to learn more about Celsius and their token, make sure to go through my Celsius playlist on YouTube.

Getting Yield on Stables

To hedge against inevitable market corrections and take profits along the way, I’ve decided to start shifting a portion of my profits into stablecoins. The massive demand for leveraged products and loans has created abundant opportunities to earn double digit yields on stables. On average I’ve seen yields around 20-30% on many protocols across multiple chains. Below I’ve listed some protocols that are currently candidates for my future deposits.

Binance Smart Chain

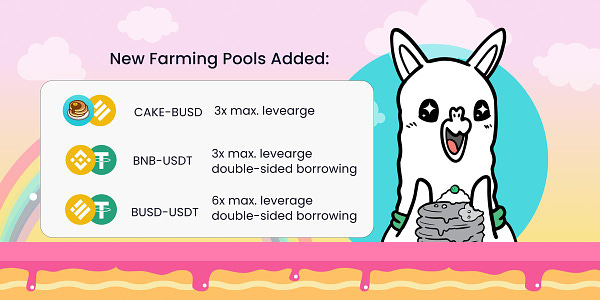

PancakeSwap

USDT-BUSD 6% APR

DAI-BUSD 8% APR

USDC-BUSD 6% APR

UST-BUSD 13% APR

ApeSwap

BUSD-USDC 20% APR

BUSD-USDT 22% APR

BUSD-DAI 26 % APR

ApeRocket

BUSD-USDC 79% APY - BANANA Maximizer

BUSD-USDC 26% APY

Polygon

QuickSwap

USDC-USDT 23% APY

DAI-USDC 32% APY

DAI-USDT 36% APY

Polywhale

USDT 51% APR, 4% deposit FEE

USDC 53% APR, 4% deposit FEE

USDT-USDC 391% APY, 5% performance FEE, 1% deposit & withdrawal FEE

Polycat

USDT 174% APR, 4% deposit FEE

USDC 169% APR, 4% deposit FEE

DAI 171% APR, 4% deposit FEE

USDT-USDC 19% APY

DAI-USDT 24% APY

USDC-DAI 24% APY

Polyzap

USDC-DAI 138% APR

USDT 128% APR

USDC 105% APR

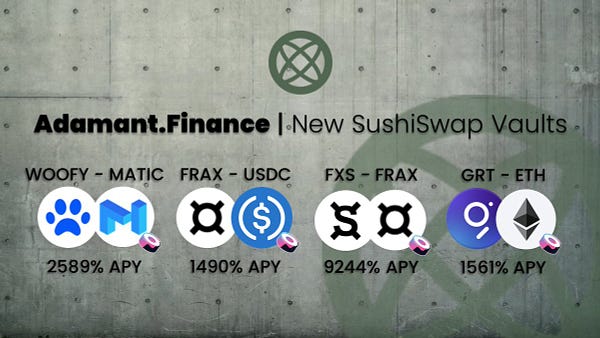

Adamant

USDC-DAI 167% APY

USDC-USDT 158% APY

DAI-USDC 75% APY

USDT-USDC 76% APY

Polycake

USDC 66% APR, 4% Deposit FEE

USDT 83% APR, 4% Deposit FEE

DAI 70% APR, 4% Deposit FEE

Dyfn

USDT-USDC 45% APR

DAI-USDT 61% APR

Ethereum

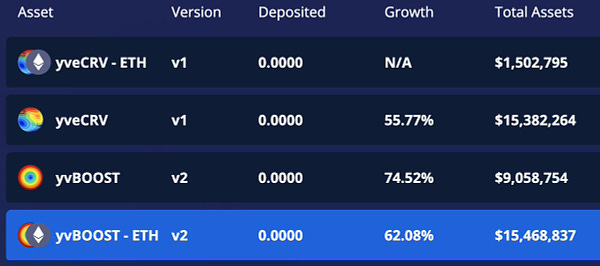

Yearn

USDC 14% APR

sUSD 31%

USDT 9%

DAI 11%

Cream

USDT 6% APR

USDC 12% APR

Mantradao

USDC 7.8% APR

USDT 11% APR

DAI 14% APR

UST 9% APR

Cross-chain

Beefy

BUSD-USDT-USDC-DAI 44.91% APY-BSC

UST-BUSD-USDT 55% APY-BSC

DAI-USDC-USDT 29% - POLYGON

USDC-USDT 24% APY - POLYGON

DAI 23% APY - POLYGON

USDT-DAI-USDC 22% APY - FTM

Autofarm

USDT-USDC 30% APY - BSC

USDT-DAI 30% APY - BSC

USDT-USDC-BUSD-DAI 28% APY - BSC

USDC-USDT 23% APY - POLYGON

Content Summary

1:19 Introduction

3:55 AVA token

5:52 Pros vs Cons

1:09 Reallocating

2:50 Assessing Loan Health

4:39 Planting Seeds

6:54 IDO

7:37 Evaluate Farming Allocation

9:32 Buy the dip

1:26 BSC

6:35 Ethereum

9:08 Terra

10:23 Polygon

1:07 Connecting w/ Trust Wallet

3:15 Creating New Wallet

4:10 Providing Liquidity

Notable Tweets