Twitter | Starter Pack | Reddit | YouTube | Patreon | Website | Earn $250 in Promos

General News

Belarus Chemical Giant Circumventing Sanctions with Crypto Payments

The international community, including the United States, imposed range of sanctions on Belarus in early summer. This put a strain on businesses operating within the nation - leaving them out of trade deals involving traditional finance channels. The chemical giant Grodno-Azot, has stated on their website that their Director for Economics and Finance had been instructed to,

“instructed to work out the issue of the possibility of making payments in cryptocurrency in order to build a modern digital economy at the enterprise.”

The chemical giant didn’t go into the details of their crypto related plan, but we’ve seen other sanctioned nations take similar approaches. For instance Venezuela went down the same road and its led the government to reportedly accrue a large amount of BTC and ETH.

In my opinion this is a net positive for the entire asset class. Sanctions are forcing governments to look into the technology and as a result they’re recognizing it’s potential. Long term this will serve to legitimize cryptos as a new asset class and aid main stream adoption.

No Crypto Ban in U.S

U.S Federal Reserve Chairman Jerome Powerll said he has “no intention” of banning cryptocurrency transactions. However, he is interested in regulating digital assets. Currently SEC Chairman and his goons are actively learning more about the industry. It appears their initial focus will be the DeFi space given recent probes into UniSwap and other protocols.

I believe its naive to think regulators will take it easy on projects who have been working closely with lawyers to remain compliant. Blockfi and other lending platforms added retired regulators to their team and still got served cease and desist orders. I have a feeling new regulations introduced either in Q4 or Q1 will lead to a market top. Long term I believe DeFi protocols and crypto assets will endure, but short-term I think we may some pain.

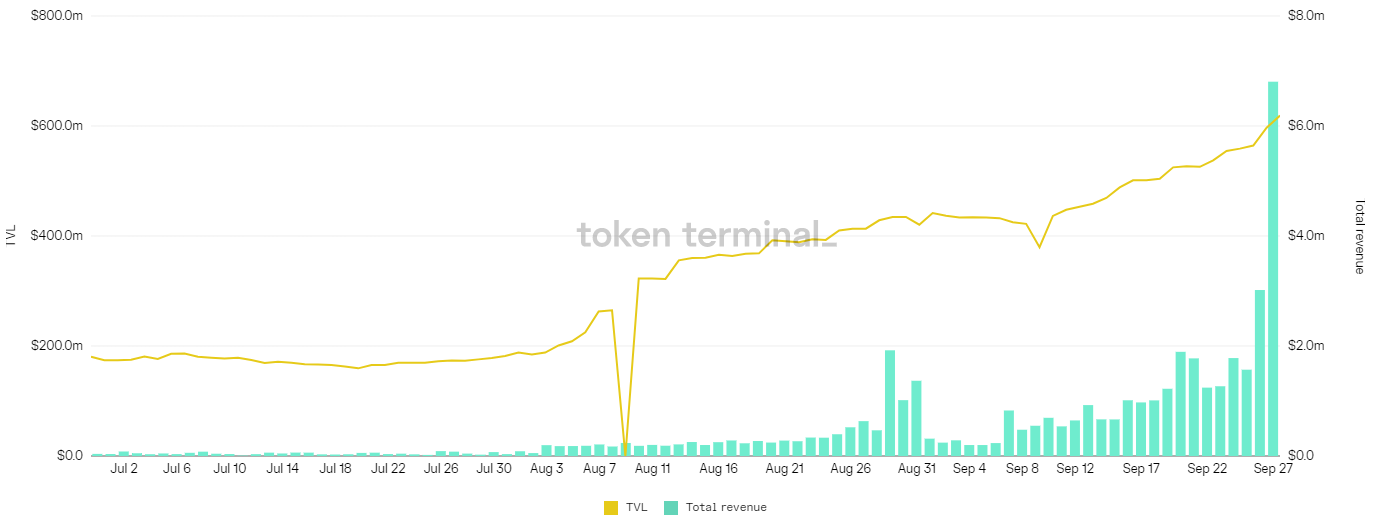

DeFi and DEX Volume Soars After China Ban

After China banned crypto assets, Chainalysis reported significant amount of regional flows within eastern Asia. Industry analysts suspect this is crypto investors shifting around their holdings. Given the lack of outflows out of Asian exchanges, it's likely that assets are being kept inside the region but not on centralized exchanges.

Increased activity on decentralized exchanges like Uniswap and the decentralized derivatives exchange dYdX may indicate where the capital is flowing. The decentralized finance ecosystem provides an uncensorable means for investors to transact outside the control and purview of governments and regulators. This increased demand for DeFi services is likely to lead to another boom and broader adoption. Currently we see a lot rigidity within the DeFi ecosystem but it will dissolve in time. As it dissolves it’ll make way for normies to get more involved and gain more financial sovereignty.

OTC Action

Asia: Robust demand for BTC and alts.

Europe: Timid BTC buyers early in the week but strong demand materialized towards the end.

Americas: Very robust demand for BTC and SOL.

Altcoin Index: For a second consecutive week the index sits at 55.

Crypto Fear & Greed Index: The index jumped to 49 this week.

Portfolio Update

I converted some XTZ to SOL, to buy more Solana based NFTs and to participate in the mints. I also sold my MBS monkey for 300 SOL to generate additional liquidity for more purchases. My goal is to maximize my exposure and begin taking some profits in a month or so.

Notable Tweets