Twitter | Starter Pack | Reddit | YouTube | Patreon | Website | Earn $250 in Promos

General News

Bitcoin Billionaire Dies: BTC Fortune Lost Forever

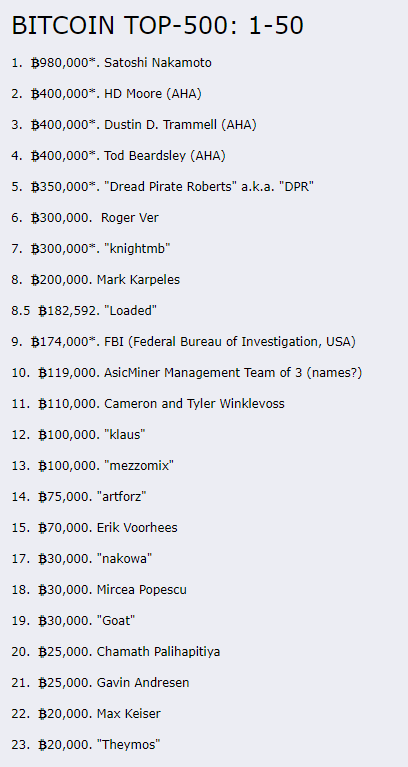

Micrea Popescu has boasted about being the single biggest hodler of bitcoin. However, it was recently reported that he died off the coast of Costa Rica. Local news reports he was swept away by the current and died immediately. At BTC’s peak his net worth would have been $2B and with the recently correction, $1B.

Some speculate only he had access to his private key, which means his BTC fortune is not accessible by anyone. Athony Pompliano highlighted in a tweet that the lost coins would make the current supply of bitcoin more valuable because there will only ever be 21 million bitcoin in existence.

A bitcoin forum assembled a list of the largest BTC hodlers back in 2013, based on public disclosures made by these individuals/entities. Note, there’s no way of validating this info and the list of top 50 hodlers has likely changed since this was originally published.

Whales Are Grabbing Bitcoin

Trader Willy Woo has shared a few charts published by Glassnode which reveal continued accumulation by owners of wallet with 1-10K BTC.

Number of BTC users also hit an all time high for 2021.

Robinhood Made 34% of Crypto Revenue from DOGE

The commission-free trading firm disclosed relying heavily on DOGE for Robinhood Crypto’s revenues. Doge climbed 15000% from its lows and accounted for 34% of Robinhood’s crypto revenue. With the token in a free fall, it could negatively impact the companies efforts to go public.

DeFi News

Resiliency of DeFi

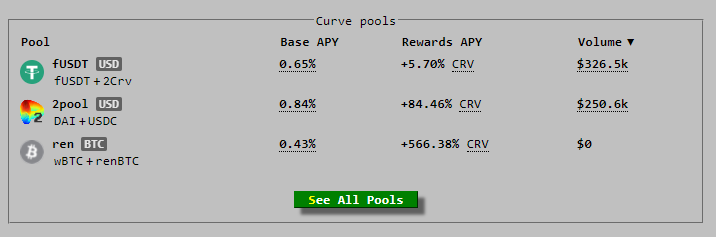

Right before DeFi winter in 2020, the total value locked (TVL) in DeFi was about $1B. Today the TVL sits at over $100B and it doesn’t account for all protocols. Despite the market action, DeFi continues to flourish. Institutions and companies are using 1-5% of their balance sheets to farm for yields in DeFi protocols. I’ve always said DeFi would thrive long term because capital always chases yield. Assuming DeFi industry continues to find creative methods to generate yield, we’ll continue to see capital inflows.

Additionally, collectively the DeFi protocols were able to endure one of the biggest market sell offs in history. Loan liquidations, margin calls, and decentralized exchanges continued to work without a hiccup. On the other hand, users of centralized finance experienced functionality issuess, which prevented them from adding collateral, closing cloans and/or completing trades. I’m confident large legacy players found this to be very impressive. It gives them more confidence to keep their capital deployed in DeFi protocols and potentially allocate more.

Lastly, Defi users continue to extract robust yields regardless of the market chop. Users continue to earn 10-50% APR on their stablecoins and triple digit yield on more volatile assets. By leveraging these opportunities in DeFi, market participants continue to remain profitable while everyone waits for the market to make a decisive move.

Aave, FireBlocks & Galaxy Explore Steps Toward Permissioned DeFi

According to the founder of Aave Stani Kulechov, before institutions can get involved, DeFi will need a system of whitelisted and blacklisted addresses. In his opinion it’ll lower the risk and thus make it a more palatable experience for large players. To make this possible Aave hopes to work with Fireblocks to introduce private and whitelisted markets.

This would be “phase one,” Shaulov said, leveraging the multi-party computation (MPC) used by Fireblocks. “We can basically then sort of whitelist them essentially, into those pools and allow them to interact with one another, while guaranteeing that they’re sort of isolated from the general pools,” - CEO of Fireblocks

Novogratz of Galaxy added the likely options are to be the walled garden approach and the chain surveillance. Walled garden approach is being worked out by Fireblocks and the surveillance option would require protocols to figure out where the transaction is coming from.

Crypto Tube

Crypto Market

OTC Action

Asia: Very little demand for BTC, most the flow came from ETH buyers.

Europe: Balanced BTC and ETH flows.

Americas: Nominal buying of alts, while BTC volume was absent.

Altcoin Index: At a two month low.

Crypto Fear & Greed Index: Slightly higher this week.

My Outlook: I remain bullish for the remaining months of 2021. The market seems to be gearing up for a decisive move this month. I expect the sentiment to shift quickly once we break up from this chop. Also, I still believe we need to have multi-chain DeFi season before the market cools off. Keep an eye on Flare Network, Cosmos, Thorchain, & Polkadot. Once all the chains have been saturated with liquidity and have their mania cycles, I’ll turn bearish.

Portfolio Update

This week I participated in the XRUNE public and strategic sales. This token will be required to participate in early stage funding rounds for projects using ThorSarter as their launchpad. I suspect the token price will benefit a lot from Thorchain’s growth, especially since XRUNE/RUNE is the most liquid pool.

I’ve been converting half my farming gains into stablescoins and depositing them into other DeFi protocols. For example, I’m farming on the PolyCrystal and selling my farmed tokens for USDC. I sell half my USDC for miMATIC (USD pegged stablecoin) and provide liquidity to the qiMATIC/USDC pool, generating a yield of 30%+ APR. I’m also converting some of my profits from Osmosis zone to diversify and accumulate more crypto assets. Assuming these assets appreciate over the next few months, I’ll see my dollar gainz compound like crazy.

New From C1S

1:23 Setting Up Wallet

5:06 Farming Strategies

Token of the Week

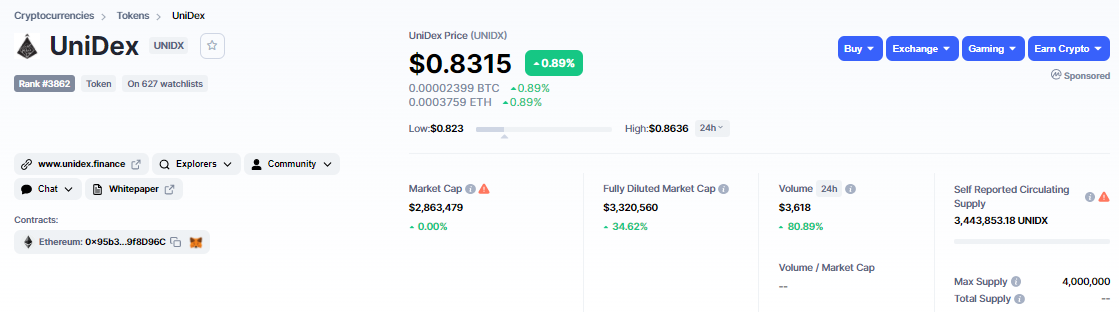

This project started by building a limit order tool for automated market makers but later expanded their service by offering order aggregation and leveraged trading. With their next update, they’ll offer ETF products, option trading, and an open source API for decentralized exchanges.

This is a low cap gem with a fully diluted value of $3.3M. There’s only 3.5M tokens circulating because all the unsold token were burned after the public sale. Token holders will be offered the following perks:

Save on platform fees

Trading fee rebates

Earn 50% of the fees generated by the platform

Currently the token, UNIDX, is only available on Uniswap but will be added as a BEP2 on the Binance Smart Chain in the near future.