Twitter | Starter Pack | Reddit | YouTube | Patreon | Website | Earn $250 in Promos

General News

Dreaded GBTC Unlock Is Approaching

A total of 40K BTC will be unlocked this month which represents $1.5B in notional value. The biggest unlock of the month will occur on 7/18 when over 16K BTC will be released. For the uninitiated, GBTC shares have remained the preferred investment vehicle for institutional investors. Currently the GBTC fund holds over 654K BTC tokens worth most than $21B, totaling 3% of BTC’s supply. GBTC shares are accessible via OTCQX, an over the counter platform.

Many major analysts and notable crypto investors are expecting the unlock to produce a major selling event. Conversely, Kraken and less prominent analysts on Crypto Twitter (CT) believe the unlock will not weigh materially on BTC spot markets. They highlight most the GBTC shares were bought with BTC to extract a premium that the shares once traded at. Moreover, most these investors also took out short positions to minimize the impact of potential negative price movements in BTC. To get a better grasp on the matter click the image below to be redirected to the Profit Maximalist podcast. Loomdart, an anon market analyst from CT, explains how big players played the GBTC premium trade and what he believes will happen after the great unlock. GBTC convo starts around the 18 minute mark.

With everybody nervous about a potential sell-off, a non-event would be bullish in my opinion. We could possibly see large investors take advantage of the fear by moving up their bids and aggressively accumulating. According to a SEC filing on July 8th, some players have already started to buy the dip.

A Man Who Accidentally Threw Away 7,500 BTC on Hard Drive

An IT engineer accidentally threw away a hard drive of an old computer containing 7,500 BTC he had procured back in 2013. The now 35 year old shares his plans to search the landfill using x-ray scanning devices and AI technology.

“We have a system with multiple conveyor-belts, x-ray scanning devices and an AI scanning device that would be trained to recognise items that are a similar size and density to the hard drive.”

“This would be a delicate search because we wouldn’t want to damage the hard drive in the process – you can’t just use a claw grabber,”

“We’ve spoken to excavation experts and proper engineers to make sure it was all being done correctly as well as in a way that was safe for the environment.”

“Over the last five months we’ve been talking to some of the best data recovery experts in the world to make sure we can get it off the hard drive.”

This search expedition is financially backed by a very wealth hedge fund who in return will get most of the recovered BTC fortune. However, the City Council is not allowing him to search landfill despite being offered $76M. Apparently they can’t allow excavations under their licensing permit and they’re also concerned about the environmental impact.

DeFi News

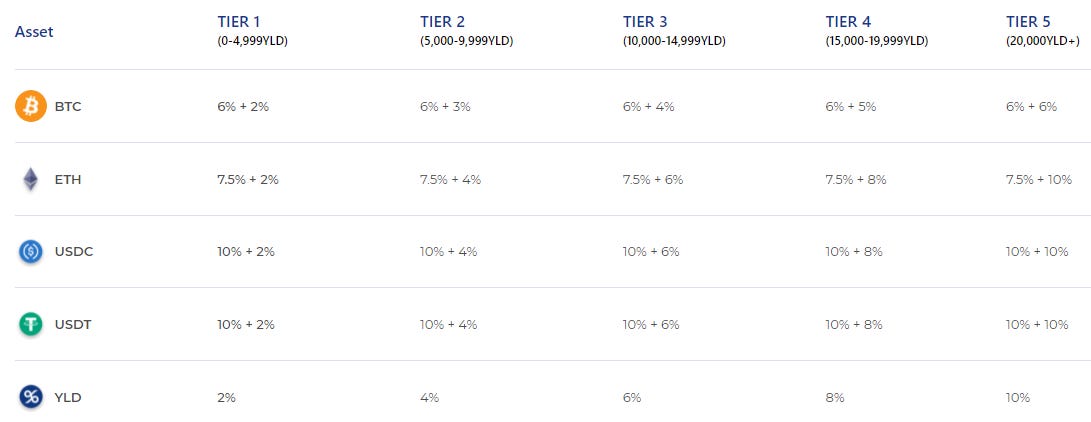

Yield App Offers 12% APY on BTC

This is a pretty good deal if you are open to getting exposure to the platform token YLD. They have a deposit cap and impose limitations so make sure to read the fine print before making any commitments. Even without their bonus rate, their base rates alone are very competitive.

Their tier bonus model is very similar other models offered by Celsius, Crypto.com, Celsius, and others.

Defi Investor Platform Zerion Raises $8.2M Series A

Unfortunately they’ve decided not to release a token or open the funding round to the public. Also, now that they’re getting funding they’re more likely to charge for services. If you have an Ethereum wallet, I would highly recommended using this portfolio management service while its still 100% free.

Iron Finance Relaunch w/ New ICE Token

Contrary to what most say, Iron Finance didn’t “rug” anybody. This was purely an economic failure due to a bank run. The protocol grew too much too fast, netting massive gains for market participants. The gains were so big that many players felt compelled to lock in the profits. This fueled the reflexive selling that followed as other investors also sold in fear of losing their paper gains. After that catastrophic event, Iron Finance has decided to make a come back. They are relaunching with a new token and IronSwap, the Iron Finance stable swap exchange. With investors shaken up from the mid-June sell off, Iron Finance maybe able to grow at a more sustainable rate this time around.

Enzyme Finance Integrates Yearn

Despite not having exposure to their governance token, Enzyme is one my favorite DeFi projects. At some point in the future I may create my own fund and only allow C1S community members to invest. This model is perfect because I never touch anybody’s capital and all my trades/moves would be 100% transparent. This move to integrate Yearn was brilliant. Now unallocated capital can collect interest as it waits to be deployed. I published a video review months ago ahead of the rebrand. Click the link below if you want to learn more.

Arbitrage Opportunities

With Aave and Compound offering low borrowing rates ranging from 3-4% for stablecoins, you can easily leverage your crypto assets for arbitrage opportunities. For example, you could use your WBTC as collateral to borrow stables at 3-4%, with a loan to value ratio up 70%. Personally, I like borrowing at 35-50% to have some cushion. You can take the borrowed money and covert it to UST on Curve. Convert your erc20 UST to Terra UST on the Terra Bridge. Once you have UST in your Terra wallet you can deposit it into the Achor protocol for a fixed APY of 20%. If you don’t feel comfortable utilizing a Defi protocol, you can also borrow at 6-12% APR from Nexo.

Here’s another strategy utilizing the services offered by Nexo.

Learn more about Anchor Protocol and the Terra Network.

Crypto Market

OTC Action

Asia: Slightly more BTC selling, even ETH flow.

Europe: Even BTC and ETH flow. Overall, very little activity.

Americas: Modest BCH, DOT, KSM, ETH, & BTC buy activity.

Altcoin Index: A new low was hit this week.

Crypto Fear & Greed Index: Down from 27 last week despite DeFi alts performing strong.

My Outlook: I believe the GBTC unlock is unlikely to have a material impact on BTC’s price. If we remain flat, this may embolden buyers to step in. Unless we have another black swan event I’m still bullish. I believe this entire market will trade higher by the end of the year. However, this next wave will likely result in a blow off top. Instead of timing the pico top, I’m going to begin cashing out in intervals. I’ll be sharing more details about my cash out plan as we approach Q3-4.

Porfolio Update

This week I entered a swing trade on LUNA and have already locked in some profits. As the price of LUNA goes up I’m borrowing more money to increase yield farming rewards. Every few days I exchange my ANC rewards for more LUNA tokens. I take these tokens and exchange them for BLUNA so I can borrow more money. If you’re not in my private discord channel and you’re confused, watch this video.

Additionally, I’ve started to convert a portion of my farming profits into stablecoins. During the market peak, I was making 10x my daily salary. Everything was working well until the market collapsed. I’m still netting respectable gains, but I wish I had been less greedy. Lesson learned, moving forward I’m at least cashing out 10-25% of gains every week.

Token of the Week

This revolutionary protocol makes it possible for investors to make lossless investments and consumers to access no fee services. They accomplish this by integrating the Anchor Protocol which provides fixed yields to depositors. For example, lets say a project is raising money. Instead of getting all the money up front from investors, the capital would be deposited into the Anchor Protocol. The yield generated by Anchor would be distributed in real time to the project’s team. The investors would receive shares/tokens and their entire deposit after the vesting period ends. This protects investors and mitigates against misallocations which tend to occur in hype cycles.

The protocol token is MINE and can be bought on their website using UST. The token grants users governance rights and fees generated by the protocol. Also, they’re offering liquidity mining incentives for users who provide liquidity into the MINE-UST pool and/or who stake their MINE in the gov vault.