Twitter | Starter Pack | Reddit | YouTube | Patreon | Website | Earn $250 in Promos

CLICK HERE to access the newsletter.

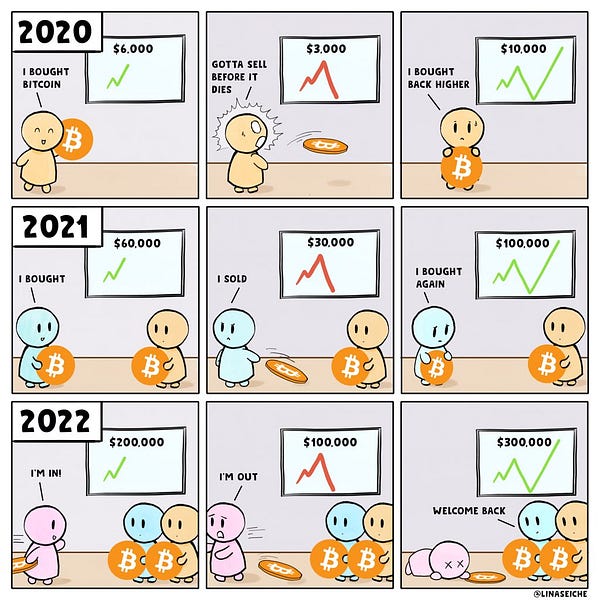

CeFi and DeFi has provided ample opportunity for us crypto holders to get a yield on our assets. It’s also attracted yield starved investors from legacy finance. We now have companies who are hedging against inflation by depositing a portion of their balance sheets into DeFi protocols. Back in early 2020 I recognized the potential of DeFi and started heavily allocating. I also viewed yield farming as an innovation that’s here to stay. For the first time projects and platforms didn’t need VC to accelerate growth. The could instead use tokens which essentially represent equity. This allowed them to bootstrap liquidity, increase economic activity, entice desired user behavior, acquire users, and much more. This is just the beginning. Over the next few years I expect more capital to flow into DeFi protocols as it naturally seeks out yield. This will help deepen the overall liquidity and allow for more financial innovation.

However, undoubtedly there’s risk involved and for this reason I like to spread my assets across a few DeFi protocols. The same applies to CeFi platforms. In the interest of diversifying risk my buddy decided to move some of his funds from Blockfi over to Ledn. They’re are currently offering 6.1% APY on BTC and 12.5% on USDC. I’ll cover the nuances in an upcoming video, but here’s a video I published months ago.

Notable Tweets