Twitter | Starter Pack | Reddit | YouTube | Patreon | Website | Earn $250 in Promos

CLICK HERE to access the newsletter.

DeFi Farming

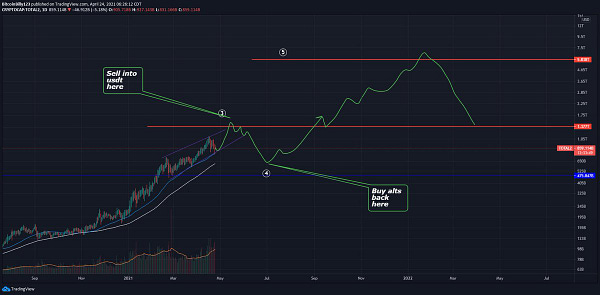

Understandably many you believe these 100% plus APR farms are unstainable and not safe. Paradoxically you’re right and wrong at the same time. DeFi protocols are built on infrastructure that is being battle tested as we speak. Also, given novelty of the space hacks will and do occur. However, this doesn’t mean you can’t extract massive yields with reduced risk. Established protocols like Pancakeswap on BSC or Harvest Finance on Ethereum offer robust yields and have a very low probability of rugging their users. Additionally, insurance products are now widely available and offer some protection. Getting 50% plus APR with a credible and reputable protocol isn’t hard as it may appear. For this reason, I believe doing your homework and finding quality protocols could potentially lead to profits like this 👇

In fact I have some clients who after months of yield farming are making over $1k a day. You don’t need to start with a large amount of capital either. With a little luck and prudent risk management anybody can make fat farming yields.

Not all the protocols will be around a year from now. However, some of them will become core primitives of a new financial system that will replace Wall Street. By being a liquidity provider you’re fulfilling a vital service and as result are being amply compensated. These tokens that are being distributed to users are essentially represent equity in a protocol. Imagine if Coinbase gave out COIN shares to users who provided liquidity to their order books. In legacy finance this isn’t possible but in DeFi the skies the limit. In my eyes liquidity farming is a more equitable, democratic, and decentralized means distributing ownership. Were building the new decentralized Wall Street and we’ll get to own it too.

Notable Tweets