Twitter | Starter Pack | Reddit | YouTube | Patreon | Website | Earn $250 in Promos

General News

Crypto All Star Leaves Andreessen Horowitz Firm

Katie Huan plans to start her own company investing in early stage venture deals within the Web 3.0 space.

She’ll continue to manage an existing crypto fund and will retain her board seats in her portfolio companies associated with the fund.

Haun started the first federal cryptocurrency task force as a prosecutor in the U.S. Justice Department. She later turned into one of the most respected female executives in the digital asset space.

Opinion: This demonstrates the growing conviction amongst crypto luminaries regarding the bright future of the digital asset space. Also, this trend of new start ups will accelerate into 2022. Individuals who’ve grown their net worth and network will begin pursuing their own endeavors. This will undoubtedly catalyze development and capital flow into the digital asset space. We’re approaching critical mass for an unstoppable innovation cycle. Deep market retracement are inevitable but I don’t foresee a two year bear market on the horizon.

Kraken Ventures Raises $65M for Early Stage Crypto Fund

This fund was launched in February 2021 and will begin shifting its focus to Web 3, DeFi, artificial intelligence and machine learning start ups.

They currently hold positions in the blockchain infrastructure platform Blockdaemon, digital asset platform Anchorage, crypto database provider Messari and a few others.

This fund will seek out investments in the $500k to $2M range.

Opinion: Many exchanges have created investment divisions to deploy their now inflated war chests. This indicates that they didn’t just start these exchanges as a “picks and shovels” investment strategy to profit from the crypto bubble. Instead they’re are entrenched players who want to double down on the entire industry. They’ve also inadvertently created a powerful capital loop. Exchanges generate an immense amount of capital during crypto hype cycles. A portion of this capital is reinvested back into the industry which sets stage for future growth cycles.

Hybridization of DeFi and GameFi

Opinion: During the summer of 2020 we witnessed a strong interest in DeFi core primitives. Essentially protocols which made up the plumbing underpinning of the DeFi ecosystem. This includes and its not limited to automated market markers (AMMs), synthetic assets, derivatives, borrowing, and lending. Little did we know these core services would also provide a strong foundation for GameFi. Prior to DeFi, gamers didn’t have any permissionless channels to sell their in game items. With Defi that’s no longer the case. For instance, in the popular game Axie Infinity Smooth Love Potion (SLP) is a digital asset that can be earned by playing the game. Today with decentralized exchanges gamers are able to accumulate and sell SLP without submitting to KYC requirements.

In comparison to DeFi, GameFi has a lower barrier to entry. As a result, we’re going to see many new non-crypto natives get introduced to the digital asset space. For adoption of blockchain technology, GameFi will have a more profound impact than Defi. Defi on the other hand will become more ubiquitous over time as they improve the user experience and take other measures to dissolve rigidity. At some point users will interact with DeFi primitives without having any knowledge of it.

Large institutions on the other hand are more fond of and intrigued by DeFi. They’ll naturally gravitate towards them for yield and eventually begin allocating to quality blue chip protocols. It’ll take time before they begin to understand how DeFi tokens are a superior form of equity. Once the light bulb turns on, I’m confident we’ll witness large institutional rotation into DeFi blue chips.

This synergy between DeFi and GameFi will attract both large investors and non-crypto natives into the digital asset space. With the prospects of making money playing online games and extracting monetary value from their online experience - early adopters in developing countries will have increased opportunities for upward mobility. Moreover, in the west our salaries are subsidized by borders. This new tech pillars will erode the borders and as a result create a level playing field. As a citizen of a Western nation I see the imminent future and I’m positioning by myself by investing heavily into these two digital asset themes.

OTC Action

Asia: Sporadic buying through out the week. About 50% of the buy demand was for BTC and rest was for ETH, SOL, DOT, and DOGE.

Europe: Strong demand for BTC and SOL. Blue chip Defi was sold in size, potentially for tax-loss harvesting.

Americas: Robust demand for BTC, ETH, SOL, ADA, and DOT all week.

Altcoin Index

Crypto Fear and Greed Index

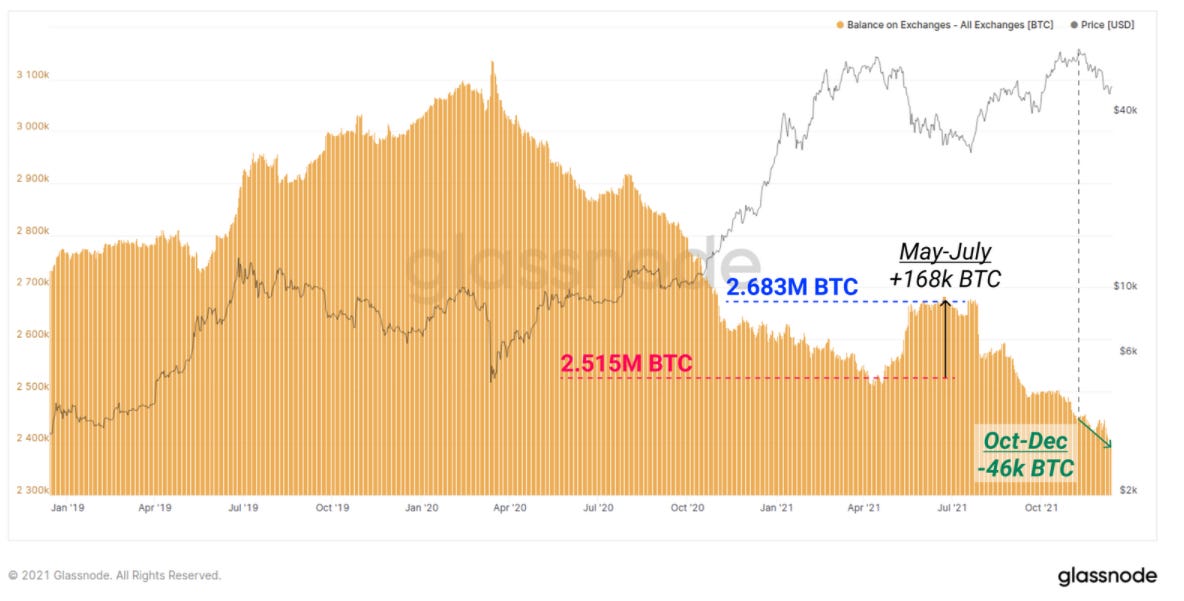

Bitcoin Balance on Exchanges

As you can see from the visual above from Glassnode, the supply on exchanges continues it’s down trend. This isn’t something you would see in a bear market. These bids are tightening the supply. Once the confidence in the market is restored or big buyers move in, we’re likely to see BTC print a big green candle. Above $70K BTC, more retail investors will flood into the space. This next wave will help extend the current market rally well into Q1-2.

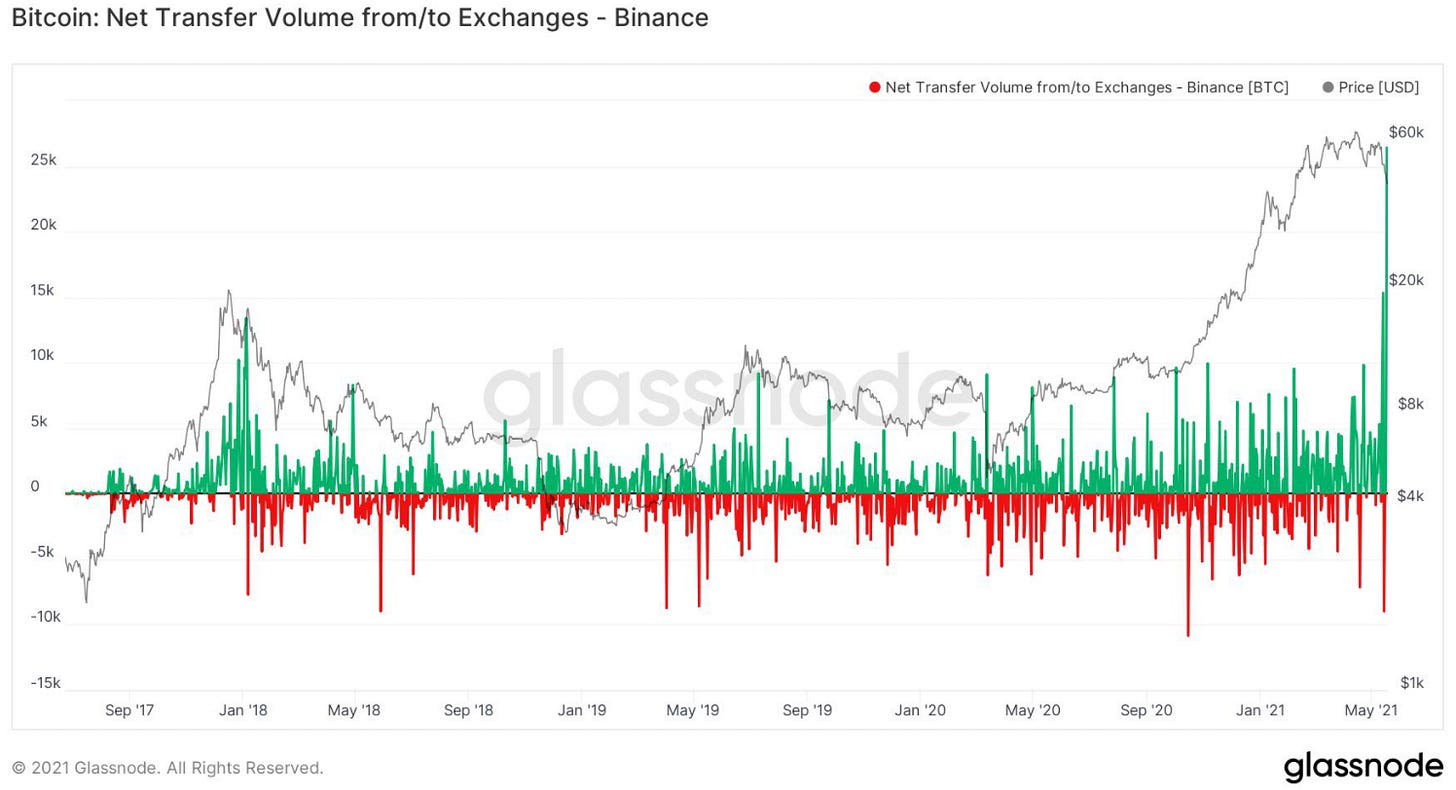

There are a few events I’m keenly watching to help me approximate the top. To begin with, meme coin mania typically suggests investors are heavily concentrated on the far right side of the risk curve. This concentration results in frothiness and typically materializes near market tops. Secondly, I’ll be closely monitoring net volume from and to exchanges.

You can see above the volume spikes have been fairly good indicators of big moves up and down. Lastly, given BTC is essentially the base monetary asset for the entire digital asset space - we don’t want to see a decoupling. Leading up to the summer sell-off this is exactly what transpired. A big BTC drop gives alts a huge liquidity shock. Minor and acute deviations are fine but large move downs are catastrophic for the market.

Portfolio Update

I added a few more Shadowy Coders and Fab Punk NFTs to my portfolio. In the video below I explain my thesis on NFTs with utility.

I also purchased more PAPER and DopeWar NFTs. After listening to a few Twitter Spaces and talking to the team, I’m growing increasingly confident in their ability to deliver. The minimal viable product won’t be delivered until Q2 at the earliest, but this means we’ve arrived very early to this opportunity.

In the last 24 hours I witnessed a notable volume surge. The floor basically doubled over night. These NFTs give holders voting rights, are bundled with in game items, and will be given land allotments in the game.

I removed my RUNE-THOR LP and converted it all to THOR. Afterwards, I staked my THOR to take advantage of the high APY of 294%. Once Thorswap goes live a portion of the fees generated by the DEX will be used buy THOR. This newly bought THOR will be distributed to THOR stakers. Within the last five days I’ve made about 1-2% on my staked THOR.

Lastly, I’ve been loading up on more JEWEL because it’s my highest conviction play. Their expansion into Avalanche will not only onboard new users but it’ll also generate more awareness. From a marketing perspective this is a great more. Moreover, JEWEL stakers on Avalanche will be eligible for airdrops. This includes the new realms token CRYSTAL. To get CRYSTAL users will have to buy and stake JEWEL or farm the gardens. In both cases the demand for JEWEL will grow exponentially.

Token of the Week

Cosmic Universe is another P2E game built on Harmony. Initially I was intrigued because of its proximity to Defi Kingdoms (DFK). Provided we see the expected growth from DFK in Q1, I’m confident other P2E games on Harmony will also see their user bases expand. At the moment they only have two mini games but they’re planning to create an immersive 3D game by the end of 2022. User will have full control over NFT characters and land.

There are two tokens used within the game. COSMIC is there inflationary token which is used as currency. MAGIC is the governance token used for yield farming, land staking, and purchasing land. I went ahead and purchased MAFIC tokens using 1.5% of my jewel tokens. For those who are interested the best liquidity source on Harmony is LootSwap.