Twitter | Starter Pack | Reddit | YouTube | Patreon | Website | Earn $250 in Promos

General News

George Soros Owns Bitcoin

Soros Fund management confirmed at a Bloomberg summit that the fund is trading BTC. Dawn Fiztpatrick, the fund’s chief executive was quoted saying,

“We own some coins - not a lot. I’m not sure bitcoin is only viewed as an inflation hedge here. I think it’s crossed the chasm to mainstream.”

This comes at the heels of Bank of America Corp publishing its first research coverage focused on crptocurrencies and other digital assets. Moreover, U.S. Bancorp announced it launched a cryptocurrency custody service for institutional investment managers who have private funds in the United States and Cayman Islands.

George Soros is considered a controversial figure by many but the important takeaway is that large players are beginning to diversify into digital assets. With the American economy taking a nose dive and stagflation rearing its head, I suspect many large funds will be forced to take on a similar hedge. A divergence between stocks and cryptos would provide a clear validation of this narrative.

Cryptos Brace for Biden Executive Order

According to anonymous sources, the Biden administration is weighing an executive order that would see a raft of new rules related to BTC and cryptocurrencies. This order would appoint a crypto czar to oversee agencies charged with making recommendations on BTC and crypto and would touch on financial regulation, economic innovation and national security. A Biden administration official said,

“even if the executive order is not released, the overall U.S. strategy for cryptocurrencies will still be made public.”

I have zero doubt in my mind more regulations are coming to crypto - especially to DeFi. In the next few months we’ll see total value locked and volume soar to new highs across the various DeFi protocols. This will prompt the administration to take decisive action and may usher in the next crypto winter.

DeFi News

Defi Growth in October

The Defi market has grown over 18% in October. According to Dappradar, the total value locked in the DeFi protocols grew from $113B to $137B. Cathie Wood, Soro’s Fund Manager and Bank of America have all expressed their bullish outlook for DeFi. They’re excited about the increased capital efficiency, reduced costs, and primitive stacking. Also, with their backgrounds in finance, relative to the other crypto assets its easier to come up with a valuation.

We already have institutions and large companies experimenting with DeFi protocols, however we don’t see major adoption due to the nascency of the industry and the lack of clarity on regulation. Over the coming years as regulations get drafted we’re likely to see a bifurcation of DeFi protocols into two categories - sanction vs unsanctioned. The sanctioned protocols will receive a green light from regulators and will require KYC from users. Conversely, we’ll have black listed DeFi protocols which regulated platforms will not be permitted to interact with.

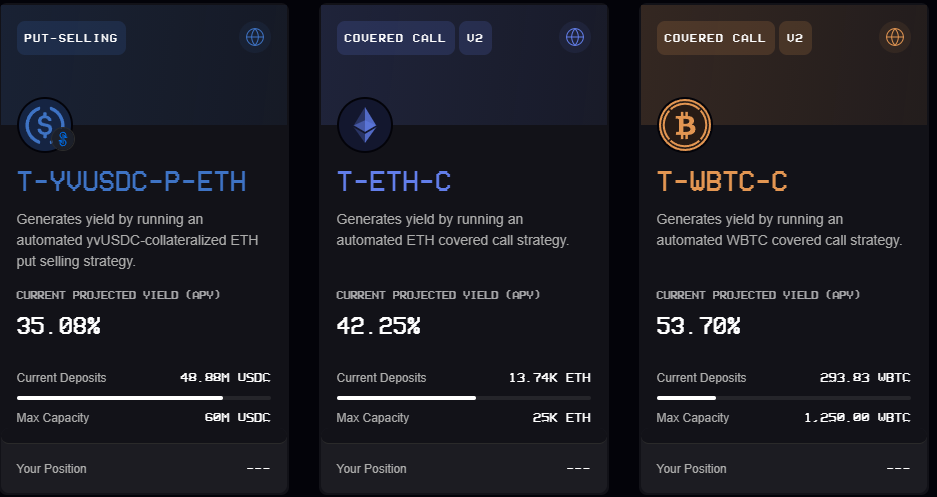

Ribbon User Hit Jackpot w/ Massive RBN Airdrop

At the current price $4, about $120M worth of RBN tokens became transferrable. One of my good friends was airdropped over $100k for depositing 1 ETH and being a liquidity provider to the Hegic protocol. They have a few interesting structured products that allow users to earn fat yields.

If you’re fishing for an airdrop check out Zapper.fi, Zerion, and Metamask. A friend of a friend claims an airdrop is coming to anyone who conducted a trade using Metamask. Not with an external DEX, but with the DAPPs native DEX. I would highly recommend experimenting with Defi protocols because airdrops are very common in this space.

This is how much I’ve made in two days for providing liquidity. A Coinbase listing is anticipated so I’ll wait to take my profits.

OTC Action

Asia: Timid BTC purchases, but zero selling.

Europe: Robust BTC buying, but very little interest in alts this week.

Americas: Equally strong demand for BTC, ETH, ADA, and SOL.

Altcoin Index: As BTC rises, the altcoin index falls to 51.

Crypto Fear & Greed Index: The index jumped to 71 as BTC pumped this week.

Portfolio Update

I sold some Ethereum for XRP. Bought the latest Watcher NFT drop. Lastly, I bought 20 plus Lunabulls NFTs on Random Earth. They’re offering passive income and a DAO membership to NFT holders. This shouldn’t be too hard to deliver given the many yield opportunities within the Terra ecosystem. Also, GalacticPunks have a high floor and its likely because they were the first quality PFP NFT on Terra. However, with competitors launching I believe we’ll see the floor on the Punks come down as people take profits to buy other NFTs.

Token of the Week

Fabric hopes to bring synthetic assets to Solana. They’ll begin by issuing commodities and equities before adding crypto assets. They recently sold over 10,000 NFTs in a successful mint.

These NFTs will share 100% of royalties with holders the first month and 50% after that. They’re launching their DEX in Q1 of next year and a portion of the trading fees will go to NFT holders.

Their governance token FAB will collateralize the synthetic assets at rate of 1000%. If they achieve a large total value locked, the FAB token will benefit greatly from this. I’ve decided to buy the NFTs instead of the token because I believe it has more upside. However, I may not be able to sell it if the demand dies down. Conversely, tokens can be market sold at any time. Also, once they introduce staking users will be able to earn yield on their FAB tokens.

Notable Tweets