Short-Term Market Outlook

Given the correlation to bitcoin, lets talk about the general market landscape.

Hi moon boys and gals!

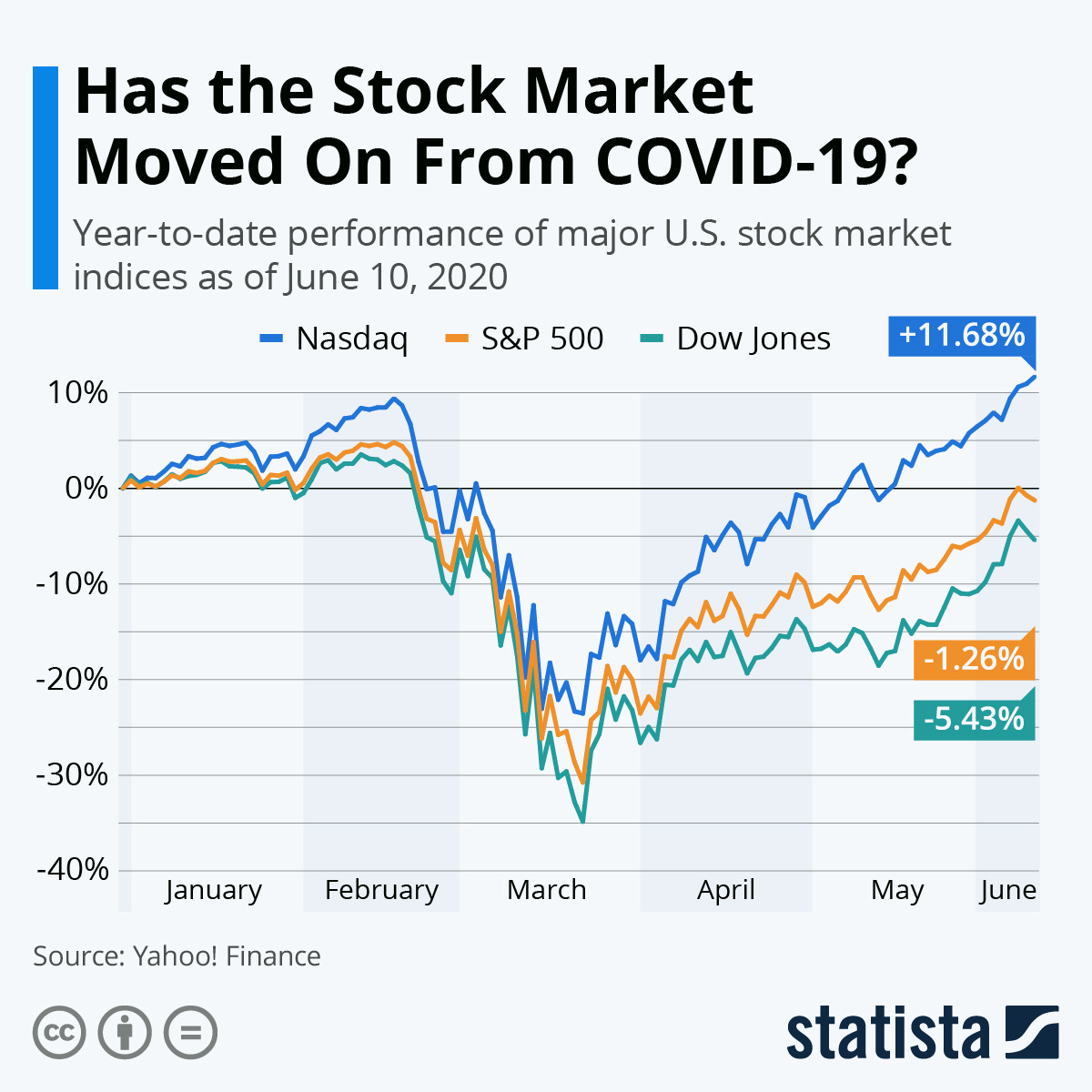

As digital asset investors its important to follow the developments in legacy markets. Given the strong correlation its become increasingly more relevant. This is what led me to formalizing my nuanced view in this newsletter. Despite the economy being in shambles and analyst making the most grim predictions, the stock has made a V shape recovery. As some of you may recall, I took the contrarian view and said a V shape stock market recovery was possible. People found this to be laudable but to date my prediction has been validated.

This is not to say I expect the markets to continue moving up indefinitely. I personally didn’t expect this recovery until the third & fourth quarter. With the COVID wave two narrative taking hold we may see a pull back, but I’m going to offer a diverging view. This is going to be some what controversial but I encourage you all to share your thoughts. I’m not a fan of echo chambers so feel to tell me I’m nuts, crazy, bonkers, etc. However, please do follow your critique with supporting facts and statements.

In this interview on real vision with one my favorite macro economists, Dan Tapiero, talks about his short-term view on the market. This is one of the few people who shared my perspective when the markets descended. Click here to watch the entire interview. It’s almost like the guy read my mind. I was echoing similar arguments with my inner-circle. Only 10% of my inner-circle accepted my argument. I provided a video clip below, just click the image below and you’ll be redirected to my lbry.tv account.

Now I’d like to highlights some point made by Dan and add a few of my own:

The fed has acted swiftly with massive stimulus and promised infinite liquidity. It was enough to temporarily satisfy many large fund managers. Previous administrations were very slow to react and take action. Kyle Bass who is no fan of the president, also commended the administrations bold moves. It’s abundantly clear this administration has the tools and knows how to use them.

Trump once stated publicly that he thinks he’ll get reelected without the markets help. I’m personally not convinced and I don’t think he is either. It obvious he’s doing everything he can to save this market and get it primed for November. Given the policy tools at his disposal I think believe it’s likely he’ll be able to keep the markets propped up.

Relative to other currencies, the dollar is strong. On a relative basis I expect it to get stronger for at least two more years. Other countries with weakening currencies and draconian capital control measures will entice investors to move a portion of their wealth into USD and USD denominated assets. You’re already starting to see this happen as Chinese investors buy USDT. I expect this trend to continue for the foreseeable future. It’s just a matter of time before international investors begin buying American equities.

Despite the COVID induced economic crisis, the fundamental are strong for the American economy. The US has cut corporate tax rates to 21% and we’ve seen historic deregulation. This is in addition to all the trade deal revisions. I expect all this to begin bearing fruit in 2021. Unlike most economies, the US has a strong legs behind it.

The Fed took the rate to zero and we may see negative rates in the coming months. The government is now deliberating over pay roll tax acts and additional stimulus measures. From my perspective, a pay roll tax holiday would be steroids for the economy. Assuming the jobs number is accurate, this will provide a nice boost the recovery.

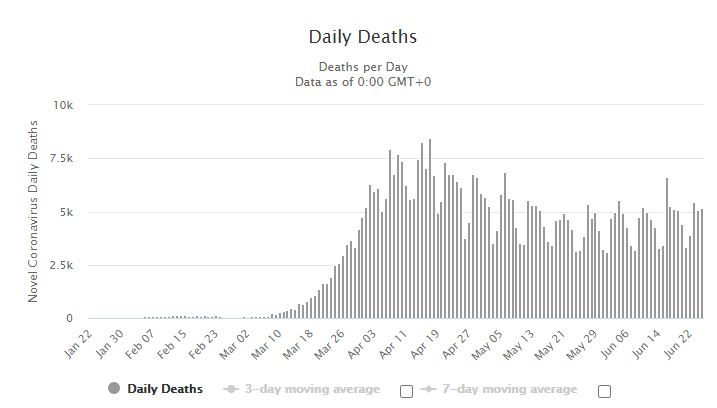

Now lets take at look at what could possibly derail this recovery. I’d like to premise this by saying I do have a medical back ground and I’ve worked in an infectious disease department. In my view, a wave two of COVID could undo some of the recent rally. I don’t expect a large scale shut down, but it may be warranted for some localities. I believe watching the number of cases is less important if you’re looking to assess the management of COVID. The most relevant metric to follow is the number of deaths.

Given the recent protest and the reopening of certain states, we should get a second wave. However, I’m not entirely convince we will. We have a better understanding of the virus, the summer is here, and some of the preliminary research shows the mortality rate may be less than the season flu. As we test more, the mortality rate will continue to decline. I believe the media if creating a hysteria by misplacing the public’s focus on the number of cases. These are the same people who told us weeks before COVID hit, it was nothing to worry about. Due to media wave two narrative push, I believe we’re likely to get choppy action in the markets. On the other hand, if we don’t get a wave two I expect the markets to continue their rally..

If we see another big sell off in the equities market you can expect to see the digital market sell off as well. Many investors in both markets are expecting a big move down, appears to the consensus view. I’m hedged against a potential downside move but I’m leaning bullish.

Based on my assessment above and other metrics I’ve made adjustments to my 401k and my core portfolio. To date the moves have played out well for me. I tend to publish a lot of content for free. However, my exact allocation percentages and real time moves are only provided to my Patrons.

This is part of the FREE subscription package that goes out to hundreds of investors. I also have a paid subscription package which includes exclusive content and insights. To really get the most bang for you buck, check out my bundle packages through Patreon.

For a limited time I’ll also be offering an option to pay in DAI. Using this method you’ll get an annual subscription for only 50 DAI.