Hi everyone,

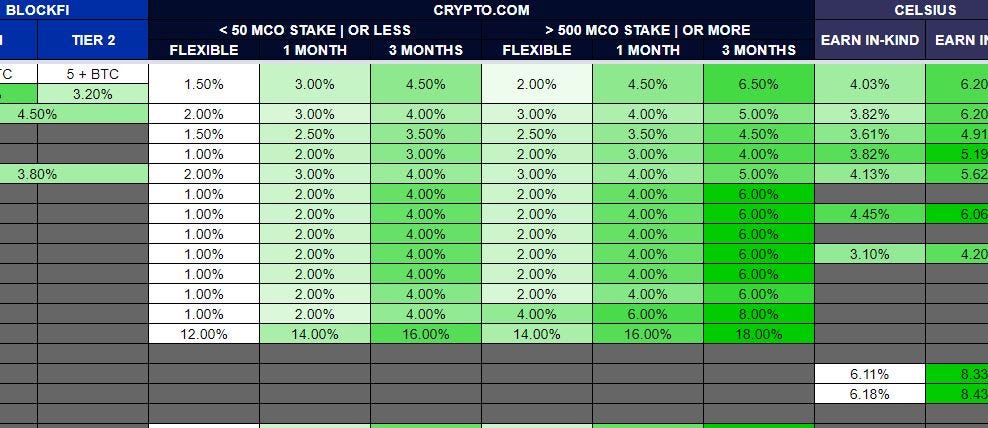

This is the first update on the lending rates offered by various centralized finance (CeFi) and decentralized finance (DeFi) platforms. My tentative plan is to provide weekly updates delivered directly to your mailbox every Saturday. You can always refer the interest tracker but this article serves to highlight the major changes. This way you can make an informed decision about where to custody your assets. I recently hired someone to write platform specific updates which I suggest reading. By using these resources at your disposal you increase your odds of getting the best yields. In case you wanted more exclusive insights consider subscribing to the paid service. I highly recommend this if you’re a big fan of CeFi, DeFi, and/or passive income. Nonetheless, here’s a summary of the latest updates for the week:

Bitrue listed ZIL for 6.8%

Nexo added BTC & ETH at base rate of 4%. Users who keep 10% of their total assets in NEXO tokens will be eligible for their bonus rates. BTC/ETH 5% and 10% of stablecoins. This similar to the Celsius and Bitrue models. I’m waiting for an official update before publishing an updated video review. However, you can click below to access reviews I’ve done in the past.

I haven’t completed formal reviews of these platforms and I don’t use them myself. However, my community expressed interest in tracking their rates. They’re the most recent additions to the interest rate tracker.

NEBEUS - BTC 6.45% 8.25% | ETH 6.45% 8.25%

They offer two types of Savings accounts.

Based on the length of time and the minimum you would keep.

Their Evergreen Savings (open with min 0.35 BTC or 18 ETH) delivers 8.25%

Their Rock Star Savings opens with min 0.006 BTC or 0.3 ETH and earn 6.45% APY

The annual interest earned are paid out in Euros in your Nebeus wallet monthly.

YOUHODLER - BTC 4.8% | ETH 4.5% | XLM 4.5% | LINK 4.5% | DAI PAX TUSD USDC USDT 12% | PAXG 8.20%

No lock in duration or period, nor special coin staking requirements.

Weekly compound interest payouts in stablecoins and crypto.

All savings are protected bu their our own security fund of $1M.

Ability to use savings funds as a collateral for lending products.

Ledn.io increased their USDC rate to 8.8%. This is their base rate, no need to buy or own tokens. To learn more watch the video review by clicking the image below.

In next week or two I’ll be covering how to exploit an arbitrage opportunity by leveraging services offered by two DeFi platforms. The entire methodology is broken down below but I will provide a quick tutorial in a video format in the coming weeks. There’s also an easier way to earn interest on LINK which I’ll also review in the video.

This is part of the FREE subscription package that goes out to hundreds of investors. I also have a paid subscription package which includes exclusive content and insights. To really get the most bang for you buck, check out my bundle packages through Patreon.

For a limited time I’ll also be offering an option to pay in DAI. Using this method you’ll get an annual subscription for only 50 DAI.