Twitter | Starter Pack | Reddit | YouTube | Patreon | Store Front | Earn $250 in Promos

Hi everyone,

Click here to access the interest rate tracker. It’s been updated so you can see the best rates offered among the various lending platforms. Also, please consider signing up for new platforms with the referral links posted by the moderator. He updates and maintains the excel spread sheet. I’m sure he’d greatly appreciate it.

Aave Liquidity Mining

Polygon is offering $40M in rewards to lender and borrowers on Aave’s Polygon market. Polygon is a layer 2 scaling solution with an aim to reduce fees and transaction time on Ethereum. The MATIC rewards for liquidity mining will be distributed in two phases.

Polygon will pay 0.5% of the total supply until 6/14

The second 0.5% will be paid from 6/14-4/13/22

Despite the millions in deposits the yields have held up pretty well. This suggests further dilution of yield is limited.

Autofarm

Last week I introduced a few new auto-compounding protocols on BSC. Given their recent launch the risk is higher, however they do compensate with robust yields. Generally speaking, yields in DeFi are a better barometer for risk than in legacy finance. The yields on Autofarm maybe lower but so is the risk. They’ve been active since December 2020 and have grown to $2B in TVL. Recently they made some big UI changes and unveiled better analytics for portfolio tracking. Consequently, I decided to mitigate my risk by shifting some funds from Swamp Finance to Autofarm. Make sure to check out their single asset auto-compounding vaults. They’ll handedly beat the yields of their CeFi counter parts.

Dracula Protocol

You’ll definitely want to book mark this protocol. They’re basically the Celsius Network of DeFi. Similar value capture mechanism for their token, DRC, but it’s automated by smart contracts. Celsius takes a portion of their assets under management to pursue yield in Defi. A very small portion of these profits are forwarded to their depositors. Dracula protocol on the other hand will yield farm and convert all mined tokens into ETH. Most of this ETH, minus the socialized gas costs, will go to depositors. This enables small depositors to earn yield farming rewards without having the burden of paying large network fees. The downside is that you can only earn rewards in ETH but this may change in future iterations. I’ll be doing a short video review for a more detailed explanation.

Thorchain

Since Thorchain will enable impermanent loss protection I’ve decided to add liquidity to every existing pool and any newly added pool. This way it’s like having exposure to a yield producing crypto index. Also, the block rewards are reduced progressively so the ideal time to provide liquidity is during the early stages. Lastly, its a good way to reinforce my own success by supporting the network.

To learn more about Thorchain make sure to check out my playlist.

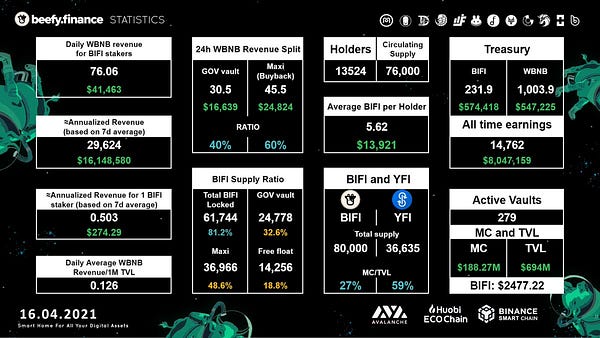

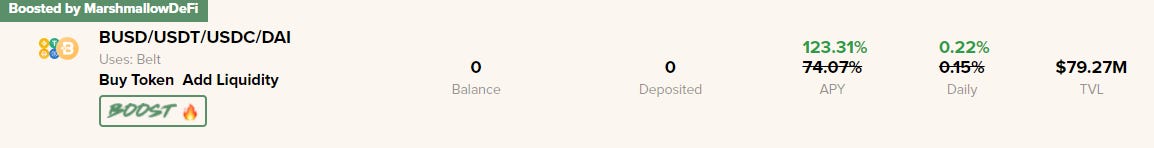

Beefy Finance

This is one of the largest yields I’ve seen on stables. It’s likely to be transient but might be worth the trouble if you’re already an active farmer.

FarmFol.io

If you’re not a fan of YieldWatch’s pay wall, consider checking out this new tracker. They only charge a flat fee of $10, but depending on your portfolio size it’s likely to be the more economical option. They support some of the popular protocols like Pancakeswap, Autofarm, Beefy, and others. I’m a big fan and I highly recommend this to fellow farmers.

Notable Tweets