Twitter | Starter Pack | Reddit | YouTube | Patreon | Store Front | Earn $250 in Promos

Hi everyone,

Click here to access the interest rate tracker. It’s been updated so you can see the best rates offered among the various lending platforms. Also, please consider signing up for new platforms with the referral links posted by the moderator. He updates and maintains the excel spread sheet. I’m sure he’d greatly appreciate it.

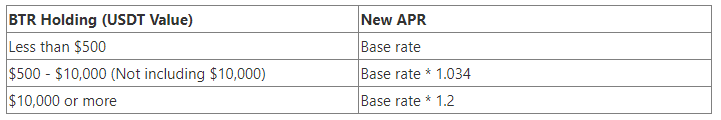

Bitrue Power Piggy 2.0

In hopes of increasing the value of BTR over time, the team has decided to implement a new tier system. Now the bonus rates are dependent on the dollar value of your BTR holdings.

Also, users will be able to use the VIP cap as soon as they add BTR to their accounts. The BTR used to generate the cap will be frozen for 24 hours. I’ve linked my Bitrue playlist if you’re interested in learning more. Bitrue provides lending, borrowing, exchange services.

XRP 3.8%

TUSD/USDT 12.5%

BTC 4%

LINK 4.8%

ETH 4%

SOL 2%

MATIC 5%

DOT 7.3%

ADA 5%

Osmosis

The first automated market maker (AMM) on Cosmos just turned on their liquidity mining incentives. I sent over my XPRT, CRO, and ATOM to take advantage of the lucrative yields. Since it takes 21 days to unbond staked ATOM token, it may take a while for the yields to get diluted.

Unlike liquidity mining incentives on Ethereum, you must bond your tokens for a fixed period of time and rewards are distributed once a day. Each pool’s parameters are governed by the liquidity providers, so you may see changes in the fees collected and the pool allocation.

To get started make sure to download the Keplr wallet. Each token resides on its own sovereign chain so you can’t use ATOM to pay for all transaction costs. For example, if you want to transact on Osmosis you must pay transaction costs with OSMO. Fortunately, the team has decided to temporarily allow for zero transaction costs to help with onboarding. Just select the low fee transaction to pay zero fees.

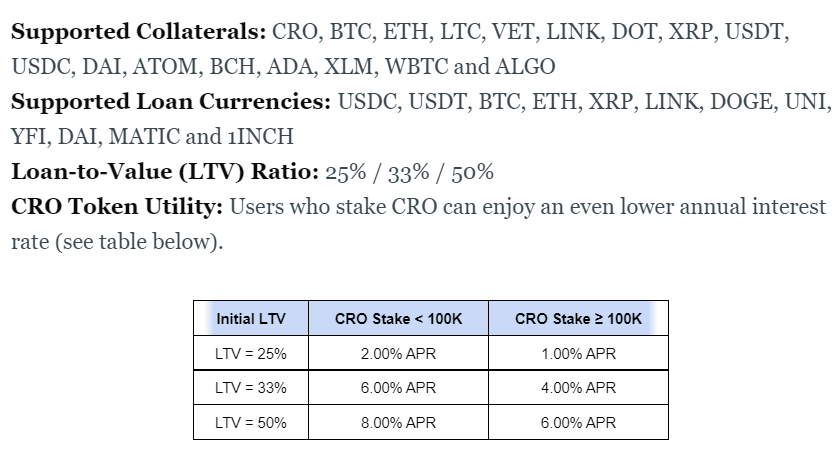

Crypto.com

New collateral types have been added for loans with interest rates as low as 1%. This is a solid option for individuals who enjoy farming with stables and don’t want to lose exposure to their crypto assets. With interest rates this low, farmers can easily arb out yield from DeFi protocols.

PolyCyrstal, PolyYeld, & Apeswap

ApeSwap is an AMM from the Binance Smart Chain which recently expanded into the Polygon Network. The teamed up with 10 other projects with the aim of securing a large TVL and providing farmers lucrative yields. Within a few days of their launch they’ve attracted almost $100M in TVL and peaked at $50M in volume. They’ve been audited numerous times and had a recent audit completed by DeFiYield.

PolyCrystal has managed to keep the token price between $3-10 which has sustained their farming yields. They’ve added some very popular pairs recently. Just make sure to review the deposit fee before making any commitments.

PolyYeld made a chad move by pairing their governance token with MATIC. They have three YELD-MATIC pools that source their liquidity from three different AMM’s. If you’re not interested in getting exposure to the YELD token, you can provide liquidity to the single asset pools.

Blockfi

Citing market dynamics, Blockfi has introduced tiers to more assets. The more capital under management a CeFi platform has, the more sensitive they are to market changes. You’ll notice smaller CeFi platforms are able to maintain their competitive rates despite their large competitors slashing rates. For example, Ledn hasn’t reduce their yield for USDC as it remains at 11%.