Lending Rate Update 🧮

Weekly lending rate updates on CeFi & DeFi platforms.

Twitter | Facebook | Reddit | YouTube | LBRY | Patreon | Store Front

Hi everyone,

Click here to access the interest rate tracker. It’s been updated so you can see the best rates offered among the various lending platforms. Also, please consider signing up for new platforms with the referral links posted by the moderator. He updates and maintains the excel spread sheet. I’m sure he’d greatly appreciate it.

CRYPTO.COM

BNB 6% to 3%

BAT 6% to 3%

LINK 6% to 3%

MKR 6% to 3%

PAXG 6% to 3%

EOS 7.5% to 4.5%

XLM 6% to 4%

VET 6% to 3%

ADA 6% to 4.5%

ENJ 6% to 3%

KNC 6% to 5.5%

ERD 6% to 4.5%

Major cuts across the board for many altcoins. I suspect this might have something to with their decision to drop the tier costs. Many users likely took advantage by upgrading their cards. As more users become eligible for the premium rates they have to reduce the payouts to remain financially solvent. I’m not very happy with the rate cuts, consequently I’ve decided to move my LINK tokens to Bitrue once my earn term matures. Originally I had planned to keep them on CDC because I was getting 2% bonus in CRO tokens. However, with the recent rate cut to 3%, I’d rather earn 7.3% on Bitrue.

Earning High Yield With yaLINK Vault

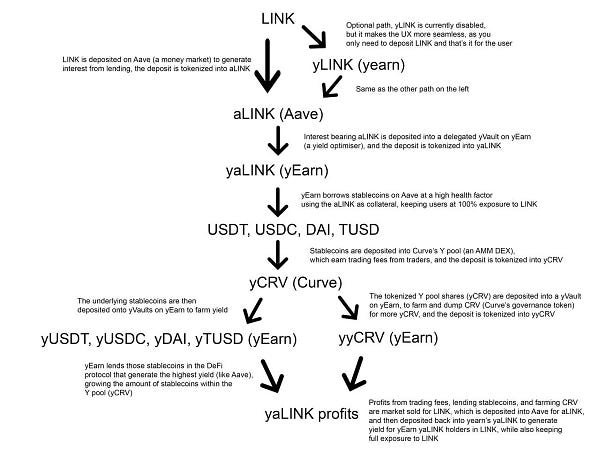

A couple days ago I decided to put a few link in the yaLINK vault on Yearn. Disclaimer this platform is in beta so use at your own risk. The platform is a yield aggregator that rebalances user deposits across various DeFi protocols. Yearn added yVaults to broaden their product line. Now users can deposit LINK tokens and earn a yield on them. The deposit flow is a little nuanced and the process works like this:

1) User deposits LINK

2) The tokens are used as collateral in the Aave protocol

3) USD pegged stablecoins are borrowed against LINK

4) USD pegged stablecoin is deposited into yVault to generate APY returns

5) The profits from the yield are sold for LINK

6) LINK accrues in the vault

I’ve talked about this in a past video, but this is the first time users can do this in one click. This saves gas and time because users are delegating all actions to the yVault. This model could be adapted to any coin, thus I expect new additions to the yVault in the coming months. I recommend using zapper.fi if you’re interested in pursuing this opportunity.

First select the correct pool to provide liquidity into.

Next pick the asset you would like to provide liquidity with (ETH, DAI, USDC, LINK). Note if you pick an asset other than LINK, it will essentially get converted to LINK.

Once you confirm the transaction you’ll be on your way to earning approximately 80-90% APY on your LINK tokens. Go to the yield farming website to check your projected returns.

For advance yield miners, check out this chart post by ChainLINKGod. It provides a more thorough outline of the capital flow. In my view this is just the beginning of DeFi composability.

Notable Tweets

This is part of the FREE subscription package that goes out to hundreds of investors. I also have a paid subscription package which includes exclusive content and insights. To really get the most bang for you buck, check out my bundle packages through Patreon.

For a limited time I’ll also be offering an option to pay in DAI. Using this method you’ll get an annual subscription for only 50 DAI.