Twitter | Starter Pack | Reddit | YouTube | Patreon | Website | Earn $250 in Promos

Hi everyone,

Click hereto access the interest rate tracker. It’s been updated so you can see the best rates offered among the various lending platforms. Also, please consider signing up for new platforms with the referral links posted by the moderator. He updates and maintains the excel spread sheet. I’m sure he’d greatly appreciate it.

Aave

Aave has finally launched on Avalanche with respectable yield farming rewards. Currently you can only get yield for supplying assets but we may also receive yield for borrowing assets. That’s right get paid to borrow! This hasn’t been confirmed but we witnessed it after Aave launched on Polygon. Being paid to borrow assets will allow users to double dip by depositing borrowed assets on yield farms outside of Aave. If you’re interested in exploring yield farming opportunities on Avalanche, Aave is a good place to start. To transfer your assets over to Avalanche from Ethereum check out this bridge.

Benqi

This is a money market protocol like Aave, however it’s relatively new. This means you’ll be taking on more risk since this protocol needs to be battle tested in the wild. On other hand, Benqi has $2B in TVL which implies that the market has confidence in the protocol. They’re backed by reputable firms in the industry which dramatically diminishes the rug risk.

The yields are subsidized by the platform governance token QI. Also, for some assets you’ll get paid to borrow. If you’re open to a little more risk, skip Aave and start farming on Benqi.

StakeDao

For all you stablecoin farmers out there, consider visiting StakeDao for their stable USD strategies. For instance, StakeDao will deposit av3CRV (USDC,USDt, DAI) into Aave for dual farming rewards. You’ll earn CRV from the Curve pool and WAVAX from Aave. This is a passive strategy, so you simply have to make one deposit to take advantage of this.

Triple Yield on Osmosis

I was dollar cost averaging into Juno for the last few days ahead of dual liquidity mining incentives launching on 10/15. The price of JUNO today is above my cost average and I’m earning close to 300% APR.

The yield is actually much higher than what’s being displayed on the dashboard.

Juno Chain will providing smart contract interoperability pm the Cosmos ecosystem via IBC. This is a very important infrastructure piece and is likely to be widely adopted. For this reason, I’m ok with getting exposure to the JUNO token.

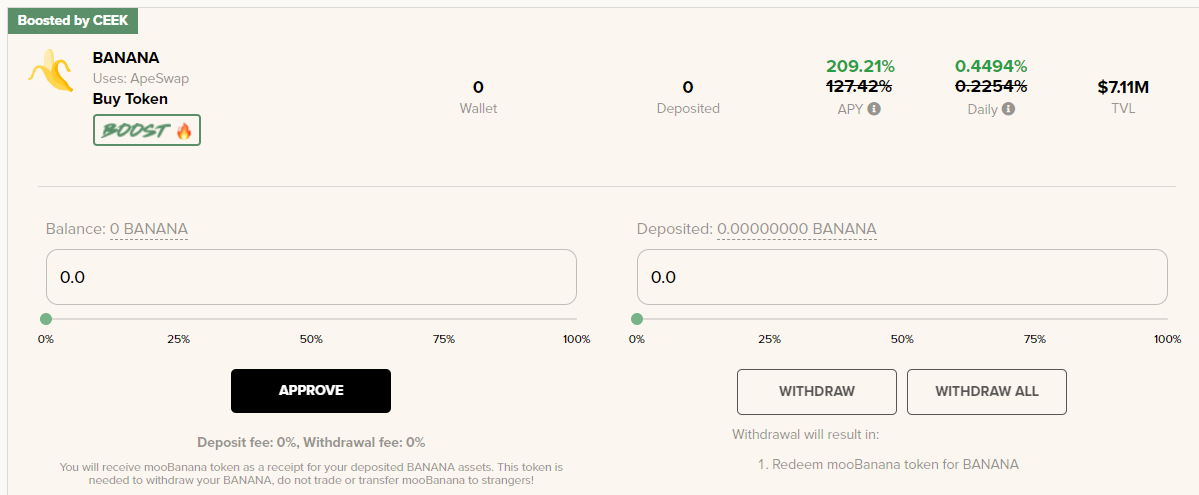

Beefy Finance - BSC

I’m a big fan of ApeSwap and I firmly believe they’ll eventually be recognized for their hard work. This is the only automated market maker that has a shot at dethroning Pancakeswap. They’ve been recognized by CZ himself and are cultivating relationships with many protocols within the BSC ecosystem. Lately, I’ve noticed many opportunities to earn boosted yield with BANANA token on Beefy Finance. Historically, the boosted opportunities were limited to Pancakeswap LPs and CAKE stakers. However, with the rise of Apeswap that has changed.

I decided to participate in the latest boosted pool on Beefy Finance that will expire in 20 days. This vault on Beefy will auto-compound BANANA rewards and generate a boosted yield in CEEK tokens. First you’ll have deposit your BANANA in the auto-compounding vault on Beefy’s front page.

By doing this you’ll only earn 0.22% APR daily. To earn an additional 0.22% APR daily in CEEK tokens you’ll need to deposit your BANANA LP token into the boosted vault.

Notable Tweets