Twitter | Starter Pack | Reddit | YouTube | Patreon | Store Front | Earn $250 in Promos

Hi everyone,

Click here to access the interest rate tracker. It’s been updated so you can see the best rates offered among the various lending platforms. Also, please consider signing up for new platforms with the referral links posted by the moderator. He updates and maintains the excel spread sheet. I’m sure he’d greatly appreciate it.

Polygon Farms

Here are a few protocols I’ve been farming. I’ve noticed many farmers are migrating their assets over to Polygon from BSC due to the performance issues. I still have funds deployed on BSC, but in hopes of taking advantage of the lucrative yields on Polygon I also transferred a portion of my BSC funds over.

QuickSwap

Currently QuickSwap is the flagship AMM on Polygon. It pays to be the first AMM on any chain. They are aggressively bootstrapping liquidity with very robust yields for a wide variety of pairs. Since its the highest volume AMM on Polygon, you’ll also enjoy high rewards from pool fees. In fact the APY displayed combines liquidity mining rewards, paid in QUICK, and pool fees.

Many of these pairs can found on Beefy and Adamant if you’re interest in auto-compounding your QUICK rewards. Provided many of these incentivized pools are paired with QUICK, as more farmers come to Polygon, the price of QUICK should appreciate over time.

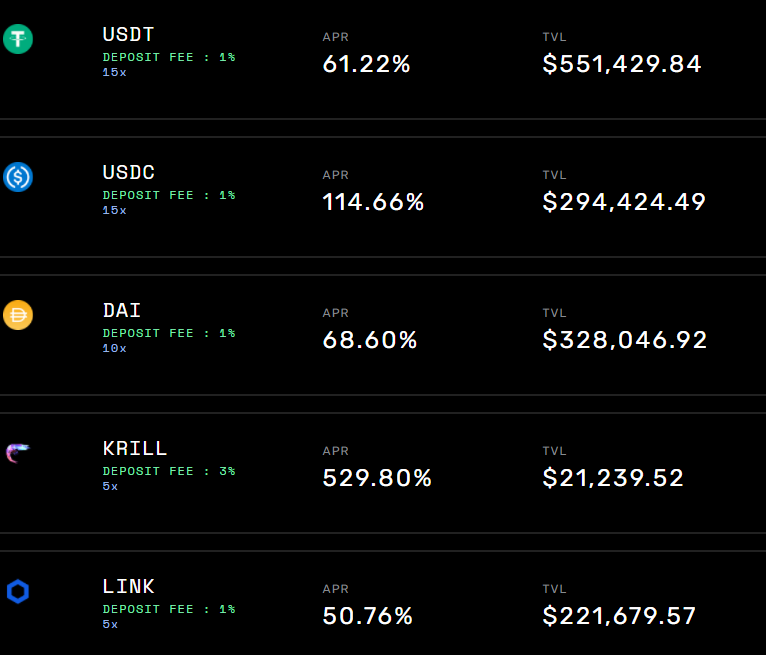

BlackSwap

This protocol expanded from BSC in hopes of increasing their TVL. Their objective is to create farms with very lucrative and sustainable yields. They have a multi token model, which I’m not a fan of. However, I admire their continued efforts to make their project a success. I decided to deposit a portion of my KRILL tokens to take advantage of the 500% plus APR.

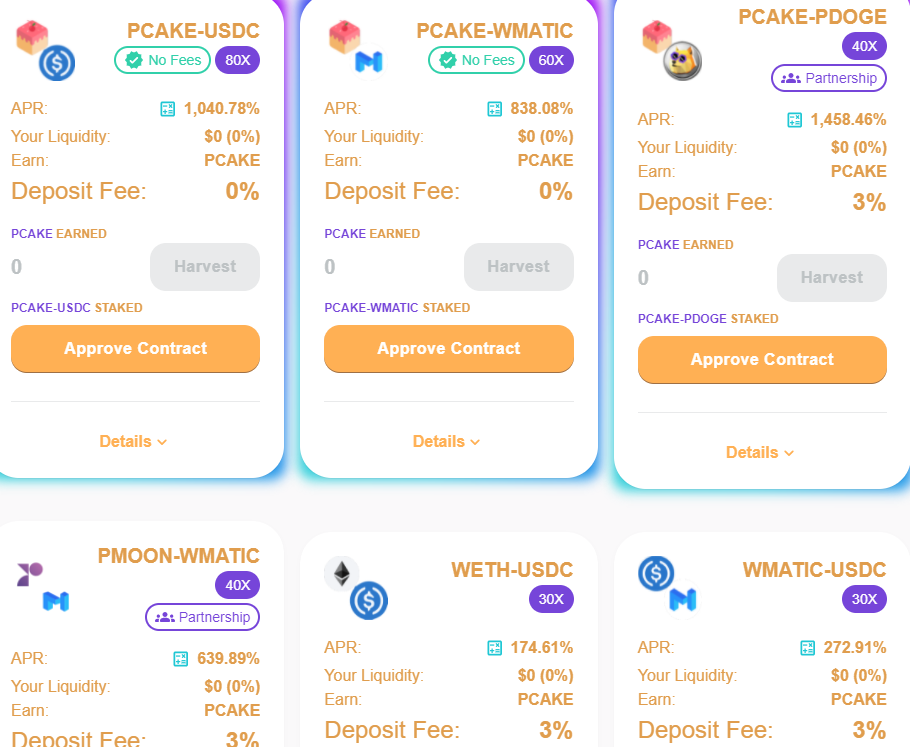

PolyCake

This protocol is a clone of Goose Finance with a nuanced token model. Every PCAKE transaction leads to 0.3% of the tokens being burned. They also charge a fee for the staking pools and 75% of the fee is used to buy and burn PCAKE tokens.

They don’t have many farms to choose from but at least they charge a slightly lower deposit fee.

They have an ambitious roadmap for the remainder of the year. If they can successfully bootstrap liquidity on their new AMM and build a vibrant community, I think the project has some potential. Personally, I cashed a few farmed tokens to cover my deposit fee and than some. I’ll let the rest ride and use them to farm MATIC in the Cake house.

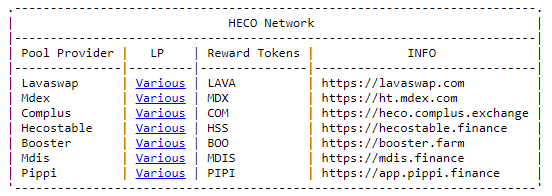

Heco and Fantom

Farming is just starting to take off on these chains. I haven’t started farming here yet because I don’t want to over extend myself. However, this maybe my next stop once the market recovers. Make sure to join my discord if you want to connect with farmers on Heco and Fantom. Also, keep an eye on Cosmos and Polkadot. I expect those two ecosystems to lure in deep liquidity very quickly.

Notable Tweets