Twitter | Starter Pack | Reddit | YouTube | Patreon | Store Front | Earn $250 in Promos

Hi everyone,

Click here to access the interest rate tracker. It’s been updated so you can see the best rates offered among the various lending platforms. Also, please consider signing up for new platforms with the referral links posted by the moderator. He updates and maintains the excel spread sheet. I’m sure he’d greatly appreciate it.

Indexed

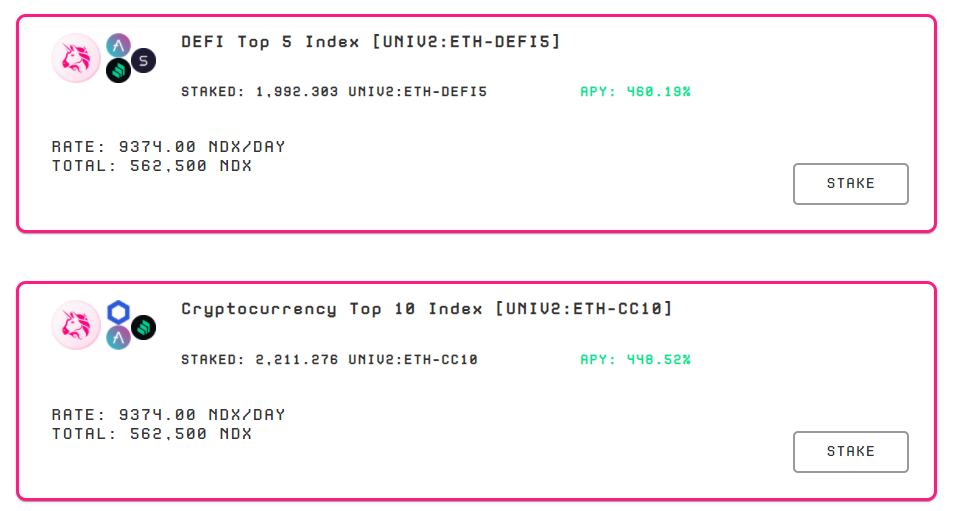

Index pools are the first products being developed by the Indexed Finance team. These pools are designed to mirror the behavior of index funds which historically have produced better returns than actively managed funds on the stock market. Each index pool has an ERC20 index token which anyone can mint by providing the underlying assets in the pool, burn to claim underlying asset, or swap with exchanges to easily manage their exposure to specific markets. Currently you can earn their governance token, NDX, for providing liquidity.

This requires the user to deposit ETH-Index into Uniswap and stake the LP token on indexed.fiance. I decided to participate in this opportunity for two reasons. I’m currently very bullish on DeFi alts and I would also like to put my asset to work. These indexes give you exposure to a basket of DeFi alts and by staking the LP token you’ll also earn a triple digit yield. The protocol hasn’t undergone an audit from a third party security firm. However, two security experts have completed independent reviews of the core contracts.

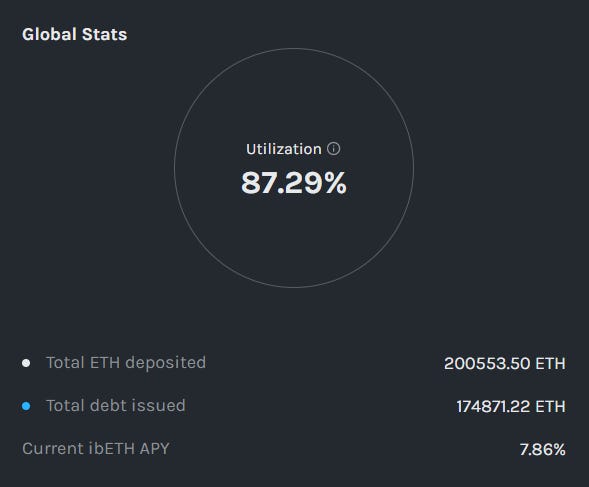

Alpha Homora

This protocol allows LP’s to leverage their ETH position to earn larger yields. Users who lend their ETH will receive a yield. The dynamic yield is dependent on supply and demand, therefore it’s subject to change. As I’m writing, the current yield is 7.86%. Also, they extended their liquidity mining program to 2/10/21 and during this period an additional 6 million ALPHA will be distributed.

Hegic

Given the current price of the HEGIC token, ETH & WBTC depositors can earn north of 300%. Liquidity mining phase 2 launched this week and will continue until one of the following conditions are met;

On-chain volume exceeds $1B

11/11/2022

Assuming the second criteria is met first 361,350,000 HEGIC will be distributed in total. This translates into 990,000 HEGIC/day distributed pro rata among liquidity providers. The protocol didn’t suffer any adverse events during phase 1 and the code has been reviewed by security firm. However, this doesn’t mean the protocol can’t be hacked. Generally speaking, any time you deposit funds into DeFi protocols you always risk losing everything. Moreover, with HEGIC you can lose some of your funds without an exploit. The option buyers extract profits from the pools. If the profits payouts exceed the premiums paid, LPs will endure losses. LPs are encouraged to hedge by purchasing call options, however the liquidity incentives to date have maintained LP profitability.

Content Summary

VGX Token Potential [1:50]

Common Issues [7:00]

1:20 Introduction

6:26 Tokenomics

8:18 My Thoughts

1:54 BTC Retracements

4:29 New DeFi Demand

7:14 Token of the Week

Notable Tweets