Twitter | Starter Pack | Reddit | YouTube | Patreon | Store Front | Earn $250 in Promos

Hi everyone,

Click hereto access the interest rate tracker. It’s been updated so you can see the best rates offered among the various lending platforms. Also, please consider signing up for new platforms with the referral links posted by the moderator. He updates and maintains the excel spread sheet. I’m sure he’d greatly appreciate it.

SifChain

To help create deep liquid pools for IBC tokens, Sifchain has launched very lucrative yield farming incentives. By providing liquidity to one of he following pairs you can earn a triple digit APR.

Sifchain uses a token model similar to Thorchain. The base token for every pool is ROWAN, Sifchain’s native token. As the total value locked grows so should the demand and value of ROWAN. Assuming they achieve deep liquidity, we could see the price of ROWAN go parabolic. Given the high potential for price appreciation, lucrative yields, and use case of Sichain within the Cosmos ecosystem I decided to provide liquidity.

Currently with Sifchain and Osmosis I’m making more money weekly than at my current day job. The plan is to extract massive yields while Cosmos goes through its expansionary phase and sell before we see a contraction. At this point it appears most market participants have shifted to risk-on. In this environment I believe its better to buy volatile assets and earn a large yield vs earning a double digit yield on stabelcoins. Not only do you get upside exposure but you often times will earn triple digit APR. You can use the generated yield to buy NFTs, more crypto assets, or auto-compound. Leveraging this strategy will multiply your gains and in my opinion will out perform most buy and hold strategies.

To learn more about Cosmos and Sifchain watch the video below.

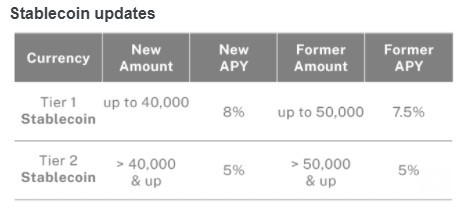

Blockfi

With yields being slashed and users losing access due to state specific regulations, you maybe searching for an alternative. The most recent platforms I’ve shifted capital to include Ledn and Hodlnaut. To date they’ve maintained competitive rates and have had zero security issues. Given these two are relative new CeFi platforms we may see yield dilution in the future. However, they are compliant with regulators and are getting ready to add a wide variety of wealth management services. I’ve highlighted a few services in the videos below.

Holdnaut / Ledn

BTC: 7.2% / 6.1%

ETH: 7.46% / 0%

USD: 12.73% / 8.5%

Many times high rates are offered by platforms as a marketing tactic. Often times within months they get reduced to match market average rates.

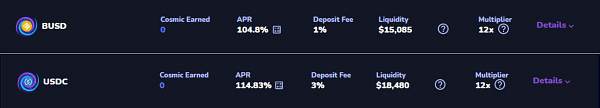

Saber

It appears VC has taken a keen interest in Solana based DeFi protocols. Just a short month ago, they raised $7.7M from Chamath Palihapitiya's Social Capital and others. With this fresh capital injection the team quickly mobilized to hire more devs and list more assets. Their platform token SBR has gone up 30x after the investment and as a result so have their yields.

These are arguably the best yields in the industry. Assuming their token doesn’t take a nose dive, these yields will last for weeks to months.

Notable Tweets