Twitter | Starter Pack | Reddit | YouTube | Patreon | Store Front | Earn $250 in Promos

Hi everyone,

Click hereto access the interest rate tracker. It’s been updated so you can see the best rates offered among the various lending platforms. Also, please consider signing up for new platforms with the referral links posted by the moderator. He updates and maintains the excel spread sheet. I’m sure he’d greatly appreciate it.

Port & Mercurial Finance

These two Solana based protocols are offering dual liquidity mining rewards for 2 weeks. To start earning simply deposit your MER into Port Finance.

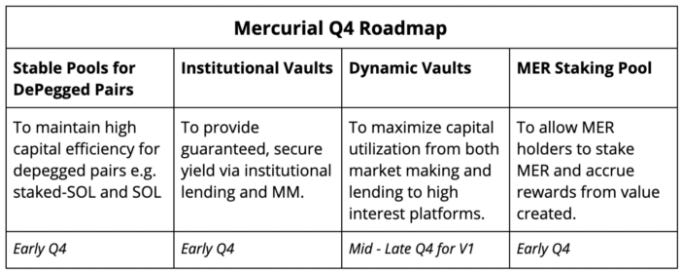

Mercurial offers a unique token model that ensures value accrual flows to MER holders. They plan to introduce a staking pool in early Q4 for MER holders. A portion of the returns from their swap pool, institutional vaults, and dynamic vaults will be used to buy back MER and re-invested into the staking pool.

I believe once these services are integrated and staking goes live, MER will go on price discovery. I suspect most investors will start accumulating ahead of Q4. Meanwhile you can a respectable yield on Port Finance.

Saber

SOCN- SOL 127% APY

UST-USDC 23% APY

apUSDT-USDT 39% APY

Currently with $8M in TVL, you can earn 127% APY in the SOCN pool on Saber. SOCN represents staked SOL on Socean. This pool allows for single asset liquidity provision, so you can deposit your SOL to be eligible for the fat yield.

Hodlnaut

First 2 BTC 7.2% APR

First 20 ETH 7.2% APR

First $25K USDC/USDT 12% APR

Out of all the lending platforms I’ve introduced, Hodlnaut currently offers the most robust rates. They recently partnered with a U.S regulated exchange Okcoin, to provide easy on-ramps and optimize current yields. To learn more watch video linked below.

Yield Farming on Binance Smart Chain (BSC)

This week I had a call with a CEO of an up and coming CeFi lending platform. I was surprised to learn they were sourcing some of their yield from BSC protocols. Despite the critics of BSC, we continue to see TVL increase and new protocols being deployed. This leads me to believe BSC will remain relevant in the multi-chain future.

Currently I’m farming on a few BSC based protocols but I’m mostly concentrated in the following protocols.

Pancakeswap: https://twitter.com/PancakeSwaptako

ApeSwap: https://twitter.com/ape_swap

Growth Defi: https://twitter.com/GrowthDefi

Pacoca: https://twitter.com/pacoca_io

Tako DeFi: https://twitter.com/TakoDeFi

Alpaca Finance: https://twitter.com/AlpacaFinance

There’s ample opportunities to earn dual yield farming rewards. For example, you can deposit your ApeSwap BANANA-BNB LP into Tako Defi and earn both BANANA and INKU. I’m currently earning about 200% APR from ApeSwap and 90% APR from Tako Defi.

I’ve been paying close attention to protocols on BSC and realized many platforms have impactful adjustments to their tokenomics. Consequently, many tokens have recovered 5-10x off their lows. Assuming the general market continues to rally, I expect these BSC tokens to continue their moves up. Also, NFT gaming has brought new market participants into the BSC ecosystem. Many of whom are experimenting with DeFi protocols for the first time. This has set the stage for another expansionary phase for BSC protocols.

Avalanche & Algorand

These layer-1 chains are getting increased attention from investors. Many VC funds are competing for investments or already have made commitments. Keep an eye on these two for potential yield farming opportunities. Also, DeFi governance tokens on these chains are likely to go up multiples as they on-board new users.

Notable Tweets