Twitter | Starter Pack | Reddit | YouTube | Patreon | Website | Earn $250 in Promos

Hi everyone,

Click hereto access the interest rate tracker. It’s been updated so you can see the best rates offered among the various lending platforms. Also, please consider signing up for new platforms with the referral links posted by the moderator. He updates and maintains the excel spread sheet. I’m sure he’d greatly appreciate it.

Sifchain & Dinoswap

Sifchain is aggressively pushing to bootstrap liquidity and as a result the total value locked (TVL) has gone from $10M to $50M in about one month. This project was started by a team that previously worked on Thorchain. Like Thorchain they also used their native token, ROWAN, as the base pair for all supported tokens. This means in theory as the TVL increases so should the price of ROWAN. Given my bullish outlook for the entire Cosmos ecosystem, I’m fine with getting exposure to ROWAN. If you’re concerned about losing your starting capital because the price of ROWAN depreciates, I would advise against providing liquidity.

Also DinoSwap, an automated market maker on Polygon, is providing robust rewards for Cosmos token pairs. This a great choice assuming yields on Sifchain get diluted. Right now we don’t have a bridge from Sifchain to Polygon, so you’ll have to use an exchange intermediary.

Ribbon

Ribbon is bringing structured products to DeFi which creates new yield opportunities. Their backed by some of the biggest names in the industry.

They launched the RBN token recently and are offering very lucrative yields to liquidity providers. I got airdropped free RBN tokens for being a liquidity to the Hegic protocol. I sold half for ETH and provided liquidity into the ETH/RBN pool. This way I earn pools fee, liquidity mining rewards, and take profits into ETH. Personally, I think RBN will trade higher in a few months so I don’t mind keeping some exposure.

Fabric

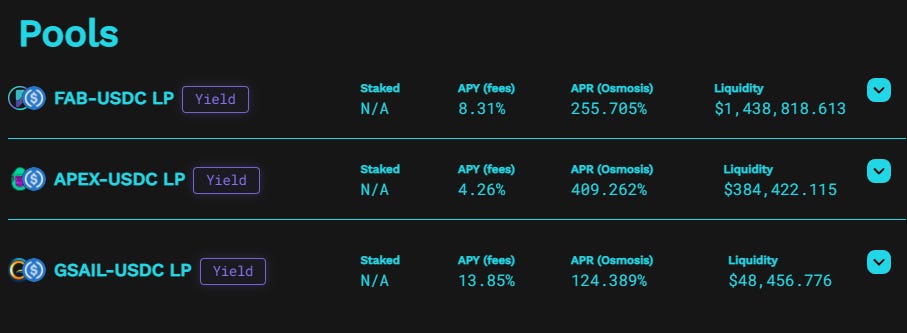

This project is building a protocol for the issuance of synthetic assets on the Solana blockchain. Their first goal is to build a deep liquidity pool for their governance token FAB. This is because the FAB token will collateralize synthetic assets 1000%. They’ll begin with commodities first and will later expand into other asset classes.

By being an early liquidity provider you have the potential of being airdropped other governance tokens and NFTs. For example, early liquidity providers to the FAB-USDC pool got airdropped Fab Punk NFTs. The money they raised will be used to hire a larger team and build out a DEX for synthetic assets. A portion of the fees generated by the DEX will be paid out to Punk NFT holders. Moreover, for the first month 100% royalties will be paid out NFT holders and 50% after the first month. Depending on the NFT trading volume over the next few months, you could potentially get a risk free investment.

A few friends and I have decided to buy close to 10% of the total Punk NFT supply. If you’re interested in getting exposure check out Magic Eden and Solanart.

Gravity

This protocol is relatively new and the team plans to distinguish their product by offering the following features.

Swap Exchange (at launch)

Vaults — Automated Investment (coming soon)

Automatic Trading Strategies (coming soon)

Derivatives Trading — Options (coming soon)

Launch Pad for IDOs (in planning stage)

Lending and Borrowing — Loans that pay themselves off (in planning stage)

Margin Trading (in planning stage)

I wanted to highlight their stablecoin yield of 25%, which happens to be highest on Polygon.

Best Yields on Cefi

Bitcoin

Celsius Network 6.2% - Video

Ledn 6.1% - Has the most consistent yield : Video

Bitrue 8.5% - Must hold BTR tokens : Video

Ethereum

Celsius Network 5.35%

Bitrue 11% Must hold BTR tokens

USDC

Ledn 9%

Celsius Network 8.88%

Check out my website for a more comprehensive list. This list is updated once a month.

Notable Tweets