Twitter | Starter Pack | Reddit | YouTube | Patreon | Store Front | Earn $250 in Promos

Hi everyone,

Click hereto access the interest rate tracker. It’s been updated so you can see the best rates offered among the various lending platforms. Also, please consider signing up for new platforms with the referral links posted by the moderator. He updates and maintains the excel spread sheet. I’m sure he’d greatly appreciate it.

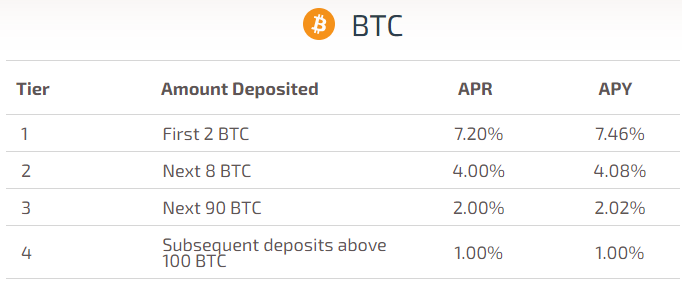

Hodlnaut

This is one of the newer crypto lending platforms. Out of the major lending platforms they are offering the best yields for BTC, ETH, and USD. Much like Blockfi they do impose tiers for interest rates.

If you’re concerned about counter party risk you can buy cover from Nexus Mutual. The following events will be covered:

the custodian gets hacked and you lose more than 10% of your funds

withdrawals from the custodian are halted for more than 90 days.

To get a comprehensive review before committing to a deposit, make sure to watch the entire video below.

Ramp DeFi

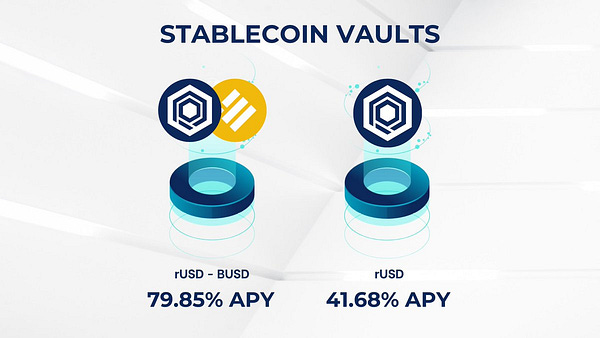

This protocol has created it’s own overcollateralized stablecoin rUSD. To date the protocol hasn’t been hacked and the peg has never broken. You can either buy rUSD off the market or you can mint it with your yield bearing collateral. Whether you deposit into a single asset pool or a dual asset pool, you’ll continue to earn interest on your deposit. Ramp supports the following pools and more.

For instance, you can deposit your NRV/BNB LP and continue to earn 97% APY. Plus you can mint rUSD against it and sell half for BUSD. Deposit your BUSD and rUSD into the rUSD/BUSD pool to earn 75% APY.

Net result: NRV/BNB LP earns 97% while your borrowed rUSD earns 75%. If you’re strictly focused on generating stablecoin yield, you don’t need to provide any collateral. Simply convert your stablecoin of choice into rUSD and BUSD. The Terra Bridge makes it very easy to transfer assets over from other chains like Ethereum and Terra.

Anchor Protocol

You can now use bETH as collateral on Anchor Protocol.

By borrowing against your bETH you’ll net 25% on your borrowed funds. Anchor is currently incentivizing borrowing by providing a 46% APR on borrowed funds. This means if you borrow $100K, you’ll earn 46K a year. However, they do charge 22% fee to borrow funds so you’ll net a 25% APY.

With this borrowed capital you can construct customized yield farming strategies aligned with your risk tolerance. Or you could exercise leverage by purchasing more crypto assets. For instance, I used my borrowed funds to buy some more LUNA around $6-8. I transferred these LUNA to Saber on Solana via the Wormhole bridge. Currently you can provide single sided liquidity and generate 31% APY on Saber. To send your LUNA to Solana, you must first transfer it to Ethereum over the Terra Bridge. Afterwards, you can use the Wormhole Bridge to send WLUNA to your Solana wallet.

Another option would be to send your UST over to Ramp on BSC and convert it into BUSD/rUSD. With this strategy you would net 53% APY.

ApeSwap

In my opinion is one of the better automated market makers in the DeFi space. They’re currently deployed on the Binance Smart Chain and Polygon. Recently they’ve shifted their focus to listing NFT gaming tokens. They also hosted a NFT gaming initial dex offering for Dragonary. Within less than a day after listing, the token was trading over 40x. I decide to deposit a portion of my CYT into the pool to generate liquidity mining rewards.

I was thinking about creating a yield generating index portfolio for NFT gaming projects. The portfolio would require 50% allocation to BNB & 50% to NFT gaming alts in order to be eligible for the yield farming rewards. BNB would provide the portfolio a hedge in the event the more speculative tokens took a big hit. Meanwhile the portfolio would generate 100% plus APR depending on which alts you get exposure to.

Notable Tweets