Twitter | Facebook | Reddit | YouTube | LBRY | Patreon | Store Front

Disclaimer: Nothing in this report constitutes investment advice—I am just reporting on my accounts and its progress on each platform. You should not use this report to make financial decisions. I recommend you seek professional advice from someone who is authorized to provide investment advice.

Hey everyone and welcome to the HODLer’s Den, DeFi Edition!

Here you will find information on the DeFi (Decentralized Finance) crypto space. As usual, I will try my best to provide insight from a HODLer’s perspective.

Uniswap & Ampleforth (AMPL)

Last week my Uniswap ETH/AMPL pool was down 23%, and with this week’s slight pull back, it is currently down 38% overall. I was conflicted on whether to cut my losses and reinvest into another project but I have decided to keep it going as long as the incentive, Geyser, is active.

The APY (Annual Percentage Yield) has also been dropping steadily. Last week it was at 137% and within a week it got slashed in half—not good from a HODLer’s standpoint. However, the incentive is increasing as I am earning roughly 100 AMPL every week while the multiplier increases. We will see how well this plays out in the long run.

Balancer/wEthereum Liquidity Pool

Just like with my crypto portfolio, I wanted to diversify my exposure to liquidity pools and C1S recommended that I try out the Balancer/wETH pool which currently pays out roughly 43% APR (Annual Percentage Rate) to liquidity providers.

If you have any idle Ethereum (ETH) sitting around, it might be worthwhile to dabble with the Balancer (BAL) liquidity pools available. We stuck to the BAL/wETH pool due to its high volume and liquidity, which translates to more fees generated from the pool to liquidity providers—that is reflected in the estimated 43% APR. The pool itself it comprised of 80% BAL and 20% wETH (wrapped ETH).

I will document my process on getting into the BAL/wETH Liquidity Pool and total up the fees involved. If you are interested, you can head over to https://pools.balancer.exchange/#/ and follow along using this as a guide.

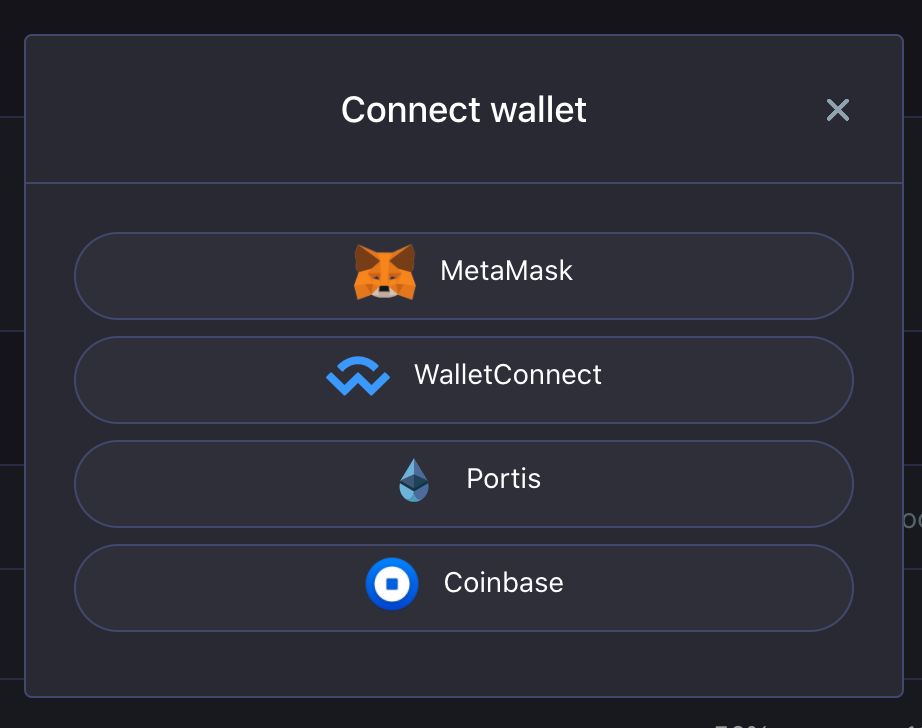

First I selected the pool I am interested in and then connected my MetaMask wallet by hitting the “Connect Wallet” button. As you can see they support multiple types of wallets.

Once connected, hit the “Add Liquidity” button to continue.

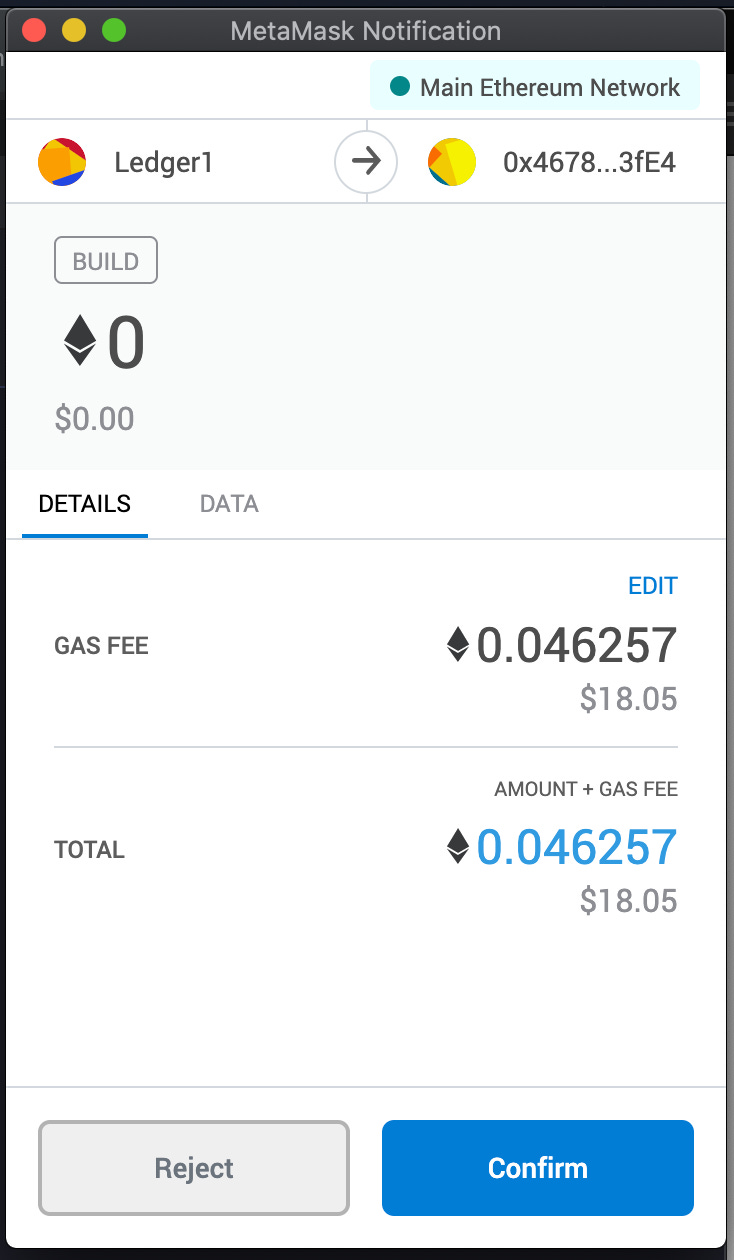

It will ask you to Setup Proxy which allows Balancer to interact with your wallet so click the “Setup” button.

Setting up a proxy will cost us some gas fees—in this case it costed me 18.05 USD.

Confirm the transaction and wait for the block confirmations to complete proxy setup.

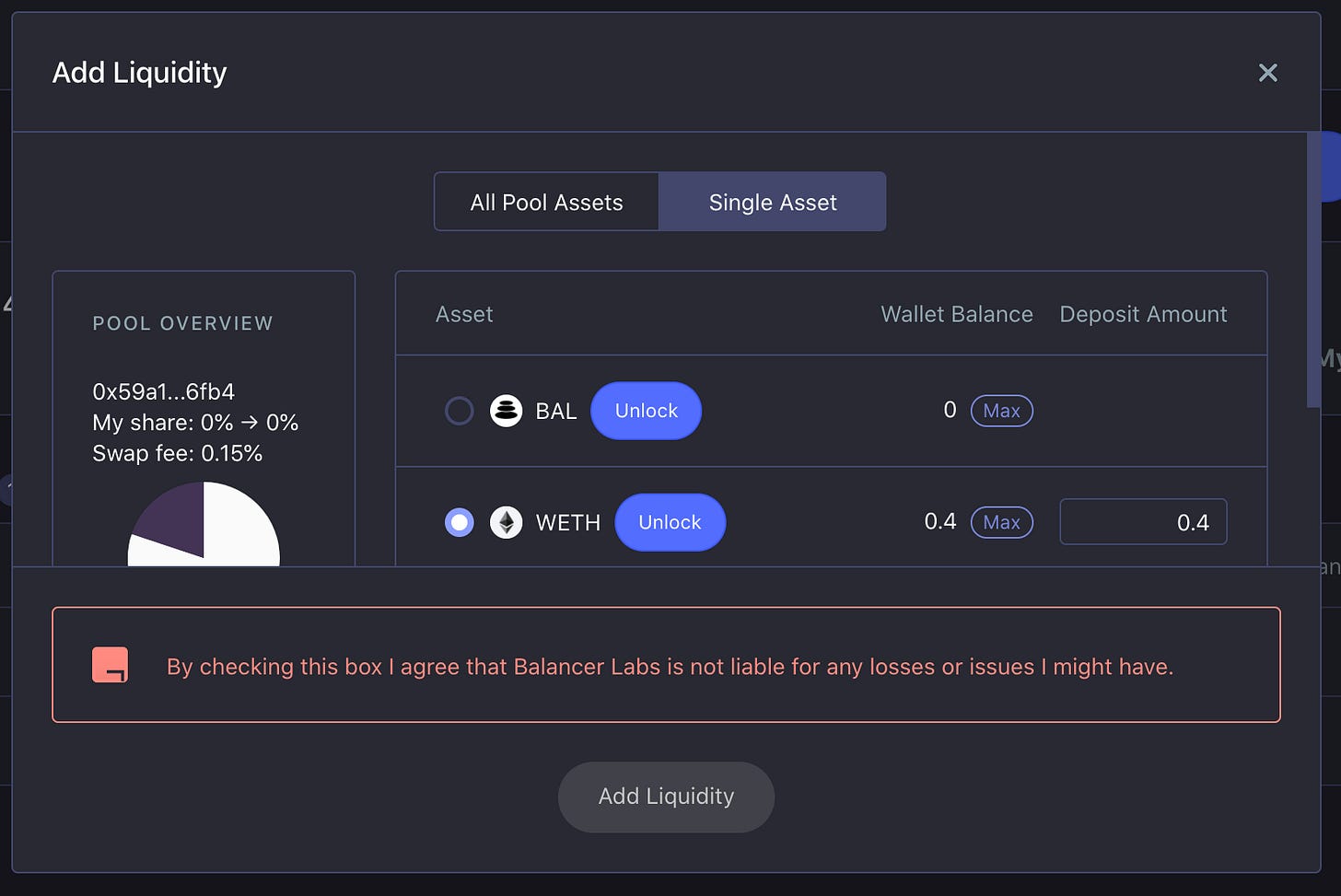

Now I can add assets into the liquidity pool. Here I have two options: deposit the appropriate amount of assets according to the pool’s ratio or use a single asset which will be automatically divided up into the correct ratio.

Since I do not own both assets, I went with the Single Asset option. But before I can do that, I have to obtain some wETH.

If you have ETH in your wallet, you can use Balancer to wrap the ETH for you like I did. Of course, this process comes with a gas fee of 1.03 USD. I decided to wrap 0.4 ETH (roughly 150 USD at the time).

I had to do a quick Google search on why I had to “wrap” my ETH and not use ETH directly. It seems like ETH itself is not ERC-20 compliant because the ERC-20 standard came after the creation of ETH. So wrapping ETH standardizes it and makes it compatible with other ERC-20 tokens which will allow it to interact with decentralized platforms and applications.

Confirm the transaction and wait for the block confirmations.

As you can see, my newly minted 0.4 wETH now shows up under my Wallet Balance.

Before I can use the wETH, I have to unlock it from my MetaMask wallet—basically, this step allows Balancer to interact with the wETH in my wallet. This comes at a cost of 1.09 USD in gas fees.

Confirm and wait for the block confirmations.

I can finally add liquidity to the BAL/wETH pool. Notice that the “Add Liquidity” button is now blue.

Click the “Add Liquidity” button to initiate another transaction. This one costed me 5.79 USD.

Once it has been confirmed, the balance shows up in the proper weight ratio of 80% to 20% as you can see below.

Overall, the process is straightforward as long as you have the right assets ready to go. However, the total fees came out to 25.96 USD to invest roughly 150 USD into the BAL/wETH pool—I basically paid 17% of my investment in fees. Of course, this number can be reduced if I contributed more than 150 USD. With the rising gas prices for transactions, the cost to provide liquidity and remove liquidity remains a major barrier for many users that want to participate.

After a week, my BAL/wETH pool balance dropped from 150 USD down to 113 USD. I did receive 0.09 BAL as my share for contributing to the pool. I wanted to experiment with different pools to better educate myself on what DeFi is capable of. Just like the ETH/AMPL pool, I will let this pool run its course and give weekly updates on it.

For more information on DeFi and crypto news in general, check out C1S’s channel on YouTube. There are plenty of videos for you to watch and learn about the fast-growing crypto space.