Twitter | Facebook | Reddit | YouTube | LBRY | Patreon | Store Front

Disclaimer: Nothing in this report constitutes investment advice—I am just reporting on my accounts and its progress on each platform. You should not use this report to make financial decisions. I recommend you seek professional advice from someone who is authorized to provide investment advice.

Hey everyone and welcome to the HODLer’s Den, DeFi Edition!

Here you will find information on the DeFi (Decentralized Finance) crypto space. As usual, I will try my best to provide insight from a HODLer’s perspective.

LEND Token Migration & Staking

If you hold any LEND tokens, you can migrate them to AAVE tokens by using this link. The conversion rate is 100 LEND = 1 AAVE. I will document my migration process. Simply go to the AAVE website and find the Migration Portal on the left side.

The first fee is to allow the website to interact with LEND in my MetaMask wallet which was around 0.7 USD.

The second transaction is the migration contract itself which will convert your desired LEND tokens. This cost around 5 USD.

Once the migration was completed, I decided to stake my AAVE tokens. Using the same website, you should find a link on the left for Staking.

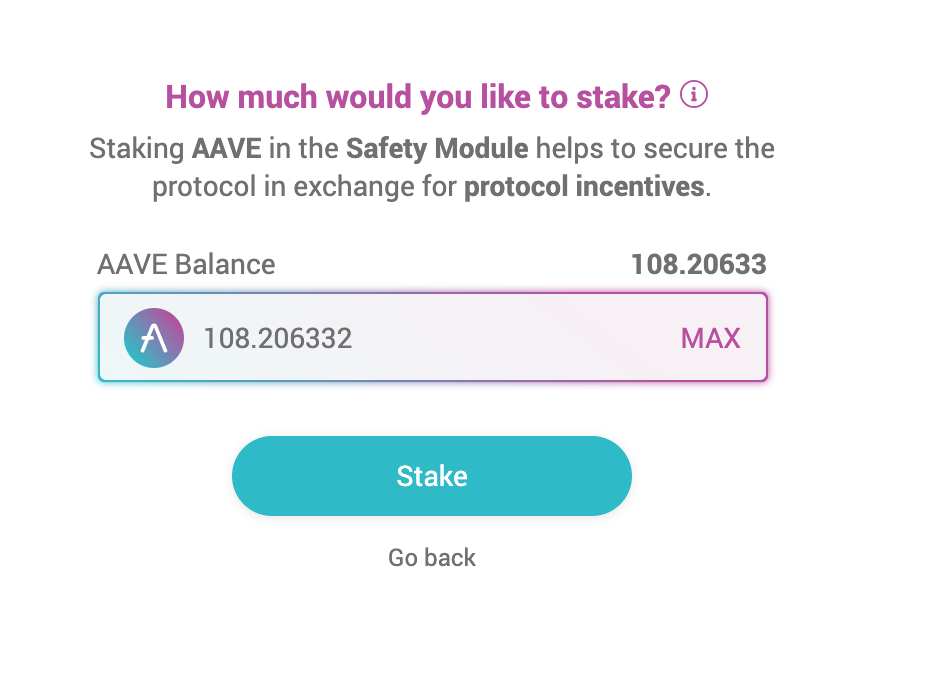

I staked roughly 108 AAVE tokens.

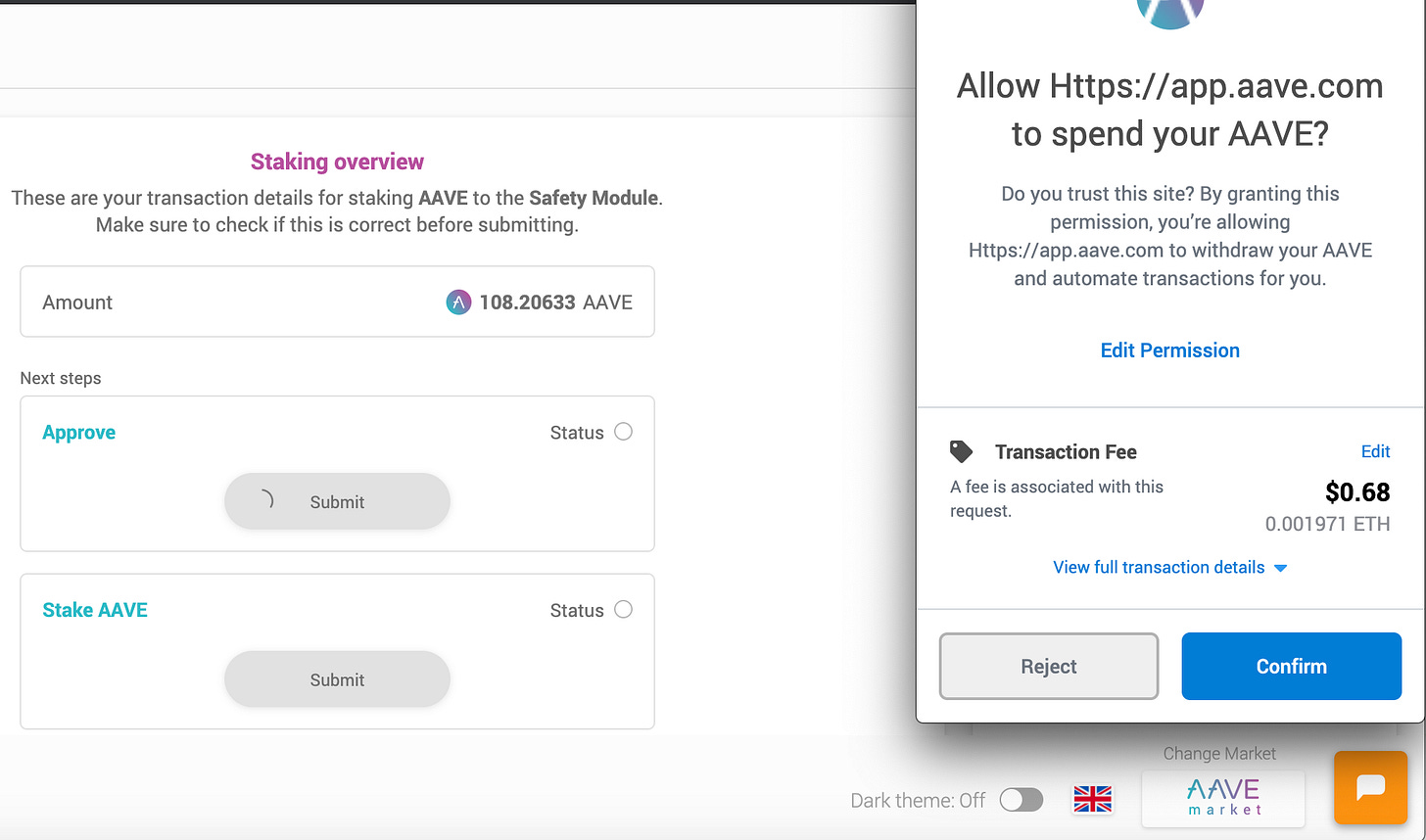

I had to approve another transaction for interactions with my MetaMask wallet. It was around 0.7 USD, again.

Then another transaction was needed for the staking contract/protocol itself which was around 12 USD.

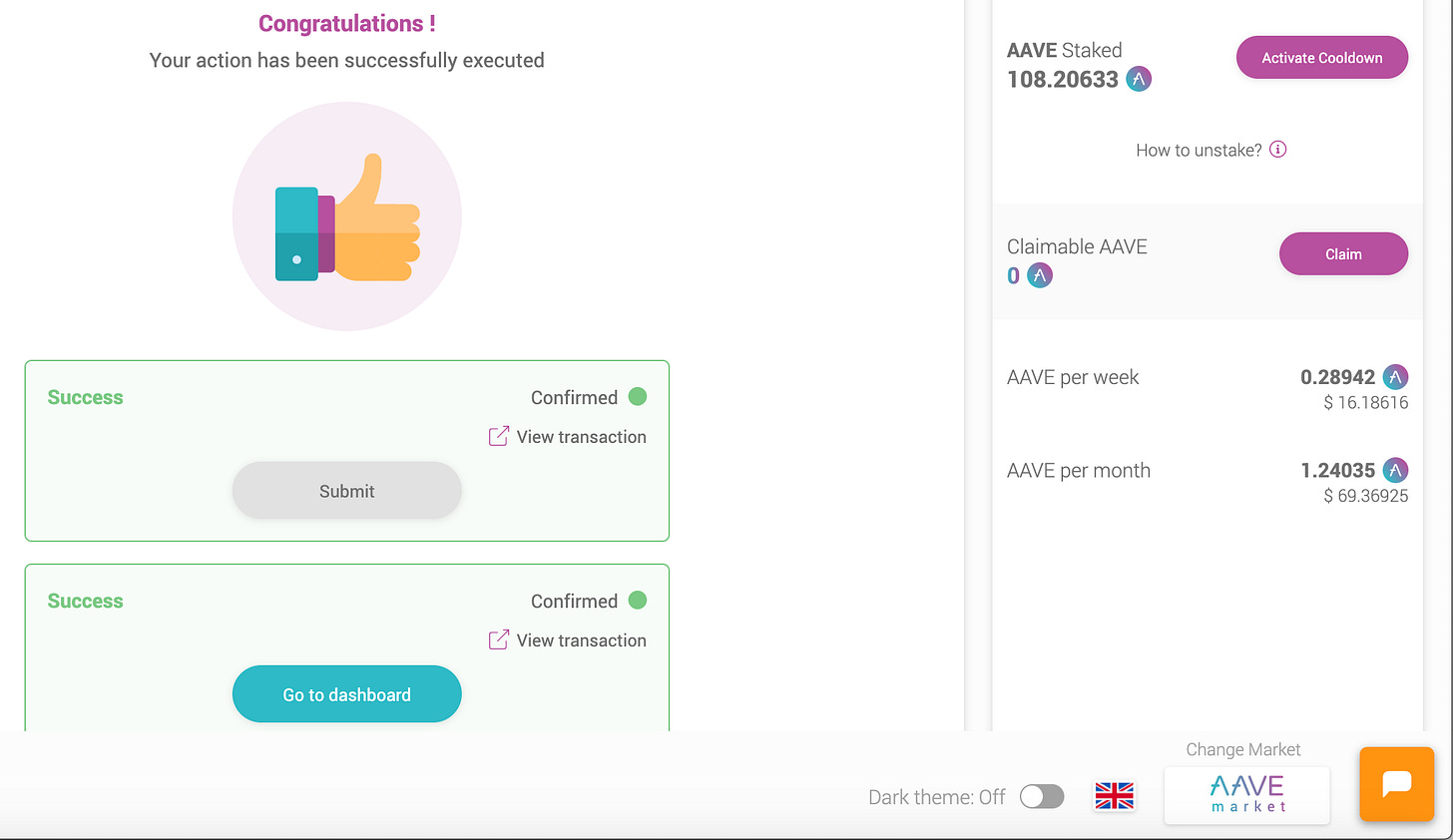

The entire process was simple and easy to do. As you can see, I will be earning 1.24 AAVE each month.

I was surprise how quickly my transactions were confirmed. I guess it is a benefit of this recent market pullback. I also enjoyed the lower transaction fees associated with the entire process of migration and staking—everything amounted to roughly 20 USD and with the current price of AAVE, I will break even in a week.

Ampleforth (AMPL) Geyser Incentive

It has been a couple of weeks since the last DeFi article, but it has been exactly 30 days—1 month since joined the AMPL/ETH Beehive V2 Geyser Incentive. There are 60 days left on this geyser and I will hold it until the very end.

Since 1 month has elapsed, my multiplier is now 2X and in total, I have accumulated 425 AMPL rewards. The APY (Annual Percentage Yield) has severely dropped from 170% to roughly 100%—this was expected as more people join the liquidity pool and incentive geyser.

The DeFi space has taken a hit and overall by AMPL/ETH investment is down 48%. Hopefully things will begin to pick up after the elections in November, but for now I still have the geyser incentive.

Balancer/wEthereum Liquidity Pool

During the last report, my BAL/wETH pool was down 35% and it still remains at the level. My original investment is 150 USD.

In the same way as the AMPL incentive geyser, I earned 1.4 BAL from providing liquidity in addition to the swap fees as a liquidity provider. This BAL/wETH pool is incentivize and that was the main reason I tried it out.

SushiSwap

I am shocked that SushiSwap is still up and running after Uniswap’s comeback with the UNI airdrop. The 24-hour volume has massively declined down to 2.3 million USD—at its peak, SushiSwap’s 24-hour volume was 100X what it is now.

Regardless, I still have my initial investment on SushiSwap earning Sushi.

Once I have roughly 100 Sushi, I will convert them into xSushi. Even though the transaction fees are currently low and reasonable, I will wait.

Conclusion

With the amount of DeFi protocols, gimmicks and clones, it is very difficult to focus on projects with real intentions to further the crypto space. The crypto space is still relatively new and DeFi is one step further so I believe many of these projects still have potential as long as they can stand the test of time and improve on their infrastructure. For now, please invest wisely and with caution.

For more information on DeFi and crypto news in general, check out C1S’s channel on YouTube. There are plenty of videos for you to watch and learn about the fast-growing crypto space.

This is part of the FREE subscription package that goes out to hundreds of investors. I also have a paid subscription package which includes exclusive content and insights. To really get the most bang for you buck, check out my bundle packages through Patreon.

For a limited time I’ll also be offering an option to pay in DAI. Using this method you’ll get an annual subscription for only 50 DAI.