Twitter | Facebook | Reddit | YouTube | LBRY | Patreon | Store Front

Disclaimer: Nothing in this report constitutes investment advice—I am just reporting on my accounts and its progress on each platform. You should not use this report to make financial decisions. I recommend you seek professional advice from someone who is authorized to provide investment advice.

Hey everyone and welcome to the HODLer’s Den, DeFi Edition!

Here you will find information on the DeFi (Decentralized Finance) crypto space. As usual, I will try my best to provide insight from a HODLer’s perspective.

Ampleforth (AMPL) Geyser Incentive

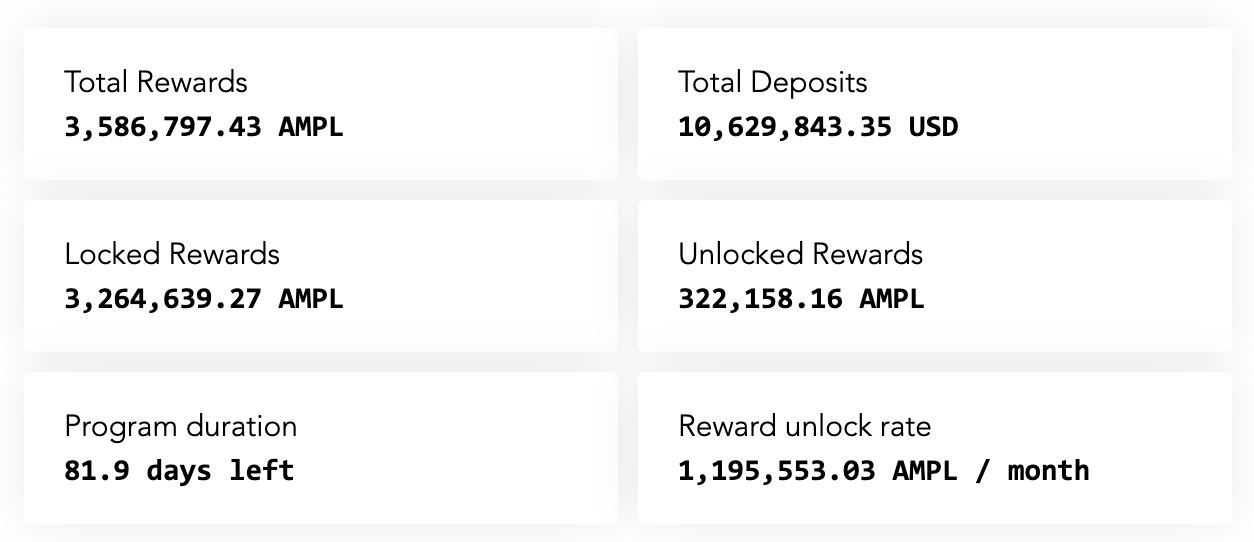

I still have faith in AMPL as long as the geyser incentives remain active. Since the last DeFi report, there is now a new Geyser Beehive V2 for the AMPL/ETH liquidity pool that started 8 days ago on September 10th, 2020. If you read my report, I had my Uniswap Liquidity Provider (LP) Tokens in the Geyser Beehive V1 for a little over two months.

At the release of Beehive V2, the Beehive V1 geyser still has 1 month remaining but I decided to migrate my LP tokens over to Beehive V2 to take advantage of the full duration. I was late to the Beehive V1 geyser which meant was unable to maximize my earnings with the 3X rewards multiplier. Since I now have my LP tokens in Beehive V2 from the very beginning, I will get 1 month with the 3X multiplier.

The geyser incentive generates AMPL to liquidity providers of the AMPL/ETH pool. The larger the deposit and the longer duration held, the greater the rewards (i.e rewards multiplier). After holding for 2 months I will reach the maximum rewards multiplier of 3X. So far each geyser only lasts for a duration of 3 months hence to maximize your rewards multiplier, you need to start at the very beginning of the geyser.

I had to withdraw my LP tokens from Beehive V1 which cost gas fees. In the process I was able to claim my AMPL rewards which was more gas fees. I took my AMPL rewards and converted it into Uniswap’s AMPL/ETH—basically increased my position as a liquidity provider for the pool—via Zapper.fi and then deposited everything into Geyser Beehive V2. I forgot to track the total gas fees but it was probably around 40 to 50 USD for the entire process.

After a week, my multiplier is at 1.2X and I have accrued 156 AMPL in rewards. Overall, my AMPL/ETH portfolio is still down 32%—it would be down more if I had not received the incentive AMPL rewards from the geyser. Also, AMPL had a nice pump a few weeks ago which allowed it to go through a couple of positive rebases. In addition, I made some decent earnings from transaction fees for being a LP in the AMPL/ETH pool—it is not much but it covered the gas fees.

Balancer/wEthereum Liquidity Pool

During the last report, my BAL/wETH pool was up 7.3%, but with the massive correction it now sits at 126.28 USD—down 15.6% since my original investment is 150 USD.

The nice thing about Balancer pools is that they reward you BAL tokens in addition to the swap fees. It is a great way to incentivize liquidity providers. So far I have earn 0.88 BAL and it will continue to grow as I provide liquidity. Providing liquidity is not the safest route as a HODLer but it is an option to consider as it is another way to Dollar Cost Average (DCA) into certain tokens.

SushiSwap

If you have some knowledge of DeFi, you must have definitely heard of SushiSwap. The SushiSwap protocol basically mimics Uniswap with a slight twist: as long as you hold Sushi tokens you will continue to earn swap fees. This means that you do not need to provide continuous liquidity yet you are still able to earn swap fees. Uniswap charges a 0.3% fee on all swaps which is then distributed to LP. SushiSwap also charges a 0.3% fee on all swaps, however, 0.25% is then distributed to LP and 0.05% is distributed to Sushi token holders.

There was a whole fiasco with the creator cashing out over 14 million USD worth of Sushi tokens as an exit scam. I will not go into details but you can watch C1S’s video regarding the whole situation.

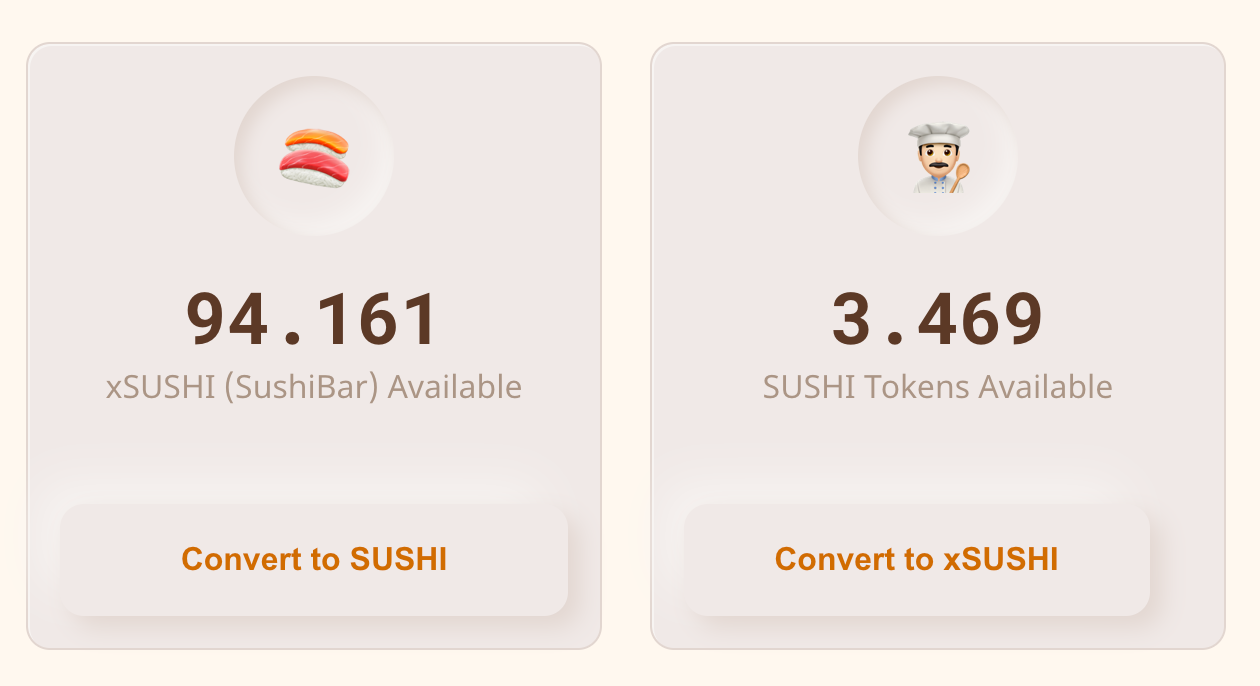

Anyway, I did dabble with SushiSwap and still have some investments on the exchange minting Sushi tokens. The interface itself is very similar to YAMs so if you farmed YAMs you should have no problems farming Sushi. The way it works is that you provide liquidity in select pools which will mint you Sushi tokens. You then take those Sushi tokens and convert them into xSushi tokens—these are the tokens that you need to stake in order to earn that 0.05% swap fees even if you decide to leave all your liquidity pools.

As you can see, I staked 94 xSushi which has earned me 3.4 Sushi tokens. I also provide liquidity for two pools on SushiSwap which are also generating Sushi tokens. With the current high gas fees, it does not make sense to convert my earned Sushi into xSushi so I will hold off.

Uniswap

With the recent market correction and pull back, Uniswap does the unthinkable and airdrops a ton of money—via UNI tokens—to any wallet that has interacted with the Uniswap Exchange prior to September 1st, 2020. At minimum, users are able to claim 400 UNI from each wallet so if you use multiple wallets then you just got a bunch of free money. With UNI price at 3 USD at the time of inception and now at 7 USD, many users are 2800 USD richer.

UNI will serve as Uniswap’s governance token meaning UNI owners can vote on future changes and additions to Uniswap. Currently, there are four liquidity pools that will mint UNI as seen above. Future pools will be decided by voting so if you want a specific Uniswap pool to be added to Uniswap then you should immediately start accumulating UNI by providing liquidity to these pools.

You can learn more about the Uniswap airdrop from C1S’s video.

After SushiSwap “attacked” Uniswap by siphoning almost 1.5 billion USD worth of liquidity, it was expected that Uniswap would have a comeback. When exchanges compete, the users benefit because they have to create incentives for providing liquidity and Uniswap’s airdrop is just one example.

Conclusion

It has been a couple of weeks since the last DeFi Edition was released and a lot has happened in the DeFi space. Honestly, too many things are occurring and it feels like the ICO (Initial Coin Offering) mania back in 2016-2017. The DeFi space is vast and can be daunting to navigate on your own. I am glad to be working with C1S as he is constantly researching the crypto space.

I would have never even touched Uniswap or have known what it is if it was not for C1S. But I am glad I did because the recent UNI airdrop definitely boosted my crypto portfolio. Ultimately, the DeFi space is still extremely new and risky so experiment at your own risk.

For more information on DeFi and crypto news in general, check out C1S’s channel on YouTube. There are plenty of videos for you to watch and learn about the fast-growing crypto space.

This is part of the FREE subscription package that goes out to hundreds of investors. I also have a paid subscription package which includes exclusive content and insights. To really get the most bang for you buck, check out my bundle packages through Patreon.

For a limited time I’ll also be offering an option to pay in DAI. Using this method you’ll get an annual subscription for only 50 DAI.