Twitter | Starter Pack | Reddit | YouTube | Patreon | Website | Earn $250 in Promos

Hi everyone,

Click here to access the interest rate tracker. It’s been updated so you can see the best rates offered among the various lending platforms. Also, please consider signing up for new platforms with the referral links posted by the moderator. He updates and maintains the excel spread sheet. I’m sure he’d greatly appreciate it.

Mimas Finance

The same team that brought us Tranquil Finance has launched another money market protocol. This time they’ve decided to deploy on Cronos with fat yields.

The yields are subsidized with MIMAS and rMIMAS tokens. The latter is a time locked version of MIMAS redeemable in 6 months. About 80% of the yield is provided by the time locked token. This could present a problem if the token value falls in six months. Given this protocol recently launched the borrow markets are very attractive. Users are essentially getting paid to borrow.

The team behind Tranquil Finance unveiled DeFira, a cross-chain DeFi metaverse game-world. You can learn more about their plans by joining their discord and reading their medium post. With GameFi and metaverse becoming dominant themes in this market cycle, Cronos has decided to attract builders with an ecosystem funds.

I suspect the Tranquil team is positioning themselves to secure a slice of this ecosystem fund. DeFira’s successful launch on Harmony would inevitably be followed by a expansion into Cronos. By locking TRANQ tokens for at least 6 months, stakers can earn protocols fees and FIRA tokens. To my knowledge this is the only to earn DeFira’s native token ahead of the game launching.

I’ll be keeping an eye on Mimas Finance for a similar opportunity. The total value locked on Mimas is significantly lower than Tranquil Finance. This may present an opportunity to earn more FIRA will less capital locked up. I want to emphasize that the team hasn’t provided a white paper for the game and they only made the GameFi pivot after DeFi Kingdoms blew up. I’m not betting the house they’ll deliver but I think it’s worth the swing.

Osmosis Zone

I first introduced Osmosis to you guys in June-Julyish. During the early months we were enjoying 300% APR plus. However, despite the yields getting diluted over time I believe it’s a great place to park your crypto assets for yield. Osmosis is a sovereign chain like Terra, Crypto.com, Secret and others. They’ve focused on becoming the liquidity hub for the entire Cosmos ecosystem. With this goal in mind they’ve successfully become the home to the largest liquidity pools. Moving forward I expect most the trading volume will remain on Osmosis. Given OSMO is paired with all the tokens listed on Osmosis, it’s turned into an index token for the entire ecosystem. The most lucrative yields are provided to the OSMO based pairs and as a result they’ve become the most liquid pools.

There’s a few exceptions but in large OSMO paired pools attract more liquidity. Deeper liquidity will result in a stronger price correlation. As the broader basket of tokens on Osmosis trend up, OSMO will follow. Uniswap’s marketcap hit $20B without the proliferation or mandate of UNI based pools.

I doubt Osmosis touches the same marketcap unless we witness a new wave of participants enter the space. However, I believe there’s enough capital in the space to send the marketcap above $10B. Evmos is an Ethereum Virtual Machine Hub on Cosmos and will make it easier for large Ethereum based protocols to expand into this growing ecosystem. Also, the Nomic Bitcoin bridge and Axelar are working to bring BTC to all Cosmos connected chains. These projects will create new channels for value and liquidity to pour into the entire ecosystem. With no close competitor in site, Osmosis is likely to see most this value traded through it’s DEX.

Solana NFTs w/ Passive Income Potential

During the last few months we’ve experienced another NFT cycle on Solana. The quality of projects and scams has improved significantly since the past summer. In many cases you could argue that the mints are just another iteration of initial coin offerings (ICOs). Instead of tokens we’re receiving NFTs. In an effort to return value to investors each project offers unique utility features. A few examples of utility include governance participation, access to exclusive discord channels, revenue share, token emissions, premium features on platform, and beta access to games.

The space is organically creating a new equity model and we’re the guinea pigs. The odds of legal recourse is very limited given most teams elect to remain anonymous and no contracts are signed. The risk in the current environment is high but so is the reward. I suspect most venture capital and crypto funds aren’t viewing NFTs in the same light. For this reason they’re likely to skip the mint and approach the team directly for a private investment deal. Until they liberalize their views on NFTs we’ll have a level playing field. I’m using the opportunity to focus on collections with passive income producing potential. The projects presented below are extremely high risk so size your bets accordingly.

Pawnshop Gnomies

This is a collection of 5,5555 NFTs with the goal of delivering a Solana’s first NFT lending protocol. Their proprietary AI algo will evaluate the price of every NFT used as collateral. Based on the determined value users will be able to borrow with a LTV of 30%. At this time users can borrow for a maximum of 7 days and must pay back the loan plus a 10% flat fee. The loan duration will be extended as the platform matures. To date they’ve remained profitable and are open to sharing the revenue with holders.

Aside from potential revenue share, Gnomie holders also receive the benefits listed below.

They’re actively searching for investors but haven’t released any info on token utility. I suspect they’ll allocate a portion of the token supply to the NFT holders. For this reason, I decided to pass on the raise and buy a few Gnomes off the secondary market.

Despite the projects potential and first mover advantage they’re some risks. In most cases they’ll have to use the floor price to quickly liquidate the NFT. This makes me question the long term benefits of developing an AI based algo for accurate pricing. Also, in this stage of the cycle there’s a lot of venture capital money pouring into the space. If they don’t move fast I’m confident they’ll face fierce competition.

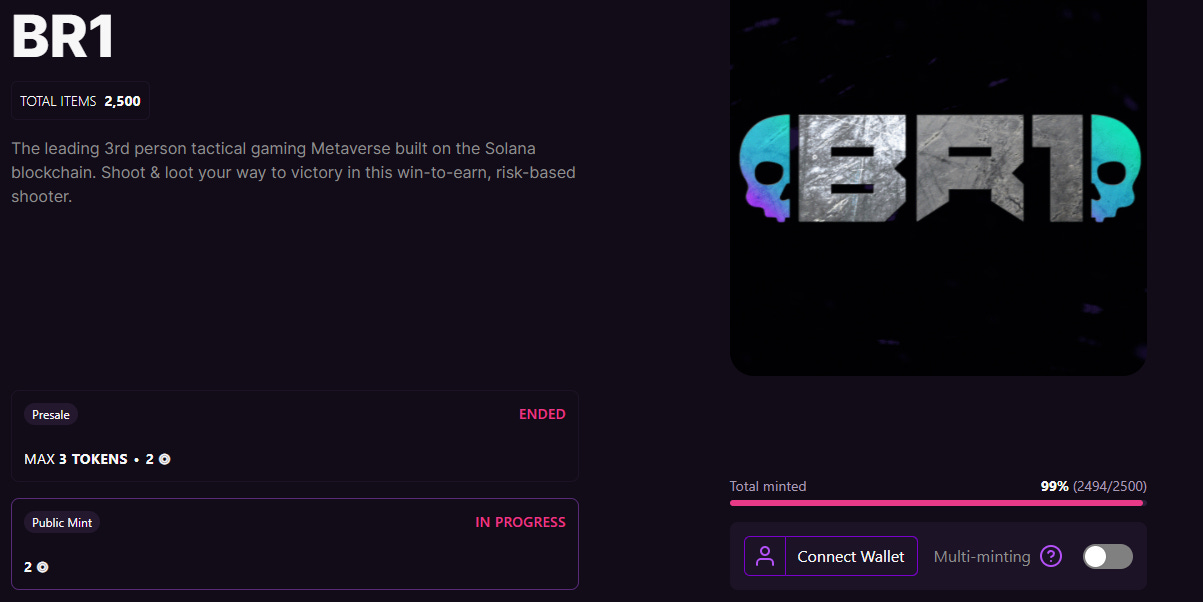

BR1

This is the first risk-based shooter game built on Solana. Players pay to enter a match and win money for every player they kill. The Mac OS build for Alpha is complete and the first closed alpha event will occur over this weekend.

This genre of games is the easiest to monetize and is likely to be one of the first to market. Every player will require a BR1 NFT to play the game. They originally planned to mint 10,000 NFT but their founder was accused of assisting a scam NFT project. This FUD significantly reduced the interest to mint and they were forced to reduce the mint size to 2500 . The founder stated in an interview that they reduced the total mint because a large number of bots ended up on the whitelist. I recommend listening to the interview and exercising your own discernment.

The Gen0 NFTs are required to play the game and will be used for breeding as the user base expands. Genesis characters will make 5% more earnings per kill and they retain 90% of their earnings when they are eliminated. I suspect at some point they’ll develop a scholarship system enabling holders to lend out their NFT to players. Both breeding and tournaments will create borrow demand for the NFTs providing holders with a passive income stream.

According to their road map the soft launch won’t be released until Q3. Renting and breeding is scheduled to be released in Q4. This means early holders will have to wait months before they can start earning passive income. Also, third person shooters are a low hanging fruit and more well capitalized teams are likely to launch their own iterations.

Despite the risks I ended up minting a few. I think there’s a good chance these trade below mint (2 sol) due to the FUD surrounding the project. However, if they’re serious about delivering I expect gaming guilds/DAOs to begin accumulating in advance of the public launch. More sophisticated funds will also get exposure once the game is more developed. For these reasons we could see a high floor price prior to the lending market becoming available. The mint will likely be sold out by the time this newsletter is published. Check out the secondary market if you’re interested in getting some exposure. The market mania has subsided and most floors have been trending down. I wouldn’t be in a rush to buy. As people take profits we may see the floors of quality projects rise but I believe most will continue to their descent.

Stablecoin Farms

To get a larger yield before it gets discovered and diluted by whales check out DeFrost Finance.

To learn more about DeFrost watch my most recent video.