DeFi, GameFi, NFTs 🧮

Solana NFTs

GameFi is clearly leading the market. Most market participants on Solana have become adept NFT traders and have long forgotten about tokens. Generally speaking Solana tokens tend to have large fully diluted values with massive token unlocks. For this reason most participants have better luck flipping NFTs. This has the following impact:

Preference for trading NFTs over tokens

Projects raise capital through mints instead of traditional methods

Increased liquidity for NFTs - in particular for blue chips

Marketing campaigns targeted at NFT investors

Assuming we see a proper GameFi wave, Solana users are more likely to play the trade by purchasing GameFi NFTs vs buying tokens. Most GameFi projects will eventually release their in game currency tokens and allow holders to earn free tokens for staking their NFTs. Unless the game produces immediate demand for the token most these tokens will also trend towards zero. Nontheless for those interested in exploring the GameFi trend on Solana there’s a few ways to capture profits.

value investing in quality projects

buying based on catalysts and quickly taking profits (airdrops, token emission for staking, alpha/beta testing)

minting hyped projects (less likely to work in low volume market)

riding broader market narratives (metaverse, gamefi, defi)

Quality games take years to build and are capital intensive. Over 90% of the games won’t survive but others will see an infinite bids on their floors. Additionally, many games will reward early supporters with airdrops that maybe extremely valuable in the future. Breeding, renting, and staking will turn many NFTs into productive assets. With this knowledge in mind here are a couple GameFi projects worth digging into on Solana.

Guild Saga

This is a play-to-earn NFT-based 2D fantasy RPG that has been in development for a year. They sold out 10,000 NFT on 2/25 and many are selling below floor price today on Magic Eden. With over 2000 listed on Magic Eden there’s plenty of time to research before getting exposure. Staking the NFTs prior to the game’s release will earn users the in game currency GGLD. The token will have the following utility:

In-game currency: purchase equipment, consumable, keys, and other items.

Keeps: Land plots can be purchased or earned through quests. Keeps earn GGLD passively and can be upgraded with GGLD for new perks and bonuses.

Upgrades: Crafting and upgrading items.

Guilds: GGLD is required to start a guild. By joining guilds players can access unique earning potential and additional gameplay features.

Governance: Token holders will be able to vote on future content releases as well as the allocation of a portion of the ecosystem fund.

The game has three modes: story mode, PVE, and PVP. All modes offer gamers opportunities to earn XP, GGLD, and NFTs for winning battles and progressing through game. To reach higher quest levels users will have to reinvest their earned GGLD on leveling up, new skills, weapons, crafting, and keep upgrades. By generating in-game demand for the token an economic loop is created.

I prefer fair launches with over 50% of the tokens going to NFT holders and ecosystem. I understand they need to raise money to build a quality game but the private allocation concerns me. The likely outcome is short lived pumps as liquidity is seeded, followed by regular dumping until there’s strong in-game demand for the token.

I participated in the mint but unfortunately I only received Bronze heroes which are being sold below mint cost.

The NFTs aren’t required to play the game but will be offered the following benefits:

In-game use: Users will be able to import their Hero and all their equipment into the game.

Earning boost: All accounts playing with an NFT will receive boots to earned GGLD.

Staking: Players will be able to earn GGLD through passive questing and NFT staking prior to the games release.

Regular items NFTs: Staked NFTs can send Heroes on quests to bring back items that will be imported and used in Guild Saga on release.

Early-game advantage and exclusive content: Tailored content, side quests, and battles for NFT stakers. Potential airdrops.

Status: Exclusive titles

I believe most GameFi projects will adopt a similar model. As early NFT investors wait for the game they should be kept busy alpha/beta releases and given on-going airdrops. Otherwise the projects risk alienating their core user base and won’t get valuable feed back as they iterate.

I’m keeping the three Heroes I minted and will potentially pick up more as the early versions of the game are released. I’m not expecting to make quick profits unless a GameFi DAO ends up sweeping. In fact the floors may end up falling further before we see any bids.

Tiny Colony

This is an ambitious play to earn project with an aim to create the first construction and management simulation blockchain on Solana. Users will be able to build/grow ant colonies, battle other colonies, cement alliances and trade in a large scale economy. In their recent sale they sold 11,547 of their 14,600 Colonies and burnt the rest. Holders will be provided with following benefits:

Exclusive discord channel access

Whitelist for future NFT drops - kinda lame, they shouldn’t need more money

Early access to game and testing opportunities

Monthly raffle for in-game token TINY

Tiny pack airdrops - first round coming soon

Staking - details TBA

Governance capabilities

Earn rent and tax

In-game bonus rewards

Initially I was going to fade this project because it had a token sale prior to the NFT sale. It looked like a cash grab to me. However, I noticed despite the large sale less than 100 NFTs were listed on Magic Eden and its the number 1 trending project on Fractal ( NFT marketplace dedicated to gaming-related NFTs). I dug deeper and found three notable partnerships: iLogos, Merit Circle, and Genesis Block Venture (GBV).

iLogos is a world-class game studio with clients that include Disney, Rovio, Ubisoft, EA, Warner Bros, and others. They will be working Tiny colony to help augment design and build an engaging gameplay system. Tiny Colony will be provided with a full game development team that includes game designers, level designers, art leads, 2D artists and animators, back end developers, and QA engineers.

GBV invests, develops, and creates blockchain projects. In general they work alongside projects to help them achieve success. They’re going to leverage their community, product and trading experience to guide Tiny Colony. This means help with marketing, trading functions, and strategy focused programs.

Merit Circle is a decentralized autonomous organization focused on developing the P2E gaming economy. They work with players to give them additional opportunities to increase their in game earnings. Merit has strong partnerships with Axie Infinity and NFt gaming studio Vulcan Forged. I suspect they will be buying Tiny colony NFTs and facilitating scholarship programs.

They had an IDO for their token TINY on 12/18/21.

Total Supply: 100,000,000 (100 million)

Initial Circulating Supply: 4,595,696 $TINY (4.6%)

Public Sale Price: $0.364

Initial Market Cap: $1,672,833 (Including LP)

IDO Unlock 50% at TGE then linear x 2 months

About 70% of the tokens were allocated to the ecosystem fund and players:

Private — 9.5%

Public— 1.1%

Ecosystem & Rewards — 29.9%

Players— 30%

Team — 15%

Marketing/Legal — 5%

Advisory — 5.5%

Liquidity — 5%

Like most Solana tokens it took a nose dive after the IDO.

Given the strong support by major players I decided to get some exposure. The team did use royalties to sweep the floor and maybe doing this periodically. Large players like Merit Circle are likely sit on their bags until the game is released and will be collecting airdrops while they wait. I haven’t seen any large DAOs outside of Merit express interest but I’m sure we’ll see others bid as awareness grows. However, I did see this large influencer (7M YouTube subs) respond to a tweet issued by Tiny Colony.

The private allocation and team allocation are in line with the industry average. It’s just something we’ll have to accept to get quality games delivered within a reasonable time frame.

DeFira

This is essentially a clone of DeFi Kingdoms (DFK)). Tranquil Finance is a money market protocol with total value locked of $303M. After witnessing the success of DFK they decided to make a pivot to GameFi.

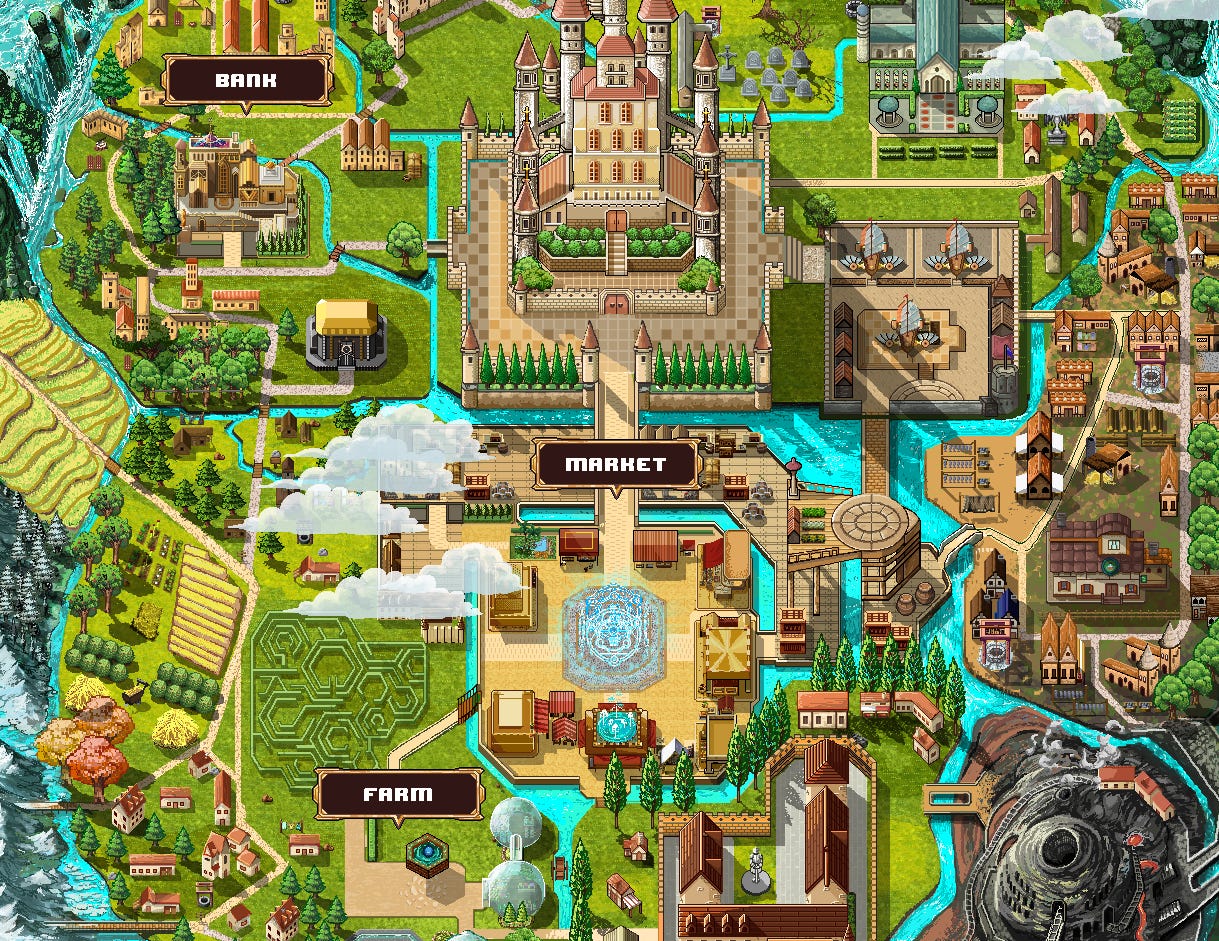

Typically I’m not a fan of copy cats but we have to accept this how markets operates. Imagine saying I’m not going to KFC because they copied Popeyes. Competition is healthy and generally benefits consumers/users. If you look at the map above they’ve clearly improved on DFK’s iteration. I’m sure moving forward they’ll learn from the mistakes made DFK and make certain they’re not repeated with DeFira.

Like DFK they’re starting out with a DEX and offering robust yields for early liquidity providers.

The yield is paid in TRANQ and sFIRA tokens. sFIRA are time locked FIRA, the in-game currency. These tokens will be unlocked in one year but DeFira will gamify early unlocking. Given how much work the team has put into the map and music I decided to take a punt. Also, I’m confident people who were late to DFK will also want some exposure. You’ll need buy FIRA on the open market if you want to provide liquidity to one of the FIRA pairs. It opened trading around $5 and hit a high of $22 before correcting.

For those who are risk adverse consider getting exposure by farming a USD based pair.

Earning Yield on Ledn, Crypto.com and Anchor Protocol

Recently I’ve committed to taking regular profits on my swing trades and NFT trades. I convert my Solana NFT profits into USDC and send it over to Crypto.com - yield of 14% APR (base yield for 3 month lock up is 8%). For exchange trades I send USDC to Ledn and earn a yield of 9.25% APY. All DEX trades I convert to UST and deposit on Anchor. Watch some of my past videos to learn about more these platforms if you’re looking to mirror my strategy. Long term I’d like hedge against third party, smart contract, and regulatory risk by spreading my stables on a few platforms.