DeFi, GameFi, NFTs 🧮

Learn about current and upcoming yield opportunities.

Twitter | Starter Pack | Reddit | YouTube | Patreon | Website | Earn $250 in Promos

Hi everyone,

Click here to access the interest rate tracker. It’s been updated so you can see the best rates offered among the various lending platforms. Also, please consider signing up for new platforms with the referral links posted by the moderator. He updates and maintains the excel spread sheet. I’m sure he’d greatly appreciate it.

Fantom

Below you’ll find both stablecoin and crypto farms on Fantom. Fantom network’s total value locked has continued to climb despite the broader market pull back. This is largely due to Andre Cronje’s project 0xDao. This protocol aims to steal liquidity from parasitic DeFi protocols and protect the interest of dedicated Fantom builders. This may potentially result in higher yields for quality projects. For this reason, I decided to introduce a few notable Defi protocols that could benefit from this initiative led by Andre.

Spooky Swap

USDC-TUSD 7.8%

USDC-MAI 23% - MAI is a stablecoin soft pegged to the USD

FTM-USDT 71%

USDC-FTM 89%

This is an auto-mated market maker (AMM) which offers a bridge, built in limit orders, and diverse farms. They have an official endorsement from the Fantom Foundation. By staking their governance token BOO users can earn fees generated by the DEX paid in BOO tokens - analogous to xSUSHI model. The pool worth highlighting is USDC-MAI. Mai Finance first introduced Mai on Polygon. Since their initial launch they’ve successfully expanded to five other chains. The biggest deviation the peg had was about six cents. Due to their experimental and volatile nature many users tend to shy away from collateralized stablecoins. However, since it’s inception, MAI has maintained its soft peg and continues to secure partnerships. Also, the total value locked on Spooky Swap for USDC-MAI is about $20M. This means you can deposit a substantial amount of liquidity without much yield dilution. Furthermore the yield can be auto-compounded by depositing your LP token in Beefy Finance.

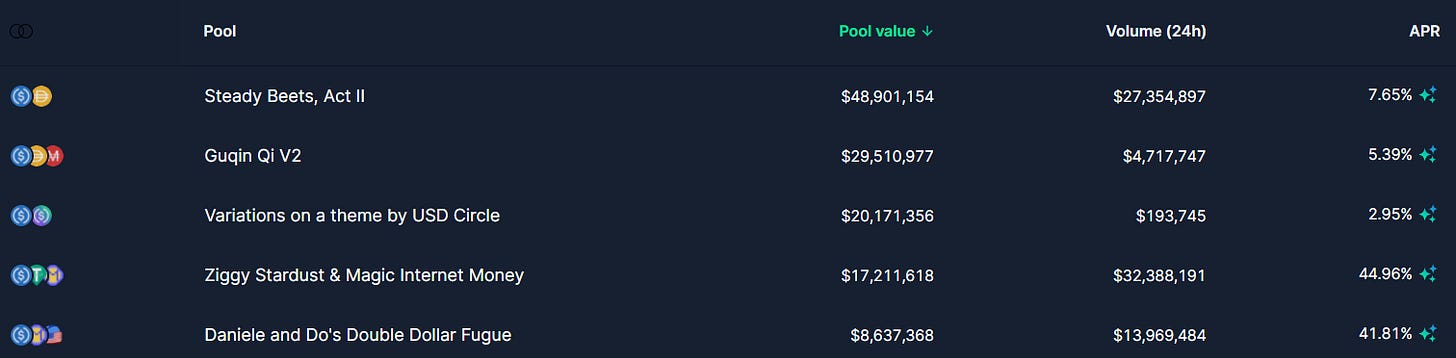

Beethoven-X

This is a balancer fork which means each pool acts as an index fund. Unlike an AMM, Beethoven pools can contain more than two assets. For example the Guqin Qi V2 pools contains USDC, DAI, and MAI. Users can provide liquidity to these pools to earn fees and use them to exchange assets.

They’re offering a boosted yield with their governance token BEETS. Their governance and fee accrual model is unique. Users who provide liquidity to the BEETS/FTM 80/20 pool will receive fBEETS. fBEETS allows users to vote on which pools should receive 30% of the BEETS emissions. Additionally, 30% of the protocol fees will be used to market buy BEETS and distribute to the BEETS/FTM pool. In other words the fees are disseminated to fBEETS holders.

Below I’ve filtered for the stablecoin pools. I’m personally staying away from anything Dan touched or influenced. This means staying away from any pool containing Magic Internet Money (MIM). Given MIM is collateralized by USD stablecoins it’s likely to maintain its peg. However in the short term I expect reduced liquidity as cautious investors derisk. Better to stay on the sideline and wait for more clarity.

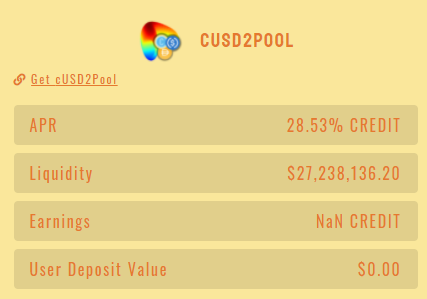

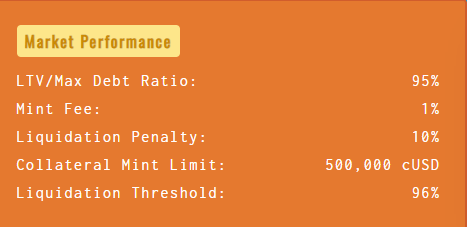

Creditum

This team has ties to other reputable protocols on Fantom like Scream. Creditum is a lending and borrowing protocol that allows users to mint stablecoins pegged at $1 by posting different tokens as collateral. Their stablecoin cUSD will remain overcollateralized to ensure the peg never goes below $1. In the event of a market downturn they’ll have ample time to liquidate positions to ensure the peg is defended.

Users can use yield bearing tokens like yvUSDC as collateral to mint cUSD for 3% APR. This means your collateral will earn interest as you borrow against it.

After depositing tcUSD in the curve pool below users can take their Curve LP tokens and to Creditum to earn yield paid in CREDIT. Simply deposit your Curve LP token in the farm below to start earning.

These CREDIT tokens can be staked to earn protocol fees. It costs 1% to mint cUSD tokens. A portion of this fee is used to market buy CREDIT and distribute to CREDIT stakers.

Furthermore, xCREDIT can be deposited on 0xDao to earn OXD tokens. Given the minting fee costs 1%, I view this as a medium term play. If you pay 1% to deposit and your netting 35%, this means you’ll have to wait 1.5 weeks to break even. The downside is that these tokens could trend down overtime. In that case you would likely just benefit from the yield being compounded in the Yearn vault (yvUSDC used as collateral.

All tokens listed above are from quality projects built on Fantom. If we return to a risk on market I would have allocated heavily to a few of these tokens. Instead I made a very small allocation to SCREAM.

ChestFi

This is an entire ecosystem of DeFi products with a game layered on top. Like DeFiKingdom I believe many projects will create in game economies by leveraging the composability of DeFi. Additionally, the games will offer users methods of producing and extracting value. By doing so they create demand for their token and essentially turn it into a currency. I can see most metaverse and GameFi projects moving in this direction.

ChestFi has delivered a structured product that allows users to earn risk adjust yield returns. They also appear to support non-native swap. Very likely these orders are being routed through one of the major decentralized exchanges on Solana.

The game hasn’t been released but an early version is expected to be revealed towards the end of February. The pirate NFTs will be used playable characters who can search for new islands and treasure. There seems to be a PVP element present as pirates will be able to engage in sea battles for supremacy.

They sold out 10k NFTs for 2.5 SOL a piece. Most of which were minted by whitelisters - a limit of three was imposed. Tentatively speaking next month users will be able to stake these NFTs to earn CHEST tokens. A vote will be held soon to determine how much is allocated to the team, community, and the treasury.

The CHEST tokens will grant users voting rights and the NFTs will multiply voting power by 1.2. This means if you have 1 NFT and 10K tokens, your vote weight will be adjusted to 12K.

Unfortunately the team isn’t doxed and don’t provide a summary of their background in any of the docs. Also, I haven’t been following them long enough to assess their skills and ethics. A strong and experienced team would add to my conviction but in this case its the projects biggest liability. On positive note I do like the fact they appear to very community centric. They didn’t receive funding from VC and they often reach out to the community for input to help guide decision making.

I ended up picking up a few on the secondary market post mint. Given the early stage of development and scarcity of information regarding the team I would rate this as high risk investment. It’s part of my broader strategy to acquire as many GameFi and metaverse assets as I can. VC and legacy don’t realize early funding is being democratized and the paradigm is drastically changing. The only competition we have are other retail participants who are likely just looking for a quick return. The information asymmetry works in our favor and I plan to take full advantage of it.

To learn more about the project check out their docs and Twitter profile.