Twitter | Starter Pack | Reddit | YouTube | Patreon | Website | Earn $250 in Promos

Disclaimer: Nothing in this report constitutes investment advice—I am just reporting on my accounts and its progress on each platform. You should not use this report to make financial decisions. I recommend you seek professional advice from someone who is authorized to provide investment advice.

Hey everyone and welcome to the HODLer’s Den!

Here you will find information on my crypto investment portfolio straight from a HODLer’s perspective. This section will focus on HODLing cryptos and interest-earning platforms.

Crypto.com

Updates

Crypto.com (CDC) is now 5 years old and to celebrate they dropped 10,000 “Mystery Box” collectibles on Crypto.com/NFT that contain 500,000 USD worth of rewards. I tried to obtain one but the queue was over 10000 so there was absolutely no way I was getting one.

The Crypto.com Exchange is now available on mobile which enables users to access key features, manage their account, and trade on the go.

Virtual Cards Are Now Available in the U.S.

Users can now apply for a Crypto.com Visa Card and once approved, make online purchases before their physical card arrives. The virtual cards can also be added to Apple Pay, Google Pay, and Samsung Pay for contactless payments at physical stores.

This is great because I remember having to wait several weeks without the ability to use my Crypto.com Visa Card because I upgraded card tier and was waiting for the physical card in the mail.

Crypto Earn added Polygon (MATIC) so users can now earn up to 12% APR on their deposits, paid in MATIC. This is a good, safe alternative if you are not into DeFi for yield farming triple digit APYs on MATIC.

The Crypto Earn rate for Ethereum (ETH) and Polkadot (DOT) also increased to 6.5% and 12.5% APR, respectively.

Plenty of new coins and tokens were added to Crypto.com under various features

Crypto.com recently enabled ACH (automated clearing house) withdrawals which is amazing because it was always a one-way street for fiat, from bank to CDC. But now, CDC users can move fiat from the platform back into their bank accounts. Combine this with the Crypto.com Visa Card and many users, like myself, can live off my crypto earnings and yield farming profits from DeFi.

I use my CDC Visa Card for daily expenses and utilities. But now that I can move fiat back and forth between my bank account, I can use my crypto earnings to pay rent. I could have done it before this feature but I would have had to add several steps—this feature greatly reduces the hassle and serves as another off-ramp for crypto.

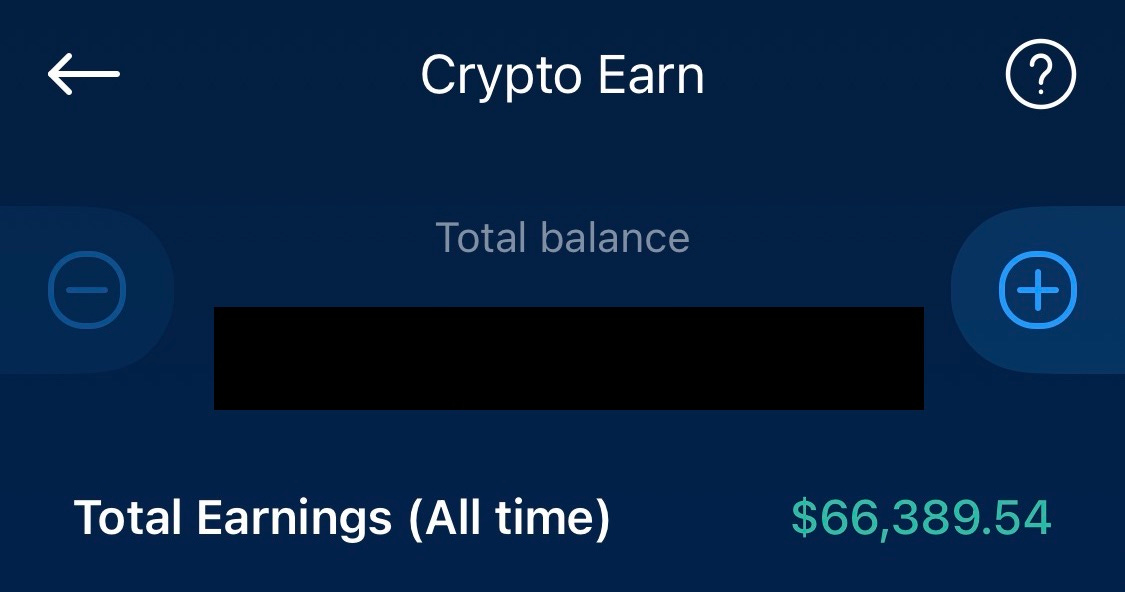

Interest Earned

It has been a rough couple of weeks for crypto but things seem to be stabilizing and the market is moving sideways. In the last 4 weeks, my portfolio lost about 4k USD in value. Not as bad as the previous report of 40k USD “loss” but things will hopefully pick up this quarter.

My Crypto Earn portfolio is down 6% in the last 4 weeks. Overall, it is still up when you compare it with the last couple of years during the bear market. You can track my earnings progress on the four major interest-earning platforms that I use by checking out this Google Spreadsheet.

A large chunk of my Crypto Earn portfolio is in BTC (Bitcoin) and ETH (Ethereum) so it makes sense why it took a big hit. BTC is currently sitting at 34.5k USD while ETH is at 2200 USD. CRO is currently moving sideways and is hovering around 0.11 USD.

CRO Earnings

Since the launch of mainnet, I have been migrating CRO from ERC-20 to the native chain on Crypto.org via the DeFi Wallet app so that I can stake to earn a better yield. However, I have unstaked all my CRO because I will be yield farming with it on the Cosmos Network. It takes 28 days to unbond so that should happen in a couple of weeks. Right now the only CRO I am earning will come from the 2% APR on my other crypto deposits in Crypto Earn since I have the Icy White Visa Card tier.

Conclusion & Prospect

I really wanted to purchase the Crypto.com Mystery box NFT as I never had experience with NFTs. However, the demand was too high and I decided it was not worth my time and effort to obtain one. I cannot believe it has been 5 years since Crypto.com was founded. The platform has grown so much in these last five years and I am glad I invested in Crypto.com. It survived a prolonged bear market and so it should have no problems dealing with another one, should we head into one.

Now that Crypto.com allows ACH transfers for fiat back into bank accounts, I now have additional routes to off ramp my crypto earnings from lending and DeFi yield farming. As I have mentioned in my previous reports, my earnings from HODLing on CeFi lending platforms and yield farming are enough to sustain my current living expenses so I am very close to financial freedom. I am still working my full time job for the extra income and security while the market is indecisive.

So far the Crypto.com ecosystem has been great to me. I enjoy using my Visa Card to make purchases because of the 5% cash back in CRO and I am making decent interest from Crypto Earn. Once US regulations ease up on crypto, I hope to enjoy other features such as the exchange and super charger. For now, I will continue to accumulate interest on my crypto and stacking CRO while Crypto.com works on Crypto.org Chain.

What I Am Doing

This section is dedicated to paid subscribers as I will go into details of what moves I am making with my interest-earning portfolios.

You are currently reading the Free Version. If you would like more information, please consider switching to a paid subscription.

Each week I will report on a different interest-earning platform that I use—mainly, Celsius Network, Bitrue, Crypto.com, and BlockFi.

If you are new to crypto or have considered joining new platforms, check out the Starter Pack created by CryptoOneStop by clicking here or if you want to earn over 250 USD in referral bonuses then click here.