Chainlink: The Trojan Horse of Finance

“If you look at history, innovation doesn’t come just from giving people incentives; it comes from creating environments where their ideas…

“If you look at history, innovation doesn’t come just from giving people incentives; it comes from creating environments where their ideas can connect.“ — Steven Johnson

Middleware is the trojan horse.

Introduction

Currently blockchain based applications rely on centralized oracles to retrieve data from off-chain sources. The advantages brought by decentralization are thrown out the window when the data feeds rely on centralized oracles. This single point of failure has the potential to bring an entire application to a grinding halt. In response, the team behind ChainLink created a decentralized oracle network to provide a means for smart contracts to interact with off-blockchain data. This includes, but is not limited to bank payments, market data, retail payments, events data, and web API’s. In my view, this is essential for main stream adoption of decentralized applications (Dapps). The space desperately needs middleware technology to enable blockhchain applications to interface with legacy systems.

Architecture

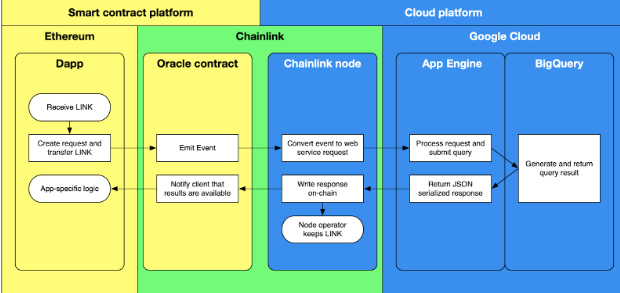

As mentioned, the principle objective is to bridge on-chain and off-chain data infrastructure. For this reason, ChainLink leverages smart contracts to help return data requests sent to Chainlink nodes (oracles). The following actions take place on-chain:

A user submits a request and the request is accepted

An oracle is selected manually or by an automated process

Data obtained and returned on-chain

Data is aggregated and returned to the requester

Source: whitepaper

Although smart contracts play a vital role on-chain, the bulk of work is executed by off-chain ChainLink nodes. The data will first pass through ChainLink’s core software before it is retrieved off-chain and returned on-chain. This software is an integral part of ChainLink nodes. To bring everything together here is the general workflow for data querying:

Request is made by a user

Oracle curation takes place on-chain before sending the request

ChainLink node accepts request and routes it to an adapter

The adapter sends request to an external API

Adapter accept data from external API and returns it to Core

Core reports data back on-chain

Data is aggregated by smart contracts and returned to user

Source: whitepaper

The overarching objective is to provide a decentralized approached to data retrieval and transmission. Developers of Chainlink plan to achieve this by distributing data sources (API’s), distributing oracles, and utilizing trusted hardware. The trusted hardware approach is the long term plan and will not be discussed in this write up. To begin with, instead of relying on a single external API, the Chainlink network will source data from multiple APIs. This means duplicate data will be fed back into the nodes for aggregation. Aggregation may possibly require majority voting. For instance, if a majority of sources return a value, it gets pushed on-chain, otherwise an error results. The second method requires the returned data to be filtered through multiple oracles rather than one monolithic oracle. However, to reduce faulty oracle liability, the data will be push on-chain for consolidation. Below you can view the pictorial representation of this two-level distribution model.

Source: whitepaper

Link Token

The primary purpose of the token is to pay Chainlink Node operators for their services. This includes retrieval of data from off-chain data feeds, formatting of data, off-chain computation, and uptime maintenance costs. The price is set by the node operator but ultimately will be driven by market forces. Additionally, the node operators are mandated to use Link as collateral. In the event an oracle provides faulty data or doesn’t query results fast enough, it could be penalized with a lower reputation score and may have to forfeit some of their collateralized Link. The token dynamics will be interesting to follow; I suspect many data providers will monetize their data sets by running their own node. High value contracts will only use nodes that collateralize an equal or greater amount of value. This will compel node operators to buy large amounts of Link in an effort to compete for high value contracts. I can only imagine the billions or trillions needed to collateralize nodes competing for contracts issued by large financial institutions.

Partnerships

Google works with Chainlink to place BigQuery data sets onto on-chain smart contracts. This interoperability could lead to new emergent on-chain businesses. Moreover, it will alleviate the front running problem plaguing the Defi industry.

Source: google cloud blog

The collaboration with Swift is perhaps the most notable partnership. The

Swift teams expects 300 billion dollars to be transacted with their new and open payment ecosystem. By utilizing the ChainLink network, banks could initiate cross-border transaction with smart contracts. Undeniably, this will create business opportunities for entrepreneurs who will leverage the middle technology to create innovative services.

Source: https://create.smartcontract.com/sibos17

Aave, Synthetix, Reserve, HyperDAO, Acala, Kava, bZx, and other Defi platforms have announced partnerships with Chainlink. Given that most of these projects are looking to access Chainlink’s price feed API, I view this more as a collaboration. In the future, I would imagine most platforms will be able to access the network without getting direct consent or acknowledgement from the team. In the foreseeable future, I expect more partnership announcements for two reasons: To begin with, ChainLink will need to work closely with other teams to troubleshoot and provide guidance. Secondly, the lesser known projects will use it as a publicity stunt to add legitimacy to their projects. I expect ChainLink to become an industry standard for Defi and achieve ubiquity within a couple of years.

Hdac decided to team up with Chainlink to enable on-chain usage of IoT data. The Hdac blockchain, founded by Dae-Sun Chung of the Hyundai family, is essentially designed to be a IoT plaform based on blockchain to help connect devices. This partnership will allow Hdac to develop various real-life use cases. Without Chainlink, Hdac would be forced to find their own solution to off-chain data integration. In my opinion, this will help Hdac speed up development.

Gaimin is a blockchain-powered gaming platform looking to become the Uber of processing power by allowing gamers to monetize their idle computer resources. Blockchains do not have an internet connection so naturally this partnership makes sense. By forming a technical partnership with Chainlink, Gaimin will take full advantage of the security and reliability offered by the oracle network.

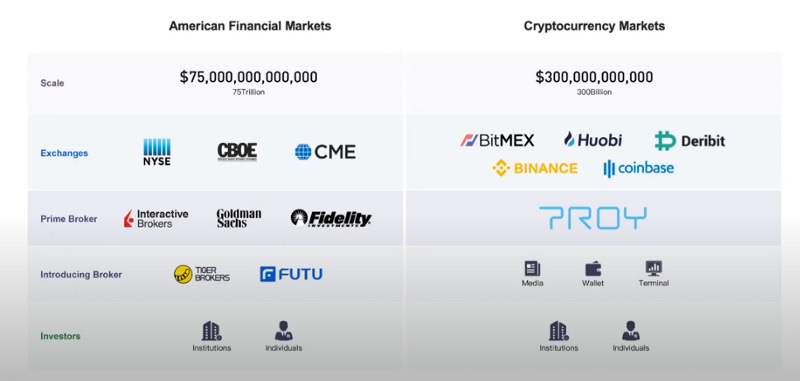

Troy is a global prime broker that specializes in crypto asset management and trading. By integrating into Chainlink’s network, Troy will streamline its efforts to provide derivatives, data, custody, lending, staking, and trading services on one platform. The Troy Network is composed of four layers: application chain, settlement network, off-chain trading, and the public chain. ChainLink will assist in optimizing the application layer. I expect this to go a long way in improving the user experience.

Bloom provides credit monitoring, data breach monitoring, and enhanced smart identity to all its users. This month Bloom announced their first live integration between traditional credit bureaus and decentralized finance. Chainlink creates a bridge for Defi platforms to access Verifiable Credentials of users. This would enable the transfer of anonymized credit data to help Defi platforms establish customer risk for on-chain lending. In my view, this will significantly expand Defi lending and allow for efficient lending at lower collateralization rates.

Investment Prospect

I would like to start by fully disclosing my investment in the Link token. I am not advocating for others to purchase the token, I am simply outlining my investment thesis. Link came to my attention when I noticed numerous exchange listings along with Tezos(link to my video). Moreover, on my Twitter feed I read about numerous partnership announcements with ChainLink. After completing my deep dive, I began adding Link to my portfolio on a weekly basis for the following reasons:

The token utility model is very strong. In my view the economic model for token implementation is crucial for Link to appreciate in value. The ICO boom in 2017 clearly revealed this with Ethereum climbing to a peak of $1400. The Link token has two primary use cases: (1) used to pay node operators, (2) used as collateral by node operators. All the platforms opting to use Chainlink’s network will have to pay for smart contract execution or pass the cost onto their users. Also, the node operators will have to buy Link and lock them into smart contracts. Both functions lead to the removal of Link from the circulating supply.

Legacy systems are incentivized to play active roles in the ecosystem. A legacy company can monetize their data sets to create an additional revenue stream. This will help onboard more enterprises into the ChainLink network.

I firmly believe linking on-chain platforms to off-chain data will create new service opportunities for entrepreneurs. ChainLink has the potential to be a catalyst for business and job creation. It is the bridge needed to transition the world into a digital blockchain-based economy.

The solution for secure and reliable transmission of data was desperately needed by blockchain-based companies. Without ChainLink, the collective approach to solve this problem would have been fragmented. ChainLink’s model provides a more fluid and frictionless resolution. Moreover, using the API infrastructure expands their connectivity by allowing them to access off-chain data feeds. Soon they will be able to access GPS data from Google and payment outputs such as Stripe. All of this frees up resources for the respective projects to focus on their core business. In part, Uber was able to speed up their development using multiple data feeds. We are likely to see a similar acceleration with blockchain projects in the coming years.

Strong partnerships with in a myriad of industries: finance, legal, web, shipping, logistics, insurance, and more. Google and Swift are perhaps the most notable partnerships announced within the last year.

I do not see any real competition in sight. I am sure many will try to dethrone ChainLink, but I expect ChainLink to dominate the market share. Some of the so-called competitors do not even have a completed white paper. Being a first mover confers significant advantages that are virtually insurmountable by competitors once a network effect has been achieved. Just ask the people who have attempted to dethrone the internet protocol and Bitcoin.

I view ChainLink’s middleware as a trojan horse. Using this technology banks will be able to conduct transnational settlement between institutions through on-chain smart contracts. If you can use a smart contract to send money between banks, it is only a matter of time before developers find a way to send money on-chain. This could potentially bring billions of dollars into the digital assets space. In theory, users could use the liquidity in their bank account to access Defi products. Imagine plugging your bank account into a Defi platform without first going through an intermediary.

Lastly, the token is being listed on practically every exchange. Also, MarkerDao expressed their interest in adding Link token as a collateral. The exchanges would not have listed the token unless there was a strong demand. Also, there is a chance they may have insider information. At any rate, increased accessibility to the token will be a positive price catalyst.

Conclusion

With all the turmoil in the legacy markets, I believe the digital assets industry is positioning itself to replace the existing market infrastructure. I believe this new digital architecture will be supported by three pillars: (1) sound digital money, (2) smart contracts, and (3) decentralized middleware. As the legacy markets begin to lose trust and endanger people’s life savings, they will look for alternatives. This transition will not happen overnight but the current infrastructure is not designed to accomodate this wealth transfer. In my opinion, Chainlink is a key component in this massive transition. It could be the missing link to broad adoption of decentralized blockchain technology.

Background & ICO

The token sale was conducted at the center of the 2017 bull market between 9/19/2017–10/19/2017. The project raised approximately 35 million dollars by selling 35 million Link tokens. Chainlink was developed by a company called SmartContract founded in 2014. The CEO, Sergey Nazarov, is a serial entrepeneur who co-founded Secure Asset Exchange and Existlocal before founding SmartContract. The CTO, Steve Ellis, was previously a Software Engineer and Team Lead at Pivotal Labs where he worked on securing sensitive HIPAA compliant data and building scalable payments automation software. For a complete list of the team check out their website.

Follow me on Twitter , Youtube, and PublishOx.

Click here for a FREE newsletter.

For a full review in video format click below.