Twitter | Facebook | Reddit | YouTube | LBRY | Patreon | Store Front

Disclaimer: Nothing in this report constitutes investment advice—I am just reporting on my accounts and its progress on each platform. You should not use this report to make financial decisions. I recommend you seek professional advice from someone who is authorized to provide investment advice.

Hey everyone and welcome to the HODLer’s Den!

Here you will find information on my crypto investment portfolio straight from a HODLer’s perspective. This section will focus on HODLing cryptos and interest-earning platforms.

BlockFi

New Coins

Big news for BlockFi as they recently added support for PAXG (PAX Gold) and USDT (Tether). Both USDT and PAXG are considered stablecoins and are safe options for BlockFi. With the addition of these two new coins, BlockFi now accepts deposits on a total of 8 coins: BTC, LTC, ETH, PAX, PAXG, USDC, USDT, and GUSD. The rate at which BlockFi is adding new coins is a bit slow but any new addition is a win for crypto adoption in my opinion.

New Hire

BlockFi hired Tony Lauro as the new Chief Financial Officer (CFO).

He will play a critical role in expanding BlockFi’s product and service portfolio, while growing our global presence and standing as an innovative, dynamic financial institution.

Lauro has decades of experience as a CFO. He has worked for big name companies like Capital One, JP Morgan Chase, Prime and Superprime, Royal Bank of Scotland, Citizens Bank, and most recently, Intermex. As you can see, Lauro’s strong background with financial institutes will be extremely beneficial to BlockFi’s forward momentum on spreading crypto adoption.

With Lauro’s help, BlockFi’s team hope to expand their product and service portfolio, while they grow their global presence as an innovative, dynamic financial institution. With Lauro’s hefty background as CFO, this looks like a promising move from BlockFi.

Continued Security

BlockFi continues to improve on security as it will focus on protecting data, people, and systems.

There’s an art to building a security program, and it requires careful balance. Aim for something too stringent and the workforce finds ways around it, implement something too flexible and attackers will exploit it.

According to BlockFi’s blog, the security team has taken a number of thoughtful steps toward hardening their systems and processes while maintaining that balance. Security is a big area to tackle and so BlockFi will be recruiting several names to the security team in the coming weeks and months.

BlockFi outlined their Major Security Initiatives which will focus on Endpoint, Cloud, Identity, Core Security Services, Custody Operations, Employee Training and Awareness, and Data Governance. By mapping out their security plan, BlockFi can now focus on each area for improvement. These initiatives will continue to evolve and change accordingly to accommodate the crypto landscape.

Speaking of security, I recently withdrew 5000 USD worth of asset and BlockFi flagged my transaction. In order to continue with my withdraw I had to upload a photo ID and do a facial scan using my laptop’s camera. Both of these processes were quick and easy to complete but it felt like I had to do KYC (Know Your Customer) over again. I was afraid my withdraw would be delayed but once I was verified—which took about 24 hours—my funds arrived about an hour later.

Interest Earned

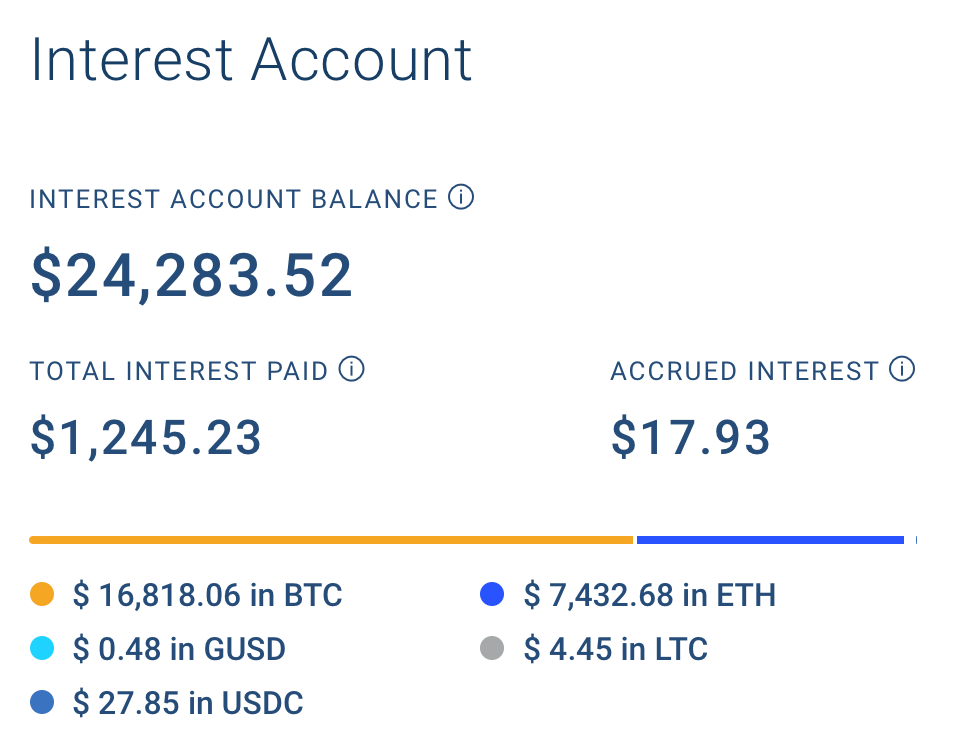

It has been 5 weeks since the last BlockFi report and during that time my portfolio gained 21 USD—a 2% increase. I track my progress with each lending platform using a Google Spreadsheet.

Please note that at the time of this report, the crypto market had a major correction—Bitcoin (BTC) is sitting at 10.1k USD while Ethereum (ETH) is at 333 USD. Both of these assets make a majority of my BlockFi portfolio and it is clearly reflected in my portfolio. Even with the massive drawback, I was surprised my portfolio was up 2%.

Conclusion & Prospect

No one likes a market correction—especially when you are invested and watching your portfolio make massive gains—but, it is healthy for the market and brings in new arbitrage opportunities. Every market is subjected to cycles and it is no different for the crypto market. As I have mentioned in my previous reports, I use BlockFi and Celsius Network as my long-term, stable investment platforms because they are well regulated with strong security.

Security is a difficult area to tackle because it is truly a fine balance between usability and flexibility. I was a bit annoyed that I had to do a mini KYC to withdraw my funds but was also glad that the transaction was flagged because of the amount being moved. The process did not take long and my fund was transferred within a sufficient amount of time.

Hopefully, the addition of Lauro to the team will help push BlockFi to offer more services and adopt more coins to their growing list. It seems like BlockFi prefers stablecoins as both USDT and PAXG are in that category. I think it is a safe play by BlockFi and that is why I believe they are great for long-term investments.

The great thing about HODLing is that you can ignore all the events happening in the crypto market and still come out ahead. With platforms like BlockFi and Celsius Network paying out wonderful interest on crypto assets, HODLing is the best option unless you are some genius day trader.

Each week I will report on a different interest-earning platform that I use—mainly, Celsius Network, Bitrue, Crypto.com, and BlockFi.

If you do not have an account with BlockFi and would like to support my work, please use this referral link to sign up and we both get 10 USD worth of BTC when you deposit 100 USD! Much is appreciated!

This is part of the FREE subscription package that goes out to hundreds of investors. I also have a paid subscription package which includes exclusive content and insights. To really get the most bang for you buck, check out my bundle packages through Patreon.

For a limited time I’ll also be offering an option to pay in DAI. Using this method you’ll get an annual subscription for only 50 DAI.