Bitrue Progress Report (Free) 📈

HODLer's Den By Aromatic (Free Version)

Twitter | Facebook | Reddit | YouTube | LBRY | Patreon | Store Front

Disclaimer: Nothing in this report constitutes investment advice—I am just reporting on my accounts and its progress on each platform. You should not use this report to make financial decisions. I recommend you seek professional advice from someone who is authorized to provide investment advice.

Hey everyone and welcome to the HODLer’s Den!

Here you will find information on my crypto investment portfolio straight from a HODLer’s perspective. This section will focus on HODLing cryptos and interest-earning platforms.

Bitrue

Bitrue Finance Token

In keeping up with Decentralized Finance (DeFi) adoption, Bitrue releases another platform-centric token: Bitrue Finance Token (BFT). Bitrue recently release its Bitrue Finance Services Whitepaper which you can read here. The Whitepaper gives background on the DeFi space and Bitrue’s roadmap for the services it will be offering.

Even if you do not participate in earning and lending, the data above demonstrate crypto adoption and an increase in trust with Centralized Finance (CeFi) platforms such as Bitrue to manage cryptos. The year-over-year growth is phenomenal and it is expected that this trend will continue in the next couple of years.

As I have mentioned in my previous reports, DeFi still has many barriers it must overcome before mass adoption. One of the main barrier is high transaction fees which makes it incredibly difficult for investors with small amounts of crypto to make a profit. Most of the time, the fees to participate in these DeFi projects will already put investors in the red and will take some time to recover from the initial investment.

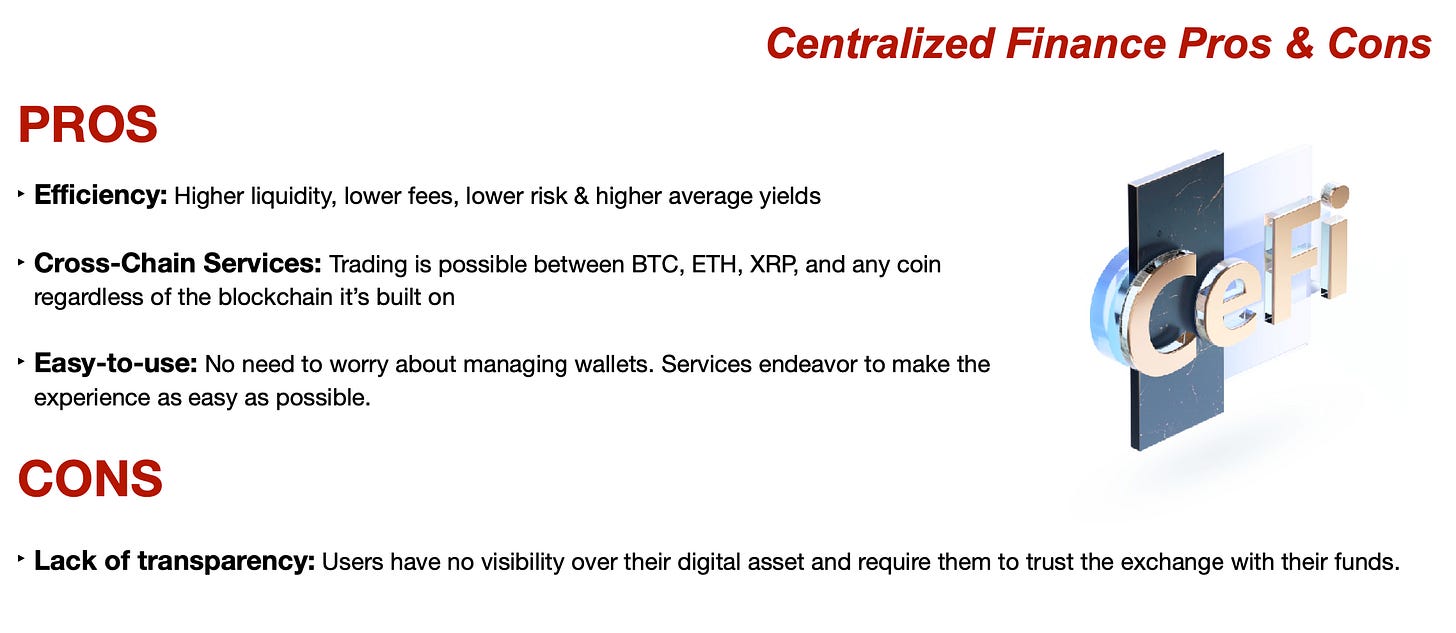

I agree with most of the pros and cons listed above. CeFi is definitely less risky and comes with lower fees since large amounts of assets are managed by one entity. However, the tradeoff is that investors must put trust into the CeFi platform as there is lack of transparency. I believe DeFi has the higher average yields but that is why the risk is much higher and it comes with high fees for entry.

I believe a lot of CeFi platforms are looking for ways to “hybridize” with DeFi and it is no different when it comes to Bitrue. The first major area Bitrue will tackle is decentralizing Bitrue loans. By doing so, Bitrue will enable lenders to fund Bitrue loans and earn interest on them.

From the Whitepaper, Bitrue will still serve as the intermediary between the borrows and lenders. However, it seems like they will make the wallets viewable to lenders of the collateralized loans to help increase transparency.

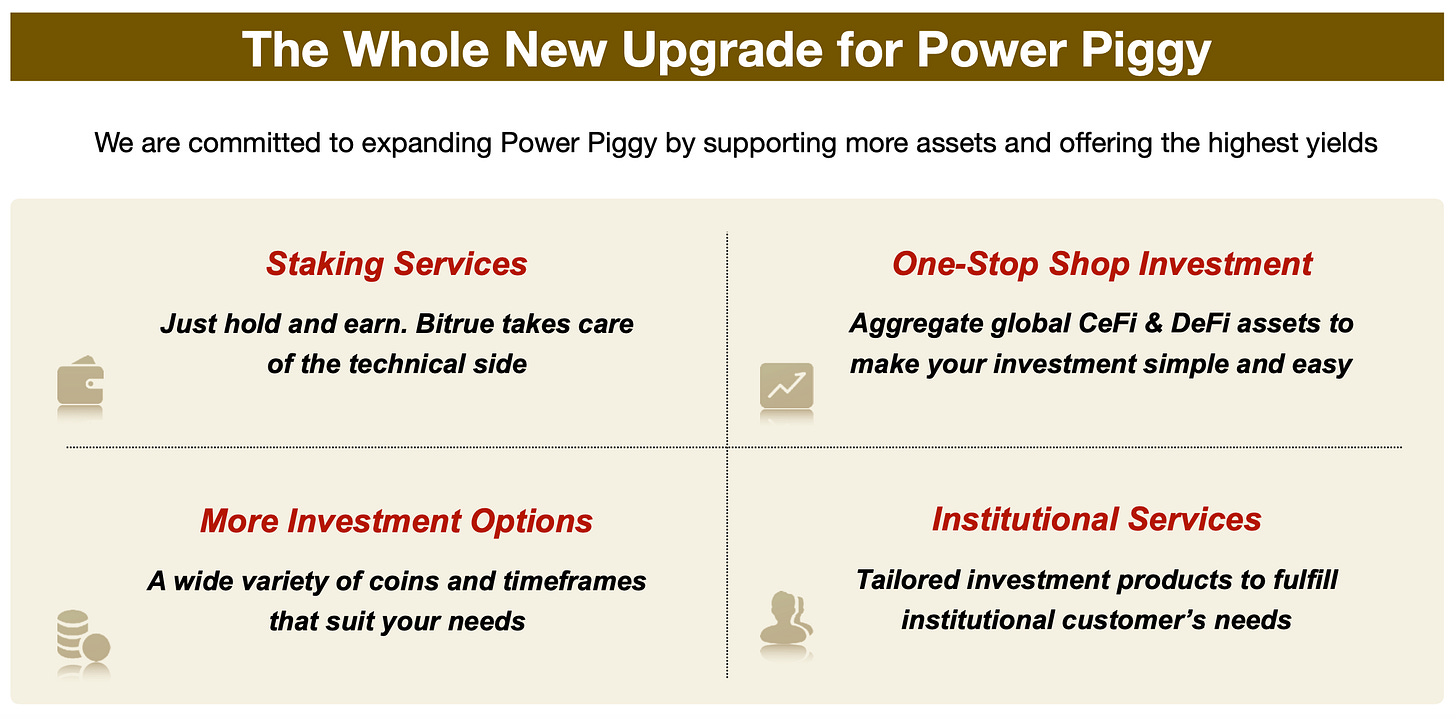

Bitrue hopes to upgrade Power Piggy by increasing the amount of supported coins and offering the best yields possible. The information about Power Piggy was very general in the Whitepaper—it does not go into detail on how they will accomplish these goals.

The Bitrue Financial Services Whitepaper also gives a brief use case for the new BFT. A lot of Bitrue (BTR) holders were upset with the announcement of another platform-centric coin as it seems unnecessary.

A couple of days after the announcement of BFT, they released a small article about the use case for both BTR and BFT.

Bitrue Coin (BTR) is our existing platform token, and is used within our existing exchange features to facilitate trading fee deductions, cash deposits of project parties, wealth management programs and more.

First of all, rest assured that Bitrue Coin (BTR) is not going away! The existing use cases for this coin, which can be found here, will continue to apply. The focus for BTR will be on powering the exchange side of Bitrue, with support for new features like perpetual contracts and margin trading coming in the future.

Bitrue Finance Token (BFT) is a new token issued by Bitrue & used within our Bitrue Financial Services suite of products. Initially it will be used as a payment and reward token, with further utilities unlocked as additional features are completed.

The Bitrue Financial Services suite includes loans, credit cards, and additional features added to Power Piggy as we continue to expand this service. In the short term we plan to provide an increased range of investable coins, timeframes, and expected yields in order to match your situation and preferences.

The utilities for both are separate, and both are used within sub-industries that have massive potential for growth that may be completely divergent from each other. We will work hard to increase the value and add more use cases for both tokens in the future.

Interest Earned

As of this report, I have earned 4326 USD from Bitrue’s Power Piggy—not bad considering that I only started truly using Bitrue sometime in April/May 2020 because of the promotional rate on Bitcoin (BTC) and Ethereum (ETH). In the last 4 weeks, my Power Piggy portfolio grew by 263 USD—a 6% increase in value. You can use this Google Spreadsheet to track my earnings on the four major platforms I use.

Below is my earnings from Bitrue’s Lockup. So far, I have accumulated 2892 USD in interest. In the last 4 weeks, this portfolio grew 5% resulting in an extra 128 USD in earnings.

Overall, my Bitrue interest earnings grew 6%, netting me a total of roughly 391 USD. Given the recent market correction, any net gain is a plus in my book. The great thing about HODLing is that I am dollar cost averaging (DCA) into these cryptos which have huge potential to pump during the next cycle. In my previous Bitrue Progress Report, I made over 3000 USD in interest in just 4 weeks so I can only imagine the gains during a massive bull run.

Conclusion & Prospect

Bitrue is going through a massive change as they transition into a CeFi and DeFi hybridize platform. With so many changes, it can be worrying for investors in Bitrue. I think the move to hybridize and adopt DeFi is the right move because many platforms such as Binance, Celsius Network and Crypto.com have already started as well. There is just too many upside potential for DeFi when compared to CeFi. I believe that combining both platforms will help bridge investors from CeFi into DeFi.

We are just beginning to see more crypto adoption around the world and it is important to have strong CeFi platforms, such as Bitrue, to help with said adoption. When I first got into crypto, I felt comfortable working with a CeFi platform because it felt familiar to traditional financial systems. I started with Coinbase and slowly expanded my horizons into other crypto CeFi platforms—I think this is the most common pathway into crypto. Eventually crypto investors will learn about more opportunities such as DeFi and slowly modify their portfolio. In terms of timeline, we are still very early in crypto and what DeFi has to offer.

Market corrections are healthy and expected as investors cash out their profits. No matter the market conditions, HODLing is the safest bet—all I do it figure out how to get the best yields by moving funds around. During bull markets your portfolio explodes and during bear markets your portfolio is dollar cost averaging—no need for stressful swing trades to make a profit. Going long is probably the best option for many investors.

Overall, I still have strong convictions in Bitrue and hope that they succeed in their goals. Even though I feel like Bitrue is lagging behind in DeFi adoption, I feel like releasing quality DeFi services is much better than releasing a product that feels rushed and unusable. Crypto still has some way to go before full adoption so I think Bitrue still has plenty of time to sort out all the kinks.

Each week I will report on a different interest-earning platform that I use—mainly, Celsius Network, Bitrue, Crypto.com, and BlockFi.

If you do not have an account with Bitrue and would like to support my work, please use this referral link. Click the link to register and invest in Power Piggy, it will let us both earn interest together! Much is appreciated!

This is part of the FREE subscription package that goes out to hundreds of investors. I also have a paid subscription package which includes exclusive content and insights. To really get the most bang for you buck, check out my bundle packages through Patreon.

For a limited time I’ll also be offering an option to pay in DAI. Using this method you’ll get an annual subscription for only 50 DAI.