Twitter | Facebook | Reddit | YouTube | LBRY | Patreon | Store Front

Disclaimer: Nothing in this report constitutes investment advice—I am just reporting on my accounts and its progress on each platform. You should not use this report to make financial decisions. I recommend you seek professional advice from someone who is authorized to provide investment advice.

Hey everyone and welcome to the HODLer’s Den!

Here you will find information on my crypto investment portfolio straight from a HODLer’s perspective. This section will focus on HODLing cryptos and interest-earning platforms.

Bitrue

DeFi (Decentralized Finance) Update

October should be a big month for Bitrue as they begin to roll out some of their DeFi projects such as Liquidity Mining. In addition, they will finally have a stronger use case for the Bitrue Finance Token (BFT) which is trading below its initial release price of 0.1 USD.

If you received UNI tokens like I have and do not know what to do with them then I suggest you put them into Bitrue’s Power Piggy or some other platform that you trust to earn a yield. There is nothing better than getting free money and then watching that same money grow in size. I know UNI was at 8 USD at one point and is now sitting at 3.3 USD, but I still believe it has potential in the long run because the Uniswap platform is robust.

According to Bitrue, they are very close to launching their first yield farming service called Bitrue Liquidity Mining. Users who want to participate will have to deposit their coins into their desired pools which will be locked up for a 7-day period. Bitrue will handle the rest from there and states that yields can be as high as 200% APR (Annual Percentage Rate)!

The return on investment that you will receive is not known at the outset and can be very volatile, but current DeFi trends suggest that 30 - 200% APRs are likely. Please note that DeFi Mining is inherently very risky! While unlikely, it is possible that the amount you receive back after the 7 day period concludes will be less than the amount you initially provided.

Of course there will be risks involved otherwise everyone will be doing it. There is still a possibility of losing some or all of your initial investment with liquidity mining. However, I am still excited to see what Bitrue has to offer and gladly welcome the hybridization of CeFi (Centralized Finance) and DeFi.

As the launch date for Bitrue’s Liquidity Mining comes closer, they sent a friendly reminder that Power Piggy is always an option for those who prefer little to no risk when it comes to investing. Power Piggy gets sold out quickly on a daily basis but by holding BTR (Bitrue Tokens), you can create a VIP cap for your account. This creates a use case for holding BTR and I think the same principal will be applied to BFT and liquidity mining which they sort of hinted at in the White Paper.

The initial liquidity mining will include the following assets and their respective rewards for participating:

ETH & FNX (to receive FNX)

XRP & BFT (to receive BFT)

ETH & BFT (to receive BFT)

ETH (to receive ETH)

USDT (to receive USDT)

TUSD (to receive TUSD)

USDC (to receive USDC)So between Power Piggy and Liquidity Mining, which service is right for you? It comes down to risk vs reward. Liquidity Mining is inherently more risky but comes with the potential for unprecedented gains, whereas Power Piggy has guaranteed returns at lower APRs.

Security Improvements

Bitrue recently added the ability to whitelist devices and IP addresses.

This feature will allow you to specify IPs and devices that you commonly use and add them to a whitelist. After that point withdrawals on your account will only allow go through if they come from these trusted sources. This means that even if a hacker somehow gains access to your account, they will be unable to initiate a withdrawal and your coins will remain safe.

I think this addition is great for security because hackers will now also need access to your device and/or IP address to withdraw funds. Right now, it is only available on the Bitrue mobile app, but they hope to extend it to the web version in the future. I do not use the mobile app as much so I will be waiting for the web version.

With the addition of whitelisted IPs and devices, Bitrue continues to add on extra layers of security to keep our funds and assets secure. Just a reminder that Bitrue also has an insurance fund in the form of XRP (Ripple) and BTR, which can be publicly viewed on Etherscan.

Bitrue Lockups

The DeFi space has certainly helped increased APRs across many CeFi platforms competing to stay relevant. Bitrue recently announced incredible APRs for 3 major assets: BTC (Bitcoin), ETH (Ethereum), and USDT (Tether).

Rate Changes For BTR Lockups:

BTC: From 6.5% to 8.5% 🤩

ETH: From 6.3% to 11% 🤯

USDT: From 13% to 16% 🤑

These new APRs are amazing and I had to take advantage of them as soon as I could. The rate for ETH nearly doubled which is insane, while the rate for BTC is the best compared to the four interest yielding platforms that I use. If you are interested in finding the best rates you can check out this wonderful Google Spreadsheet. However, remember that you will need enough BTR to be able to access these incredible rates which is the only caveat.

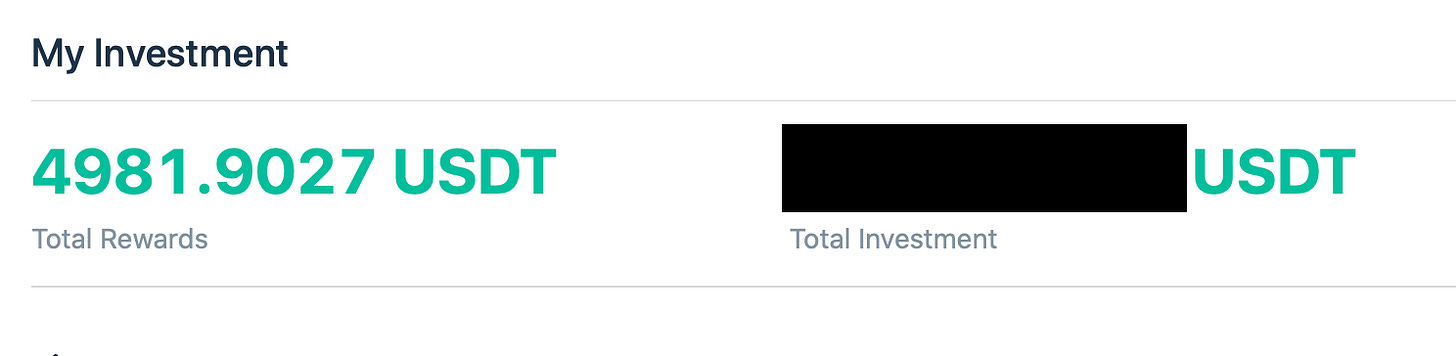

Interest Earned

As of this report, I have earned 4981 USD from Bitrue’s Power Piggy—not bad considering that I only started truly using Bitrue sometime in April/May 2020 because of the promotional rate on Bitcoin (BTC) and Ethereum (ETH). In the last 4 weeks, my Power Piggy portfolio grew by 655 USD—a 15% increase in value. You can use this Google Spreadsheet to track my earnings on the four major platforms I use.

Below is my earnings from Bitrue’s Lockup. So far, I have accumulated 3748 USD in interest. In the last 4 weeks, this portfolio grew 30% resulting in an extra 856 USD in earnings.

Overall, my Bitrue interest earnings grew 21%, netting me a total of roughly 1511 USD. Given the recent market correction, any net gain is a plus in my book. The great thing about HODLing is that I am dollar cost averaging (DCA) into these cryptos which have huge potential to pump during the next cycle. In my Bitrue Progress Report 2 months ago, I made over 3000 USD in interest in just 4 weeks so I can only imagine the gains during a massive bull run.

Conclusion & Prospect

As a BTR and BFT holder, I agree with the current sentiment that both coins/tokens seem unnecessary but there is nothing we can do about it for now. The crypto space is still new and companies are still developing and learning about new financial models. We have to give these platform a chance to experiment with what they believe is best. Yes, it may seem disappointing to watch the price of your investment drop, but as a HODLer you should be earning interests which will help offset some of the loss.

We have not yet seen BFT in action or used on the Bitrue platform and I think it is best to wait and see how Bitrue Liquidity Mining will perform before making a sound decision on the token’s use case. As I have mentioned in several HODLer’s Den reports: crypto investors are part of the 1% and there is plenty of room to grow. Companies that can survive during a bear cycle will do exceptionally well during a bull cycle. I had my initial doubts with Bitrue because they were fairly new to the space, but after using their services for over a year I am quite satisfied.

I recently moved some funds off of Bitrue to Celsius Network because of the better APRs on certain coins. I was surprised to get an email from Bitrue stating the following:

Dear User,

We noticed that you recently withdrew a large amount of funds from Bitrue. If this was due to difficulties accessing our platform over the last couple of days, we want to sincerely apologize for the service disruption. Bitrue was unfortunately the target of a DDoS attack that made our platform inaccessible at times, but we are pleased to say that we have thwarted the attack and have put extra systems in place to ensure that this issue will not happen again.

We take your feedback very seriously and your comments may have a significant impact on our future development roadmap. Other possible reasons you may have for withdrawing include:

1. Other platforms are offering better investment options

2. I want to have the keys to my coins

3. World events have made me nervous about the state of my finances

Please let us know if any of these reasons apply to you, and please feel free to share any other feedback you may have.

Best Regards,

The Bitrue Team

I responded honestly and told them that it was due to other platforms offering better investment options. About a week later, Bitrue raised the rates on their lockups for BTC, ETH, and USDT. Was it a coincident? I think not. They probably took my response seriously and made the appropriate changes and I could not be happier—that is exceptional customer service.

The email also reminded me of the problems Bitrue had earlier that week due to the DDoS attack. I was unable to access the web version and the mobile version was very limited. The attack caused Bitrue to be down for almost an entire day, but fortunately no funds were lost in the process—just annoyed users. Of course, I was a bit nervous but then I remember that traditional institutions like banks also get attacked and become unavailable at times. The important thing is that no funds were lost.

Every time I track my Bitrue progress, I am surprised by my interest earnings. No matter the current market conditions, I am always up. The interest that I earn can easily cover my week-to-week expenses, but I will continue to compound my earnings and watch it grow.

What I Am Doing

This section is dedicated to paid subscribers as I will go into details of what moves I am making with my interest-earning portfolios.

You are currently reading the Free Version. If you would like more information, please consider switching to a paid subscription.

Each week I will report on a different interest-earning platform that I use—mainly, Celsius Network, Bitrue, Crypto.com, and BlockFi.

If you do not have an account with Bitrue and would like to support my work, please use this referral link. Click the link to register and invest in Power Piggy, it will let us both earn interest together! Much is appreciated!

This is part of the FREE subscription package that goes out to hundreds of investors. I also have a paid subscription package which includes exclusive content and insights. To really get the most bang for you buck, check out my bundle packages through Patreon.

For a limited time I’ll also be offering an option to pay in DAI. Using this method you’ll get an annual subscription for only 50 DAI.