Twitter | Starter Pack | Reddit | YouTube | Patreon | Website | Earn $250 in Promos

Hi everyone,

Click here to access the interest rate tracker. It’s been updated so you can see the best rates offered among the various lending platforms. Also, please consider signing up for new platforms with the referral links posted by the moderator. He updates and maintains the excel spread sheet. I’m sure he’d greatly appreciate it.

Always make sure to do your own research before aping into the farms I present. This is not intended to be endorsement of these protocols and I don’t farm all the protocols I review. This is for educational purposes only. If you wanted to learn about these farms sooner make sure to follow me on Twitter and join my private discord.

Also, let me know of any farms or projects you think are worth reviewing. I can’t commit to anything, but your recommendation could prompt video or written reviews.

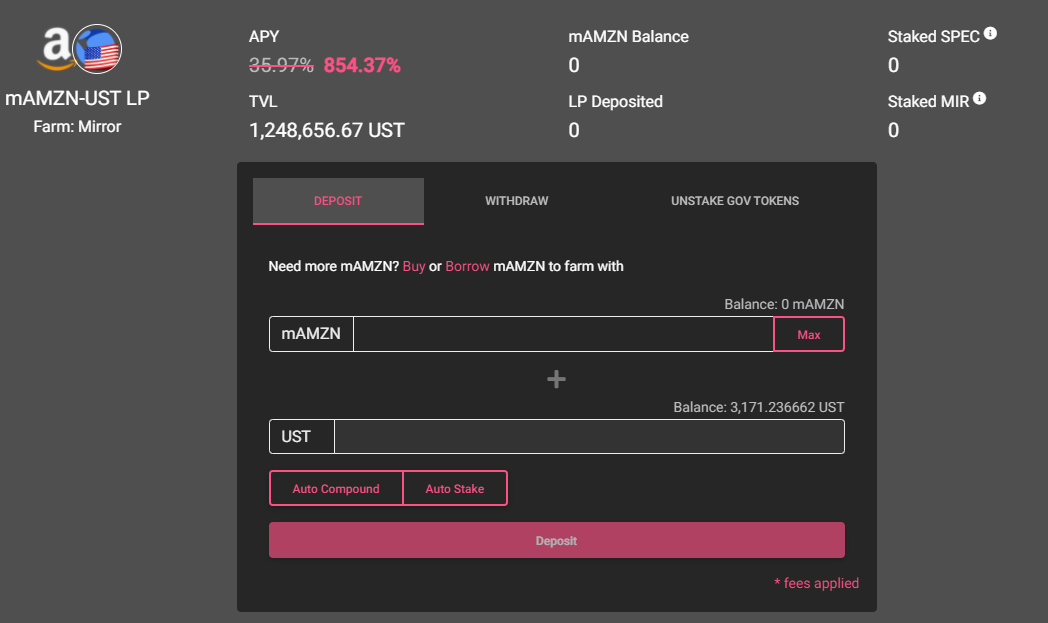

Spectrum Protocol

The first auto-compounding protocol on Terra Network recently launched offering juicy APYs. Unfortunately nobody knows anything about the team including Do Kwon, the Co-founder of Terra. I would advise caution entering any of these pools. I and a few my private members have decided to allocate a small bag for experimentation.

You have the option to auto-compound your SPEC rewards or automatically stake them into gov vault to earn rewards.

Currently there is a vote in progress to support vaults and assets.

You can tell most participants are hesitant to provide liquidity because the TVL has been growing very slowly.

Pylon Protocol

This is another protocol built on the Terra network. Their goal is to create a suite of savings and payments products that leverages DeFi services like Anchor Protocol. For example, for subscription based services users can deposit their UST and spend accrued yields to access platform services. After they’re done they can withdraw their deposit. This could also be abstracted to renting cars and apartments too.

Currently they are offering a couple liquidity mining incentives. You can deposit your UST into one of these pools to receive linear distributions of the MINE token.

Or you can provide liquidity to the MINE-UST pool.

Gravity Dex

Gravity Dex is scheduled to launch next Monday on 7/12 with 10 major pools to farm. Here are a few things you can expect based on what I’ve gathered from their discord:

average apy of 50%

6 months worth liquidity mining rewards

1.2M atoms distributed over 6 months

10 major pools with an average size of $10M

I was saving a portion of my liquidity mining rewards from Osmosis to provide liquidity to Gravity Dex. However, I may revise this strategy given what we’ve learned. They don’t plan to launch with their own token and instead plan to give out ATOM tokens to farmers. This is going to significantly limit the yield for each pool. On a more positive note this may end being bullish for OSMO holders. The lack luster yield will likely encourage peeps to provide liquidity on Osmosis over Gravity. As more people provide liquidity to the OSMO paired tokens, in theory the price of OSMO should appreciate.

If you’re interested in learning more about Gravity Dex and the Cosmos network, make sure to watch the interview with the CEO of Tendermint linked below. Also, here’s a good summary on Emeris, Gravity Dex’s cross-chain portal.

Balancer Stablecoin Pool

A new pool consisting of USDC, DAI, miMatic, & USDT was just added to Balancer on Polygon. Currently it isn’t incentivized, so you will likely just earn a yield from people entering the pool. However, I believe there’s a reasonable chance that this pool will eventually become incentivized. Currently, only the following pools are provided liquidity mining rewards.

Recently I’ve decided to become more aggressive in allocating my farming profits into a stablecoin reserve. Until I commit to this move, I’ll continue to squeeze profits into the ETH/BTC/USD pool on Balancer. This way I’m locking in gains, maintaining exposure to the market, and generating a yield on my portfolio balance.

Planet Finance

This project is a stablecoin yield aggregator on the Binance Smart Chain (BSC). They’ve been live since April and recently added a UST pool. The pool is generating a fat yield of almost 60% APY. Despite offering the best stablecoin yields on BSC, they only have a total value locked (TVL) of $23M. The yield is paid out in AQUA tokens. Currently you can only generate yield on your AQUA balance, but in the future protocol revenue will be distributed to token holders.

The protocol charges a 2.5% profit fee and a 0.1% one time deposit fee. Only 1% of the deposit fee is used to buy back and burn AQUA tokens. If we see a massive surge in TVL not only will it dilute our yields, but I’m confident most these farmers will be dumping their AQUA rewards.

ApeSwap Initial Ape Offering (IAO)

This initial dex offering will be going live today at 3AM UTC. Given the profits I’ve made in the past with IAOs, I plan to participate in this sale. The name of the project launching on ApeSwap is BiShares. They aim to provide an index fund for the BSC ecosystem.